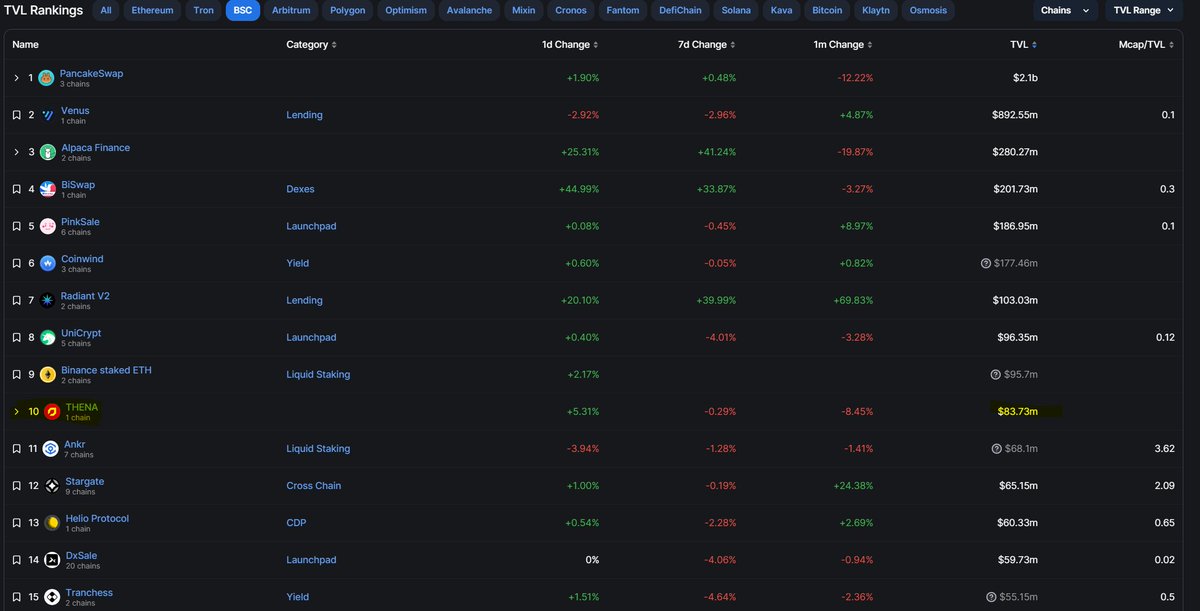

BNB chain has over 1m+ daily active users and continues to grow.

If you are bullish on BSC and are looking for a way to capitalise…. @ThenaFi_ could be the answer.

With its innovative Solidly model, real yield and a thriving community, Thena is poised to explode in growth.🧵

If you are bullish on BSC and are looking for a way to capitalise…. @ThenaFi_ could be the answer.

With its innovative Solidly model, real yield and a thriving community, Thena is poised to explode in growth.🧵

Let’s dive in…

• $THE

• Price = $0.33

• DEX

• BNB Chain

• Market cap = $7m – Rank 1123

• All time high = $0.995914 (-66.5%)

• All time low= $0.257983 (29.5%)

Thena was launched at the start of 2023 and is Decentralised exchange based on the Solidly ve(3,3) model.

• $THE

• Price = $0.33

• DEX

• BNB Chain

• Market cap = $7m – Rank 1123

• All time high = $0.995914 (-66.5%)

• All time low= $0.257983 (29.5%)

Thena was launched at the start of 2023 and is Decentralised exchange based on the Solidly ve(3,3) model.

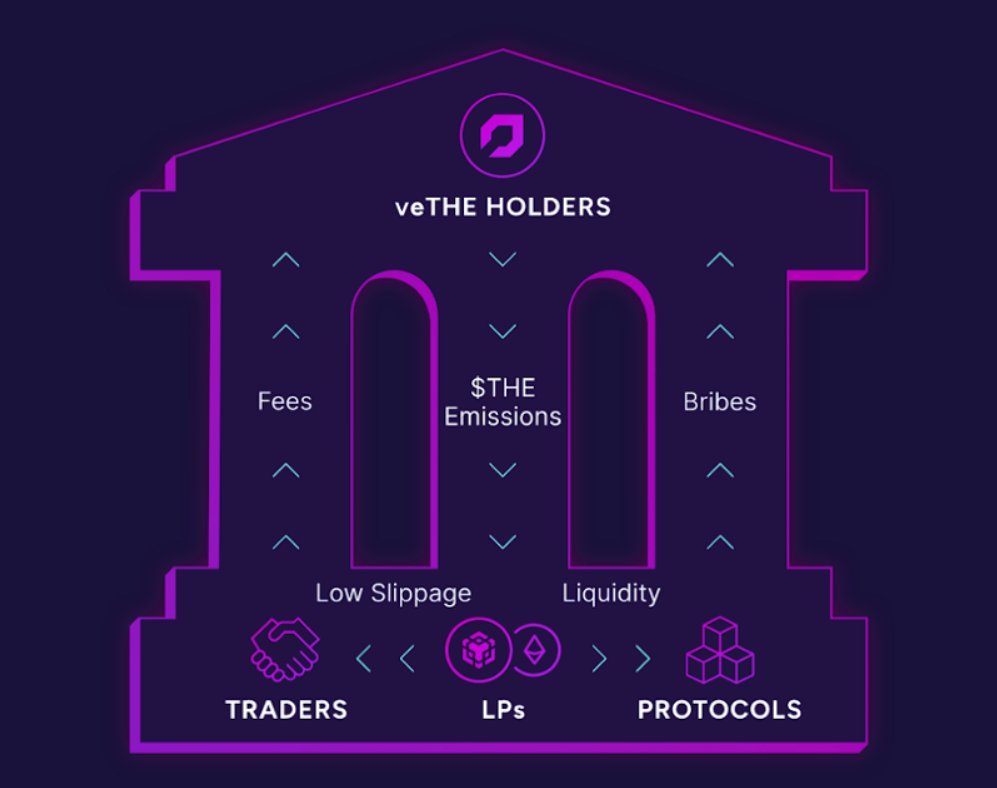

It aims to improve on Andre Cronje’s original concept and become THE native liquidity layer of BNB Chain.

On the protocol you can

• Swap tokens

• Provide Liquidity

• Lock $THE to $veTHE & earn rewards

• Vote on LPs to earn bribes

A great thread by @defi_naly

On the protocol you can

• Swap tokens

• Provide Liquidity

• Lock $THE to $veTHE & earn rewards

• Vote on LPs to earn bribes

A great thread by @defi_naly

2. Treasury

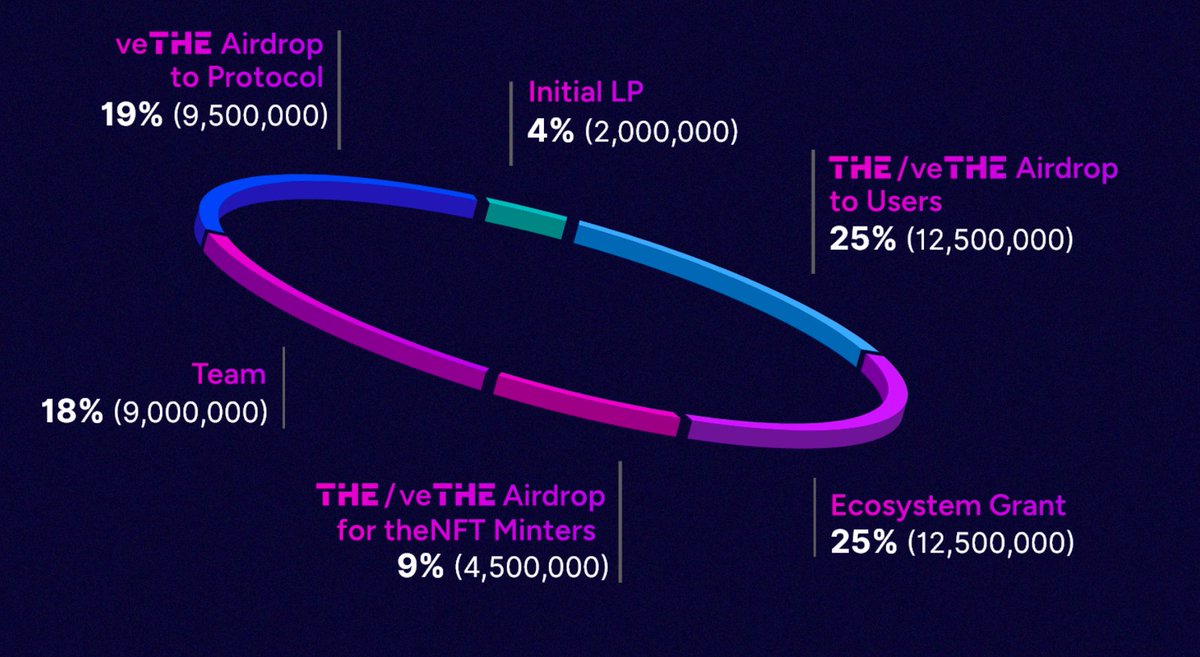

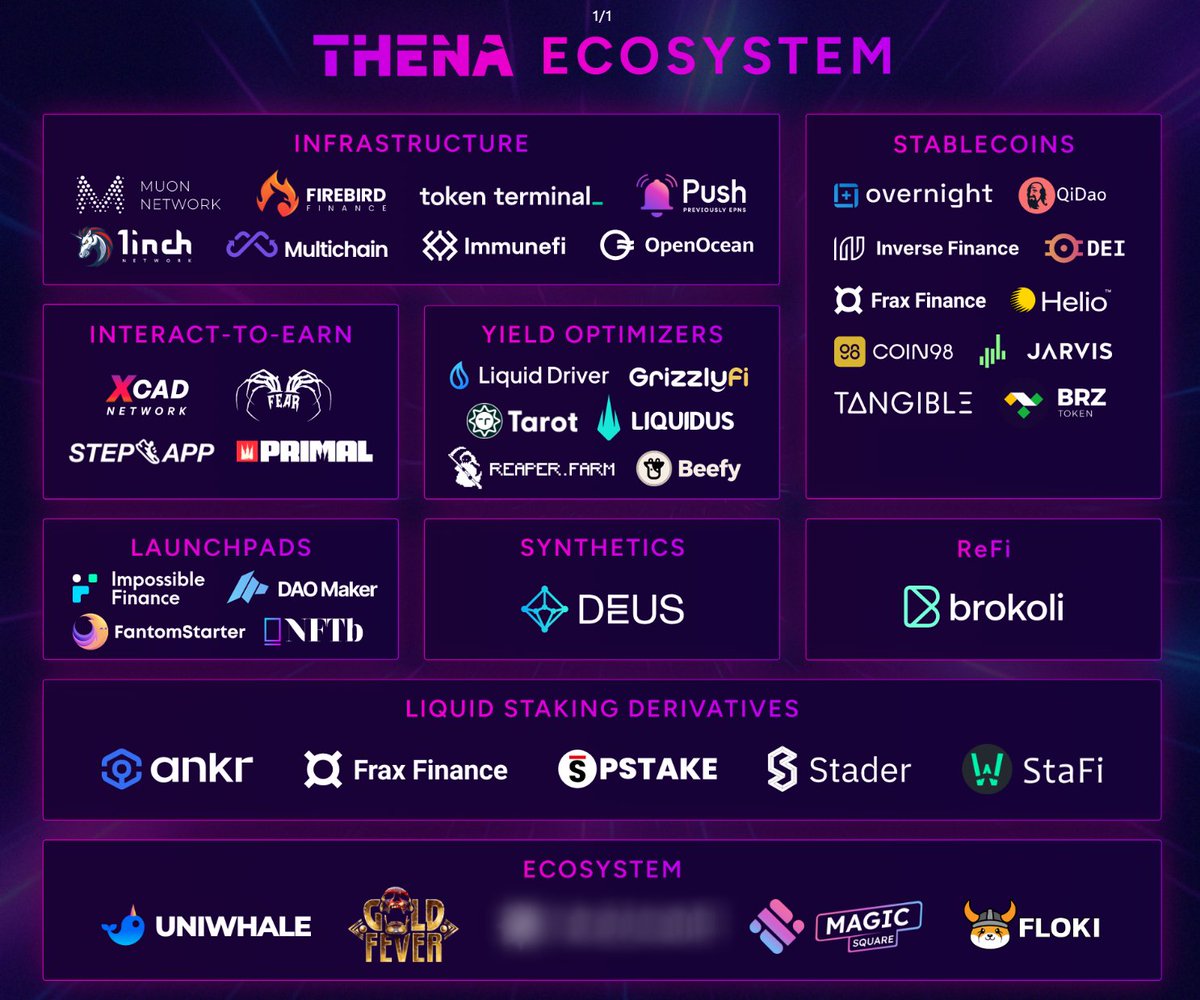

There is no ‘Treasury’ as such for Thena, but 25% of the initial supply was allocated to the Ecosystem Grant.

This is to support a wide range of projects and accelerate the growth of THENA.

• 12.5m $THE @ $0.33

• TOTAL $4.13m USD

7 for Treasury.

There is no ‘Treasury’ as such for Thena, but 25% of the initial supply was allocated to the Ecosystem Grant.

This is to support a wide range of projects and accelerate the growth of THENA.

• 12.5m $THE @ $0.33

• TOTAL $4.13m USD

7 for Treasury.

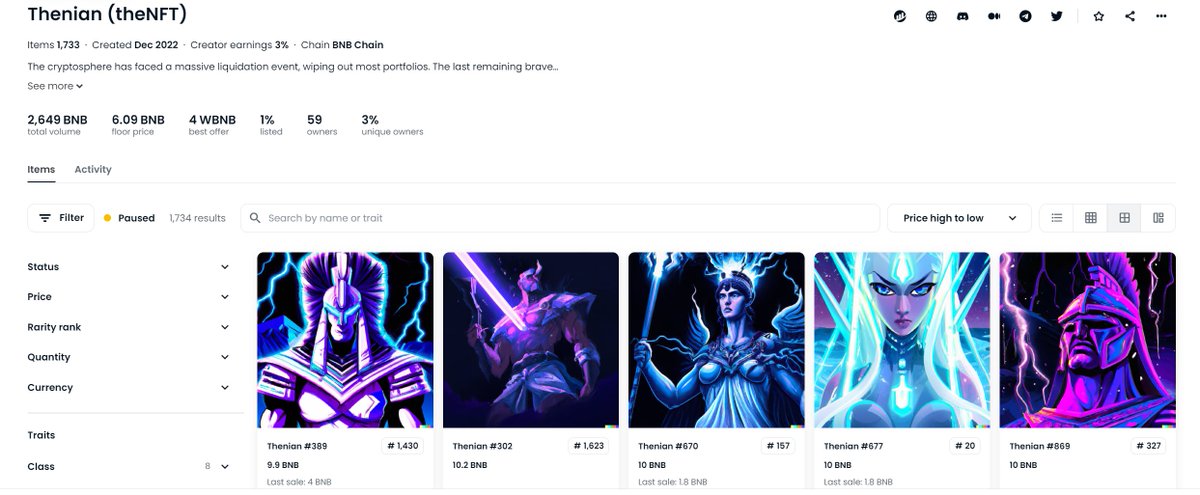

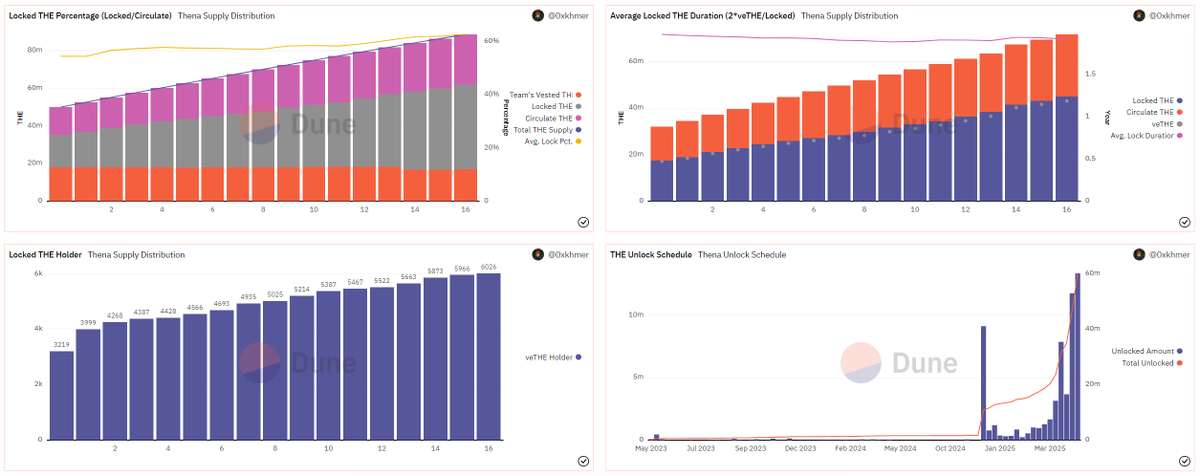

There are three main tokens

• $THE

• $veTHE

• theNFT

$THE is the utility token of the protocol and its purpose is to

• Incentivise liquidity for optimal trading conditions

• Encourage decentralized governance

• $THE

• $veTHE

• theNFT

$THE is the utility token of the protocol and its purpose is to

• Incentivise liquidity for optimal trading conditions

• Encourage decentralized governance

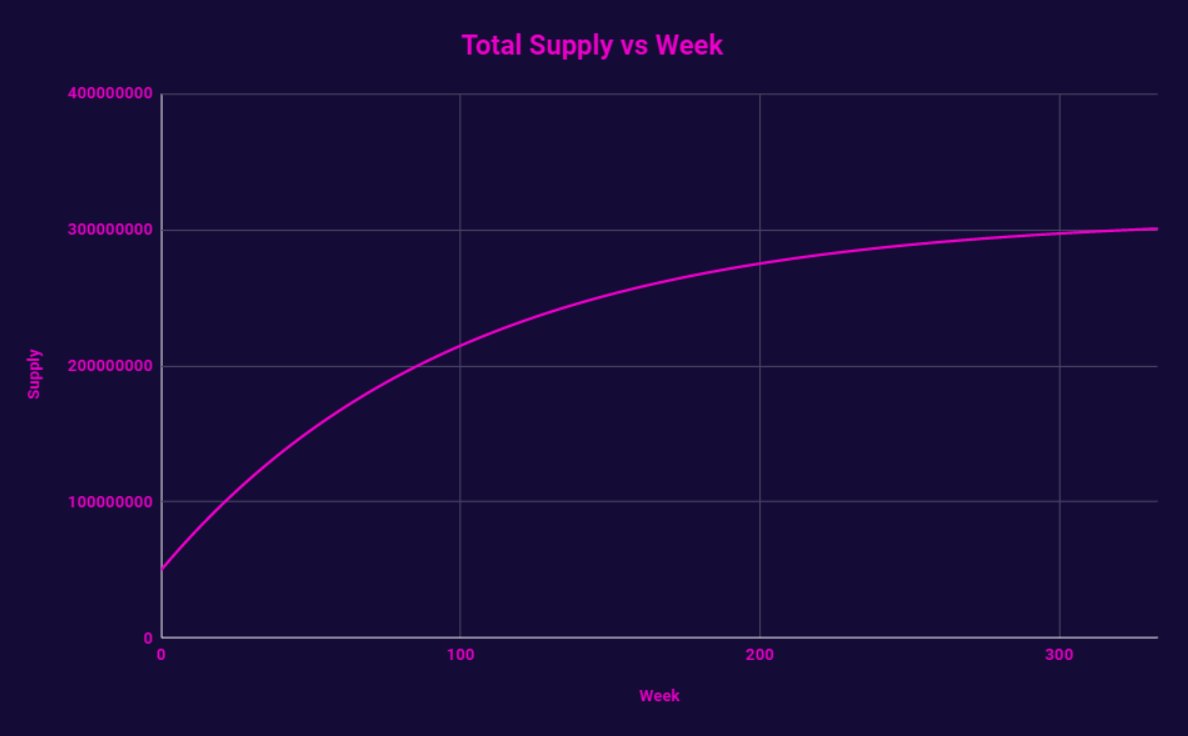

• Curve- Vote escrowed model to strengthen incentives for long-term token holders

• Olympus DAO - Staking/Rebasing/Bonding or (3,3) game theory

The mechanics are quite complex, I recommend reading @SimplifyDeFi ‘s thread.

9 for Tokenomics.

• Olympus DAO - Staking/Rebasing/Bonding or (3,3) game theory

The mechanics are quite complex, I recommend reading @SimplifyDeFi ‘s thread.

9 for Tokenomics.

6. Roadmap

Thena Fusion was released in April and comes with it the following improvements

• Users can add concentrated liquidity which is managed automatically

• More consistent rewards to LPs

• Core/ stable pools could create self-sustaining flywheels

Thena Fusion was released in April and comes with it the following improvements

• Users can add concentrated liquidity which is managed automatically

• More consistent rewards to LPs

• Core/ stable pools could create self-sustaining flywheels

Read more about the exciting update by @Slappjakke

After the V2 migration has been completed, there isn’t a lot of info from the team on future roadmap.

7.5 for Roadmap.

After the V2 migration has been completed, there isn’t a lot of info from the team on future roadmap.

7.5 for Roadmap.

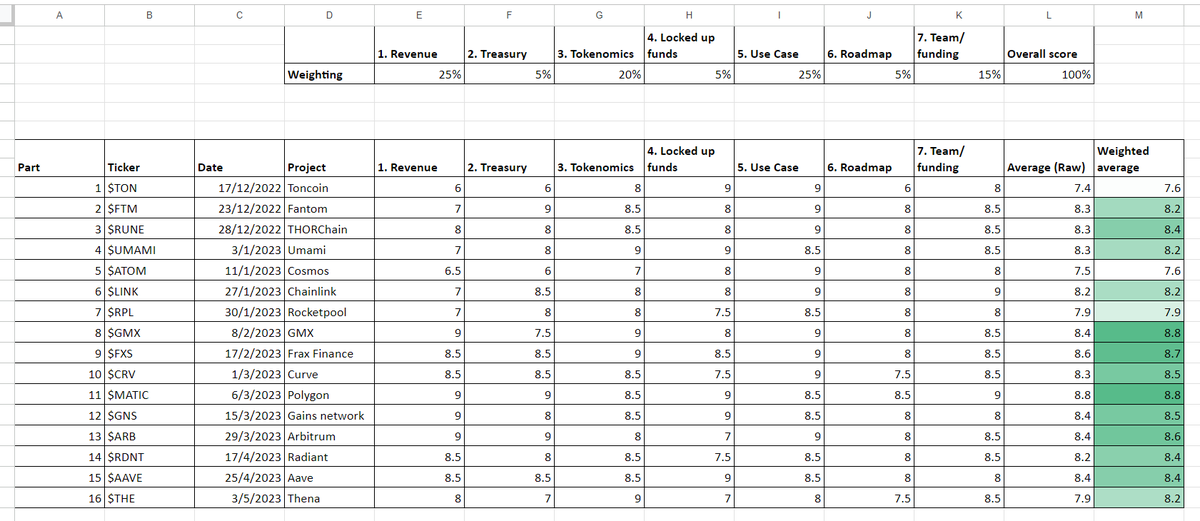

8. Summary

TLDR summary for each category’s score out of 10.

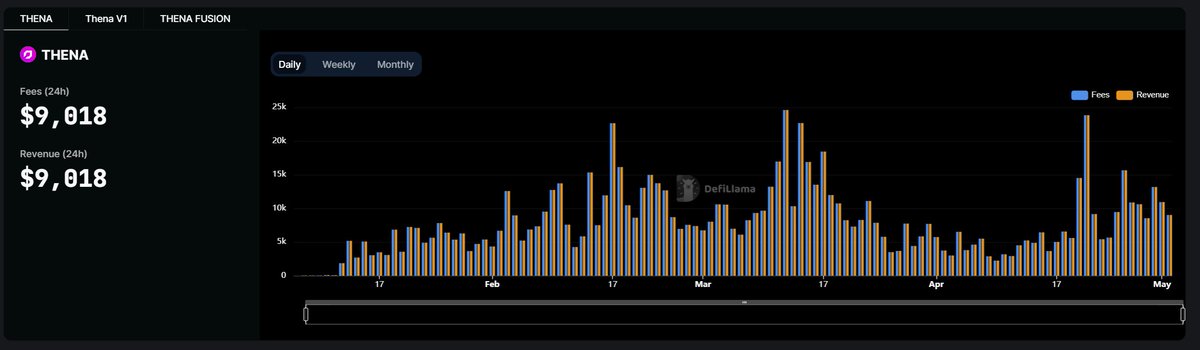

8 - Revenue – $9k daily revenue- all to holders

7 - Treasury– $4.13m in Ecosystem Grant

9 - Tokenomics – Improved Solidly ve(3,3) mechanics

TLDR summary for each category’s score out of 10.

8 - Revenue – $9k daily revenue- all to holders

7 - Treasury– $4.13m in Ecosystem Grant

9 - Tokenomics – Improved Solidly ve(3,3) mechanics

Thena is one of the more exciting and innovative DeFi projects I have covered recently.

It has great tokenomics and has positioned itself well within the BNB chain ecosystem to benefit from the influx of new protocols and liquidity.

It has great tokenomics and has positioned itself well within the BNB chain ecosystem to benefit from the influx of new protocols and liquidity.

As it is a young protocol with a small market cap, there are of course risks involved with being early. However, I do believe that the project has strong potential.

The purpose of this thread is for education and research- not financial advice. I am not a paid advisor or ambassador of Thena.

Always DYOR before Apeing in. Here is a framework I prepared earlier.

Always DYOR before Apeing in. Here is a framework I prepared earlier.

The current macro conditions are still very choppy so stay safe out there frens.

Tagging some fellow Thenians who are all worth a follow

@rektdiomedes

@crypthoem

@schizoxbt

@Slappjakke

@SimplifyDeFi

@resdegen

@crypto_linn

@NickDrakon

@DeFiSurfer808

@CryptoDamus411

Tagging some fellow Thenians who are all worth a follow

@rektdiomedes

@crypthoem

@schizoxbt

@Slappjakke

@SimplifyDeFi

@resdegen

@crypto_linn

@NickDrakon

@DeFiSurfer808

@CryptoDamus411

@drakeondigital @blockbytescom @CompleteDegen @CryptMoose_ @danblocmates @SmallCapScience @0xKhmer That's a wrap!

If you enjoyed this thread:

1. Follow me @jake_pahor for more of these

2. RT the tweet below to share this thread with your audience

If you enjoyed this thread:

1. Follow me @jake_pahor for more of these

2. RT the tweet below to share this thread with your audience

جاري تحميل الاقتراحات...