On $ETH, lending protocols such as $AAVE - 5.35B $COMP $JST etc. dominate with a majority of market share.

However, @zksync has been lacking in #lending projects, which is a critical #DeFi section.

I found @SyncBankxyz, which was created specifically for #zkSync

A thread 🧵👇

However, @zksync has been lacking in #lending projects, which is a critical #DeFi section.

I found @SyncBankxyz, which was created specifically for #zkSync

A thread 🧵👇

1⃣ What is @SyncBankxyz?

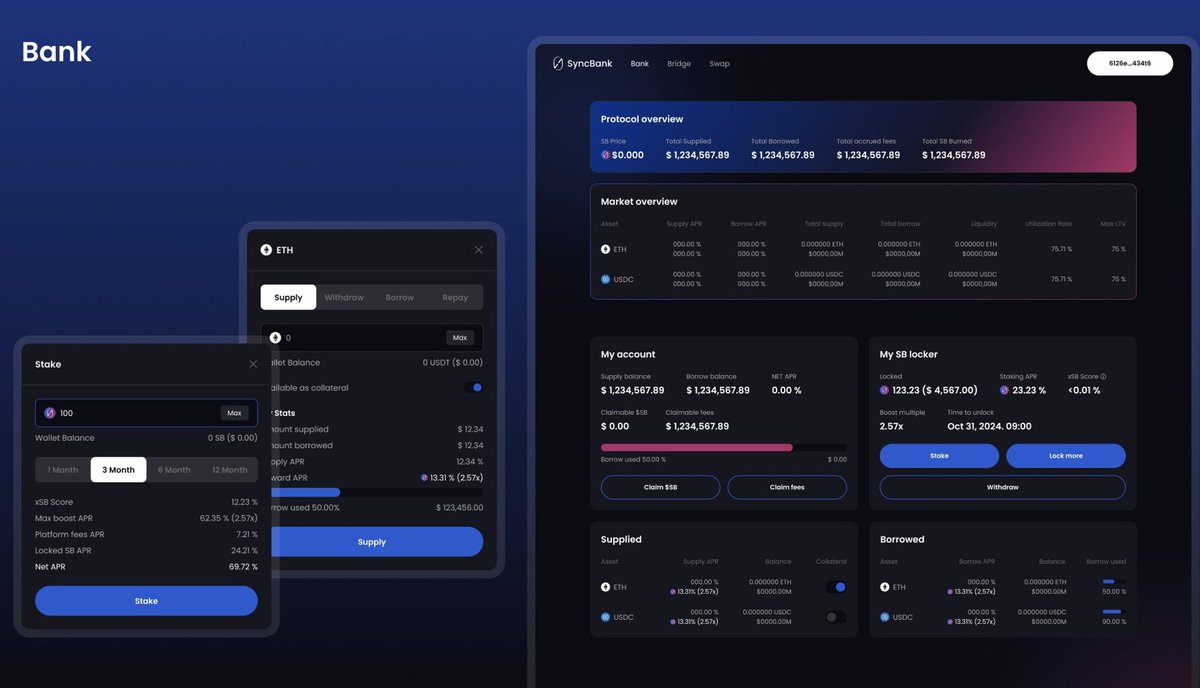

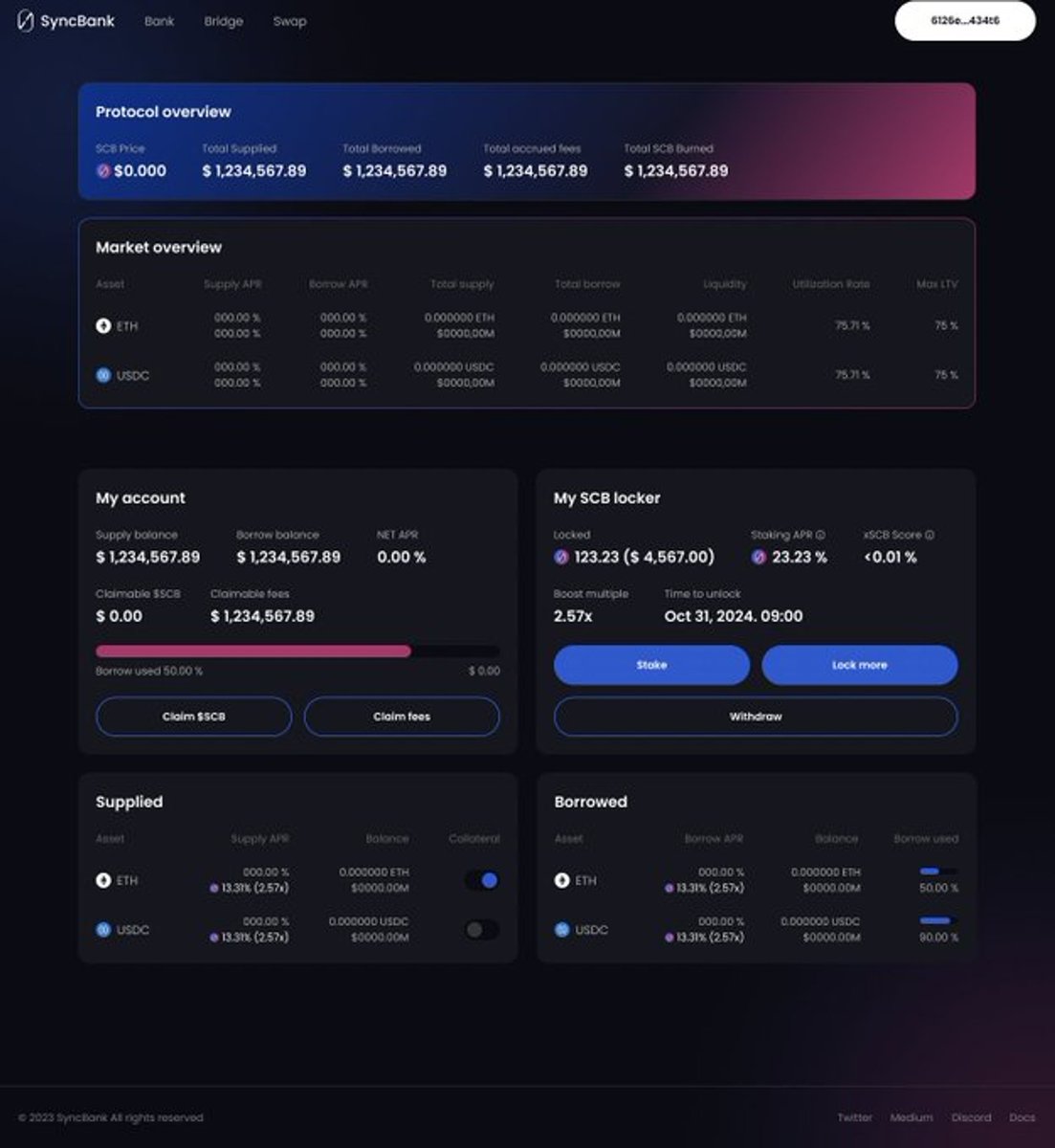

🔹A non-custodial lending platform that empowers users with full control over their funds by utilizing @zksync

🔹A cutting-edge lending protocol aiming to achieve the highest TVL on #zkSyncEra

🔹A non-custodial lending platform that empowers users with full control over their funds by utilizing @zksync

🔹A cutting-edge lending protocol aiming to achieve the highest TVL on #zkSyncEra

2⃣ What's so special about @SyncBankxyz?

🔹Auto buyback of $SCB tokens from accumulated fees

🔹Easy staking of $SCB tokens on a user-friendly UI/UX

🔹Partnership with @izumi_Finance for automatic swaps & dual pools

🔹Auto buyback of $SCB tokens from accumulated fees

🔹Easy staking of $SCB tokens on a user-friendly UI/UX

🔹Partnership with @izumi_Finance for automatic swaps & dual pools

🔹 Yield Boosting Mechanism

🔹 Revenue Sharing Model

🔹 Exciting meme token #BankerPepeV2 is already listed

🔹 Deep connections with China & Korea projects & communities

🔹 Revenue Sharing Model

🔹 Exciting meme token #BankerPepeV2 is already listed

🔹 Deep connections with China & Korea projects & communities

🔹 Fees are accumulated in ETH and USDC but can only be claimed in $SBC with a 5% fee

🔹 Accumulated #ETH & $USDC are used to buy $SBC from the market & distribute to stakers upon rev share claims

🔹 A 5% fee is charged during claims, which is also used for further $SBC buyback

🔹 Accumulated #ETH & $USDC are used to buy $SBC from the market & distribute to stakers upon rev share claims

🔹 A 5% fee is charged during claims, which is also used for further $SBC buyback

🔹 Given that the lending protocols inherently have no impermanent loss (IL) risk

🔹 It's likely that the TVL could reach even higher levels

🔹 It's likely that the TVL could reach even higher levels

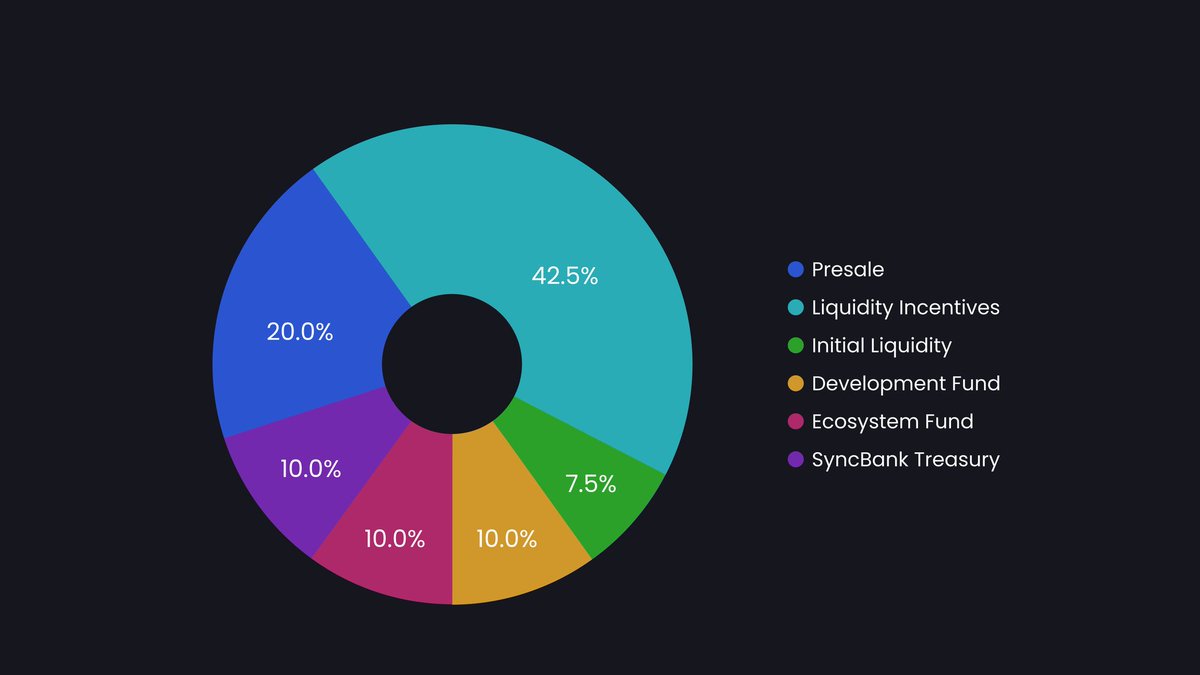

5⃣ Tokenomics

▪️ Name: $SCB(SyncBank token)

▪️ Ticker: $SCB

▪️ Chain: @zksync

▪️ Max supply: 100,000,000 $SCB

▪️ Name: $SCB(SyncBank token)

▪️ Ticker: $SCB

▪️ Chain: @zksync

▪️ Max supply: 100,000,000 $SCB

▪️ Development Fund (10%): 3 months cliff followed by an 18-month linear vesting period

▪️ Ecosystem Fund (10%): 20% TGE, 6-month linear vesting period

▪️ Treasury (10%): Same release schedule as the Ecosystem Fund

▪️ Ecosystem Fund (10%): 20% TGE, 6-month linear vesting period

▪️ Treasury (10%): Same release schedule as the Ecosystem Fund

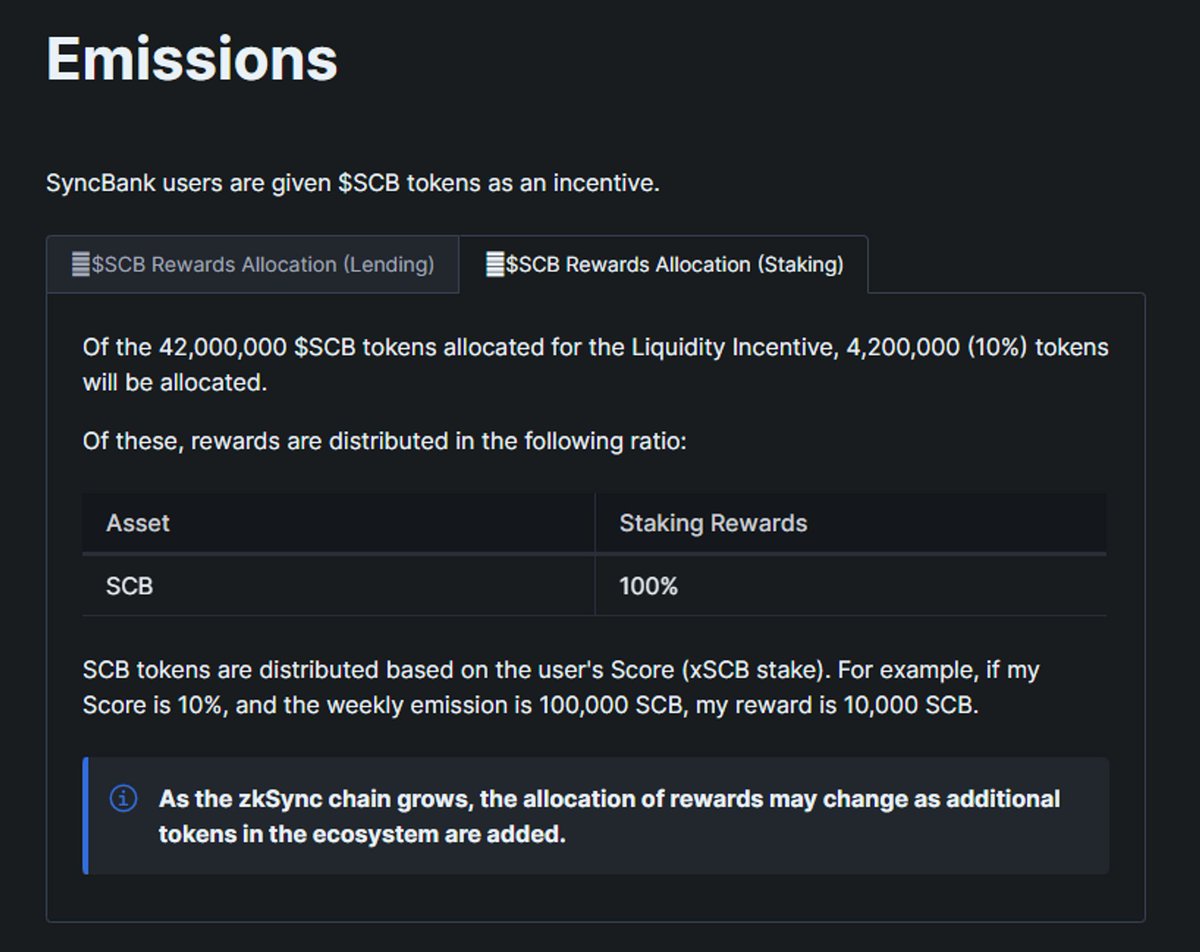

▪️ Borrowing

• The remaining 10% (4,200,000) used to reward users who borrow $SCB tokens

• This allocation has a 100% rewards distribution ratio for SCB borrowing

• The remaining 10% (4,200,000) used to reward users who borrow $SCB tokens

• This allocation has a 100% rewards distribution ratio for SCB borrowing

@Syncbankxyz partnered with Izumi finance to create a feature that swaps profits from ETH and USDC pools into SCB with a 5% fee.

After IDO, SCB tokens will be listed in a dual pool on Izumi finance, allowing staking and rewarding izi and SCB tokens simultaneously.

After IDO, SCB tokens will be listed in a dual pool on Izumi finance, allowing staking and rewarding izi and SCB tokens simultaneously.

9⃣ That's a wrap up!

You can participate in the 2nd WL #Giveaway to win a better entry if you really care about @SyncBankxyz

Find more info here:

Thanks for reading, like & follow me on Telegram for more analysis like this: t.me

You can participate in the 2nd WL #Giveaway to win a better entry if you really care about @SyncBankxyz

Find more info here:

Thanks for reading, like & follow me on Telegram for more analysis like this: t.me

Follow @Tanaka_L2 & @SyncBankxyz

also follow these chads:

@ScottGShore

@BraverCrypto

@CryptoLuga

@ElCryptoDoc

@Mikee_93

@leilanibabiez

@SherifDefi

@0xBispo

@CRyptOracl3

@Tanaka_L2

@MoonKing___

@Kaffchad

@Karamata22

@CryptoChads_OG

also follow these chads:

@ScottGShore

@BraverCrypto

@CryptoLuga

@ElCryptoDoc

@Mikee_93

@leilanibabiez

@SherifDefi

@0xBispo

@CRyptOracl3

@Tanaka_L2

@MoonKing___

@Kaffchad

@Karamata22

@CryptoChads_OG

جاري تحميل الاقتراحات...