In times of volatility, good cash management approaches can make all the difference.

Enabling companies to extend runway, hedge against inflation, and manage cash flows.

Enabling companies to extend runway, hedge against inflation, and manage cash flows.

However many onchain allocators experience challenges accessing banks and brokerages.

This prevents them from participating in offchain options that meet the risk, liquidity and accounting requirements of cash management.

This prevents them from participating in offchain options that meet the risk, liquidity and accounting requirements of cash management.

Onchain options are yet to provide the peace of mind necessary to attract hard earned treasury funds.

Counterparty risk is either too high, assets too illiquid, or rates between 1-2% too low for the level of smart contract risk.

Until today!

Counterparty risk is either too high, assets too illiquid, or rates between 1-2% too low for the level of smart contract risk.

Until today!

1. Simple and fast access for non-US Accredited Investors and Entities

So Lenders have more time to focus on core business activities, we’ve simplified onboarding to 3-steps.

DAOs are eligible and we’d be delighted to support with the governance process.

So Lenders have more time to focus on core business activities, we’ve simplified onboarding to 3-steps.

DAOs are eligible and we’d be delighted to support with the governance process.

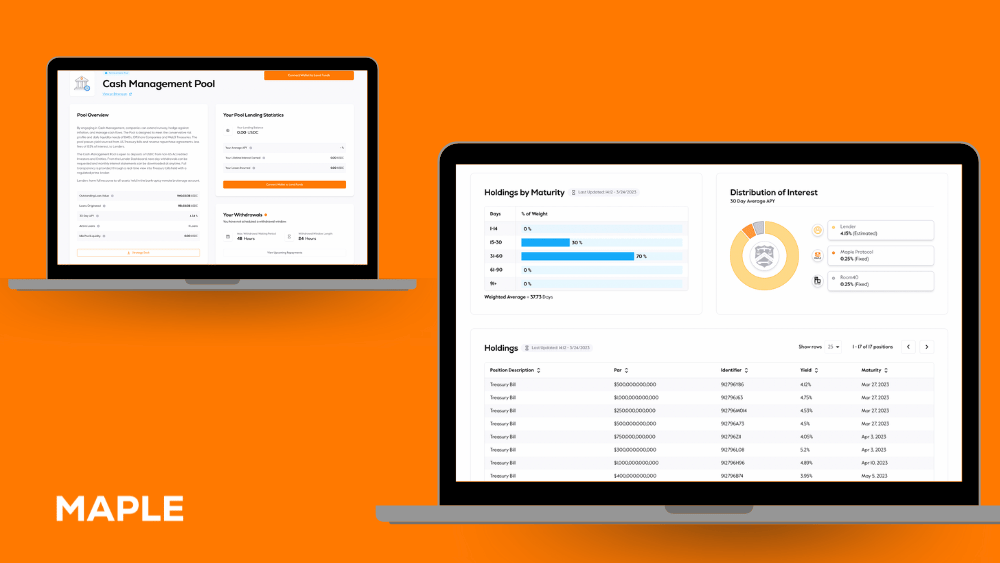

2. The pool will pass the 1-month US Treasury bill rate, less fees, to Lenders

Room40 Capital has established a stand-alone SPV to be the sole borrower from the pool.

The team has decades of operational and trading experience with particular expertise in the US Treasury market.

Room40 Capital has established a stand-alone SPV to be the sole borrower from the pool.

The team has decades of operational and trading experience with particular expertise in the US Treasury market.

3. Interest accrues immediately and next-day withdrawals are facilitated

So Lenders can manage cash flows first and foremost, there’s no lock-up period and withdrawals will be serviced the next US banking day.

So Lenders can manage cash flows first and foremost, there’s no lock-up period and withdrawals will be serviced the next US banking day.

5. Managed with leading 3rd parties

The borrower has decades of experience trading Treasuries and will trade, custody and clear from an account with a regulated broker.

Maple has a track record in providing secure products with best in class smart contract infrastructure.

The borrower has decades of experience trading Treasuries and will trade, custody and clear from an account with a regulated broker.

Maple has a track record in providing secure products with best in class smart contract infrastructure.

6. Extra steps taken in light of recent market events

Assets are held in standalone single purpose vehicle, custodied by a regulated prime broker and Lenders have full recourse over all assets held in the brokerage account.

Assets are held in standalone single purpose vehicle, custodied by a regulated prime broker and Lenders have full recourse over all assets held in the brokerage account.

We’re really proud to bring this to market at the perfect time, and see the Pool becoming a core part of diversified corporate and DAO Treasury allocations overtime.

Read the full press release:

maple.finance

Read the full press release:

maple.finance

جاري تحميل الاقتراحات...