Yield on your crypto assets will fluctuate over time, it tends to go up in bull markets and down in bear markets.

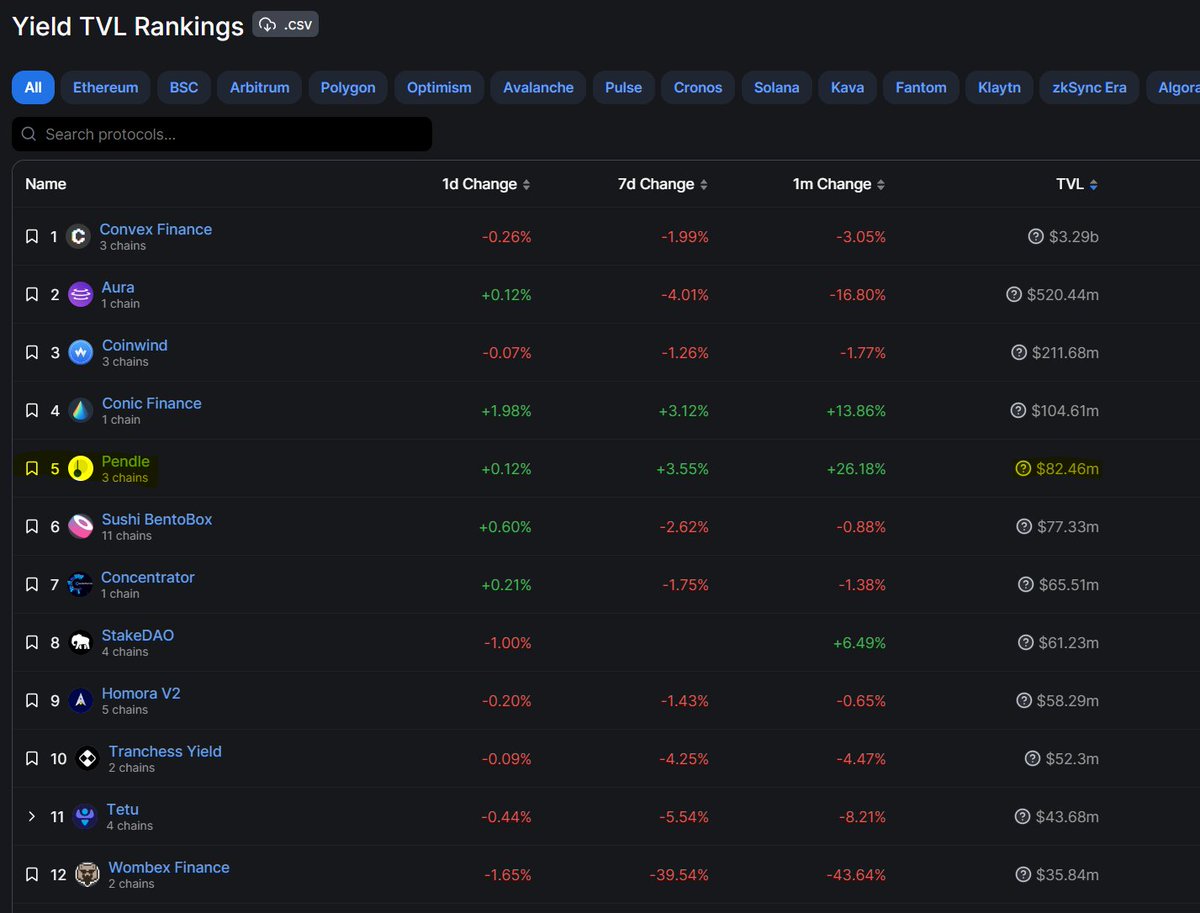

Pendle's aim is to allow you to maximise your yield through all market cycles.

Pendle's aim is to allow you to maximise your yield through all market cycles.

@pendle_fi is a permissionless yield-trading protocol where users can execute various yield-management strategies.

There are 3 main products of Pendle:

1. Yield Tokenization

2. Pendle AMM

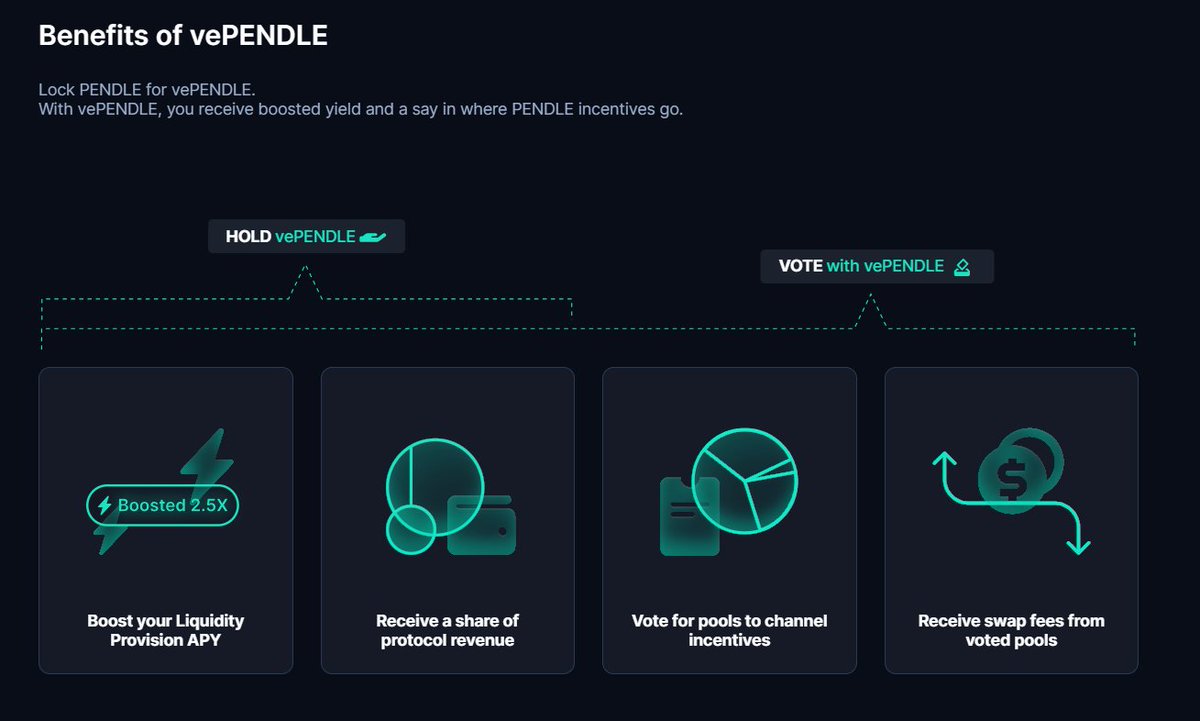

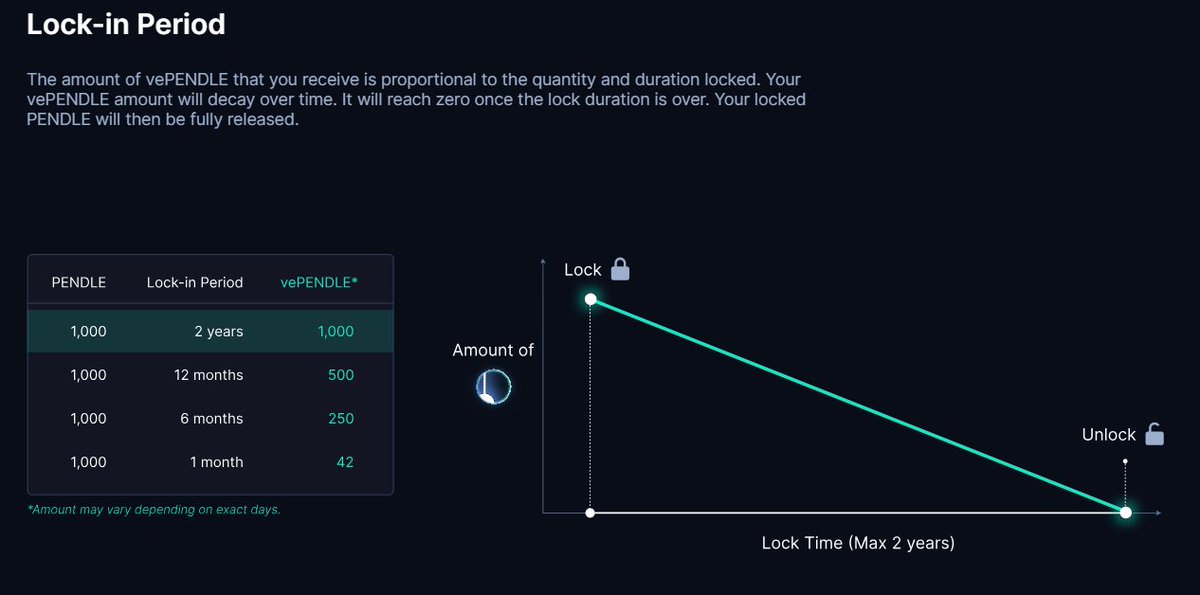

3. vePendle

There are 3 main products of Pendle:

1. Yield Tokenization

2. Pendle AMM

3. vePendle

At the core of what Pendle does is yield tokenisation. Essentially, they split a yield bearing asset into

· YT = Yield of the asset

· PT = Principal of the asset

Here is a great thread by @LouisCooper_ to get you up to speed on the project.

· YT = Yield of the asset

· PT = Principal of the asset

Here is a great thread by @LouisCooper_ to get you up to speed on the project.

1. Revenue

There are 2 revenue sources for the protocol

1. Swap Fees- from Pendle’s AMM.

2. YT Fees- 3% fee from all yield accrued by YT in existence and yields from matured, unredeemed PTs.

There are 2 revenue sources for the protocol

1. Swap Fees- from Pendle’s AMM.

2. YT Fees- 3% fee from all yield accrued by YT in existence and yields from matured, unredeemed PTs.

Currently, 100% of the revenue from swap fees & YT fees is distributed to vePENDLE voters & holders (none goes back to the protocol).

All rewards are also distributed as USDC.

All rewards are also distributed as USDC.

2. Treasury

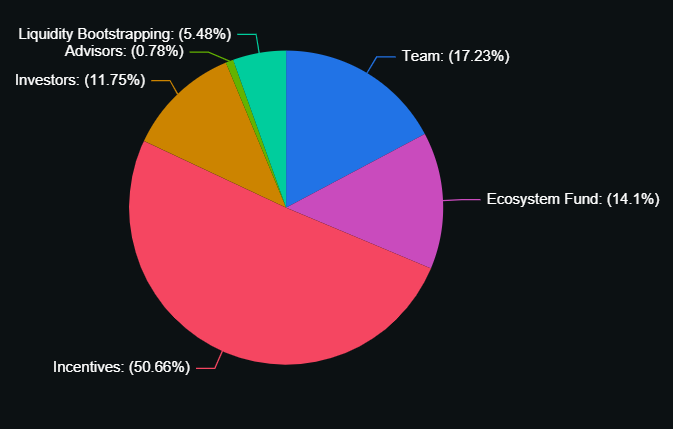

There is no ‘Treasury’ as such for Pendle, but 14% of the initial supply was allocated to the Ecosystem Fund. This is currently worth:

· 46m $PENDLE @ $0.43

· TOTAL $19.6m USD

Note: no protocol revenues currently go to treasury.

7 for Treasury.

There is no ‘Treasury’ as such for Pendle, but 14% of the initial supply was allocated to the Ecosystem Fund. This is currently worth:

· 46m $PENDLE @ $0.43

· TOTAL $19.6m USD

Note: no protocol revenues currently go to treasury.

7 for Treasury.

There are two main tokens that support the ecosystem:

· $PENDLE

· $vePENDLE

The release of PENDLE V2 in late 2022 introduced improved tokenomics and the implementation of ve(3,3)- a version of the Andre Cronje Solidly model.

· $PENDLE

· $vePENDLE

The release of PENDLE V2 in late 2022 introduced improved tokenomics and the implementation of ve(3,3)- a version of the Andre Cronje Solidly model.

4. Locked up funds

These are the current supply stats

• Circulating supply = 207m

• Max supply = 251m

• Market cap = $90m

• FDV = $109m

• Market cap/ FDV = 0.83

These are the current supply stats

• Circulating supply = 207m

• Max supply = 251m

• Market cap = $90m

• FDV = $109m

• Market cap/ FDV = 0.83

In TradFi, the interest derivative market is worth over $400 trillion in notional value, but it’s only accessible to the whales- funds & banks.

Pendle is bringing yield to the people through creating a decentralised and permissionless yield market.

8.5 for Use case.

Pendle is bringing yield to the people through creating a decentralised and permissionless yield market.

8.5 for Use case.

6. Roadmap

The last major upgrade was Pendle V2 which was launched in November 2022. It introduced significant upgrades including:

· Rebuilt AMM

· Improved tokenomics with variant of ve(3,3)- Andre Cronje model

· Standardised Yield (SY)

The last major upgrade was Pendle V2 which was launched in November 2022. It introduced significant upgrades including:

· Rebuilt AMM

· Improved tokenomics with variant of ve(3,3)- Andre Cronje model

· Standardised Yield (SY)

There are no fixed or published roadmaps. However, the following have been mentioned:

· Multichain expansion.

· New simplified tools for users to utilize the protocol’s variety of use-cases.

· New partnerships with market leaders.

7 for Roadmap.

· Multichain expansion.

· New simplified tools for users to utilize the protocol’s variety of use-cases.

· New partnerships with market leaders.

7 for Roadmap.

7. Team & funding

Pendle was launched in Jan 2021 and is led by a mostly anonymous team:

· TN Lee – Co-founder @tn_pendle

· Vu Gaba Vineb – Co-founder & dev @gabavineb

In 2021, the project raised $3.7m, led by Mechanism Capital.

All investor tokens have been fully vested.

Pendle was launched in Jan 2021 and is led by a mostly anonymous team:

· TN Lee – Co-founder @tn_pendle

· Vu Gaba Vineb – Co-founder & dev @gabavineb

In 2021, the project raised $3.7m, led by Mechanism Capital.

All investor tokens have been fully vested.

Pendle has the following partners and integrations:

· Wonderland Fi

· [Redacted] Cartel

· Chainlink

· Coinbase Pay

· Camelot DEX

· GMX GLP

· Layer Zero Labs

· 0xAcidDAO

8 for Team & Funding.

· Wonderland Fi

· [Redacted] Cartel

· Chainlink

· Coinbase Pay

· Camelot DEX

· GMX GLP

· Layer Zero Labs

· 0xAcidDAO

8 for Team & Funding.

8. Summary

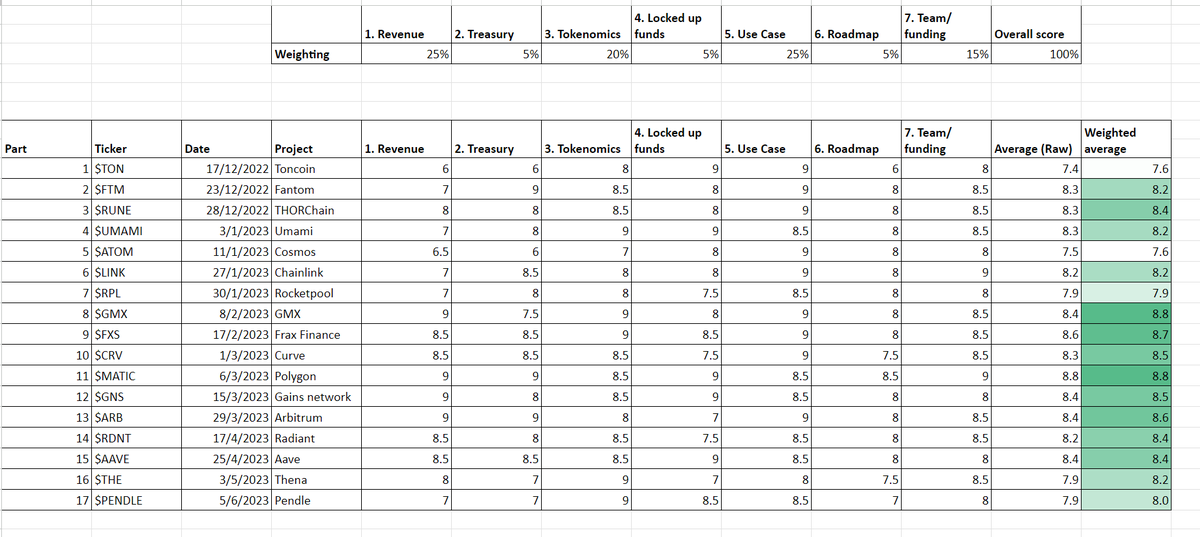

TLDR summary for each category’s score out of 10:

7 - Revenue – 100% of protocol revenue to vePENDLE holders

7 - Treasury– $19.6m in Ecosystem Fund

9 - Tokenomics – Improved vePENDLE mechanics, Real yield

TLDR summary for each category’s score out of 10:

7 - Revenue – 100% of protocol revenue to vePENDLE holders

7 - Treasury– $19.6m in Ecosystem Fund

9 - Tokenomics – Improved vePENDLE mechanics, Real yield

Pendle is one of the more exciting and innovative DeFi projects I have covered recently. I think the tokenisation of yield and implementation within DeFi has a huge potential for growth.

As it is a young protocol with a small market cap, there are of course risks involved.

As it is a young protocol with a small market cap, there are of course risks involved.

The purpose of this thread is for education and research- not financial advice. I am not a paid advisor or ambassador of Pendle.

Always DYOR before Apeing in. Here is a framework I prepared earlier.

Always DYOR before Apeing in. Here is a framework I prepared earlier.

The current macro conditions are still very choppy so stay safe out there frens.

Tagging some fellow Pendle heads who are all worth a follow

@0xTindorr

@SmallCapScience

@Flowslikeosmo

@TheDeFinvestor

@FungiAlpha

@0xSalazar

@crypto_linn

@_FabianHD

@CryptoShiro_

Tagging some fellow Pendle heads who are all worth a follow

@0xTindorr

@SmallCapScience

@Flowslikeosmo

@TheDeFinvestor

@FungiAlpha

@0xSalazar

@crypto_linn

@_FabianHD

@CryptoShiro_

جاري تحميل الاقتراحات...