Trillions of dollars in family wealth are set to be passed down in the next few years — and the transfer will largely reinforce U.S. inequality. nyti.ms

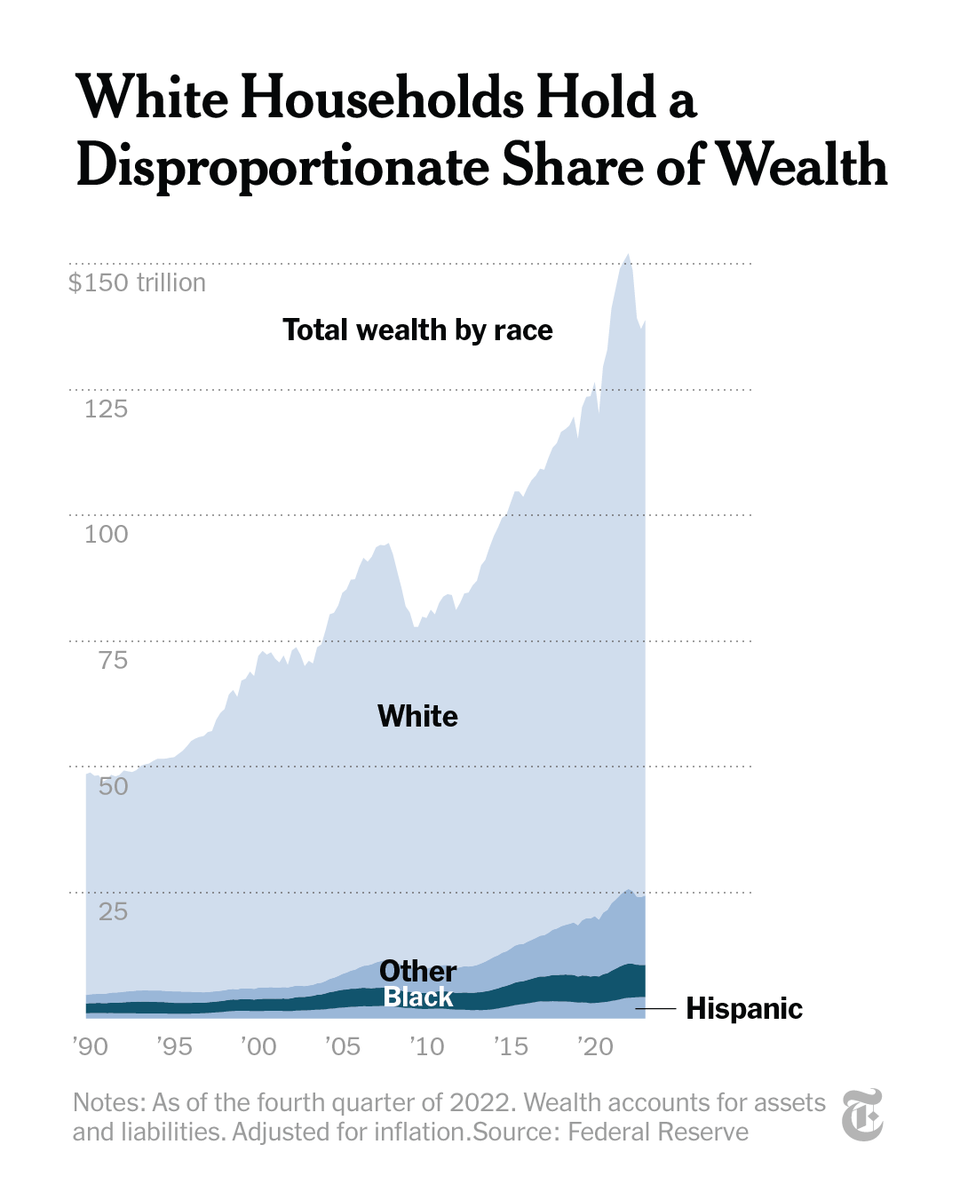

Total family wealth in the U.S. has tripled since 1989, reaching $140 trillion in 2022.

Of the $84 trillion projected to be passed down from older Americans to millennial and Gen X heirs through 2045, $16 trillion will be transferred in the next decade. nyti.ms

Of the $84 trillion projected to be passed down from older Americans to millennial and Gen X heirs through 2045, $16 trillion will be transferred in the next decade. nyti.ms

The top 10% of households will be giving and receiving a majority of the wealth. The top 1% — with about as much wealth as the bottom 90%, — will dictate the broadest share of the money flow. The bottom 50% will account for 8% of transfers. nyti.ms

A reason there are such large soon-to-be-inherited sums is the uneven way boomers benefited from price growth in the financial and housing markets. The average price of a U.S. house has risen about 500% since 1983, when most were in their 20s and 30s. nyti.ms

The boomers who benefited from decades of growth in real estate and financial assets were, in general, already rich, white or both.

Black and Hispanic or Latin households have higher-than-average poverty rates and far-below-average household wealth. nyti.ms

Black and Hispanic or Latin households have higher-than-average poverty rates and far-below-average household wealth. nyti.ms

There are few aspects of economic life that will go untouched by the knock-on effects of the handover: Housing, education, health care, financial markets, labor markets and politics will all inevitably be affected.

Read more in our full story. nyti.ms

Read more in our full story. nyti.ms

جاري تحميل الاقتراحات...