This thread consists the following:

1) What is Real World Asset tokenization?

2) The focus for my comparison

3) The compared projects explained

4) Special features of the projects

5) Key differences

6) Conclusion

1) What is Real World Asset tokenization?

2) The focus for my comparison

3) The compared projects explained

4) Special features of the projects

5) Key differences

6) Conclusion

2) The focus for my comparison

· For me it was important to make this thread as

short & understandable as possible.

· For this reason, I have focused on the following:

➡️What do the projects deliver?

➡️What are their unique features?

Let's go!

· For me it was important to make this thread as

short & understandable as possible.

· For this reason, I have focused on the following:

➡️What do the projects deliver?

➡️What are their unique features?

Let's go!

3) The compared projects explained

I'm comparing the following projects:

· $LEOX

· $THEO

· $LABS

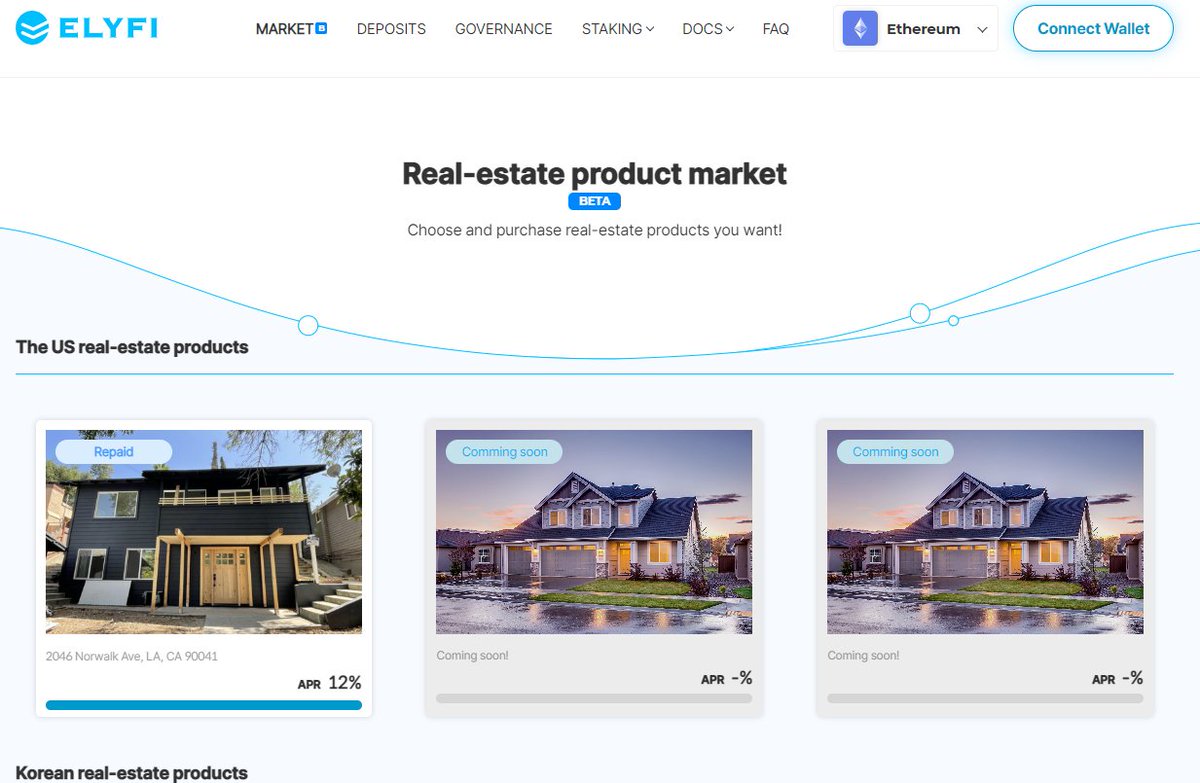

· $ELFI

· $FACTR

Why these?

Because in my opinion, the hype around these is the greatest & I want to create clarity accordingly.

I'm comparing the following projects:

· $LEOX

· $THEO

· $LABS

· $ELFI

· $FACTR

Why these?

Because in my opinion, the hype around these is the greatest & I want to create clarity accordingly.

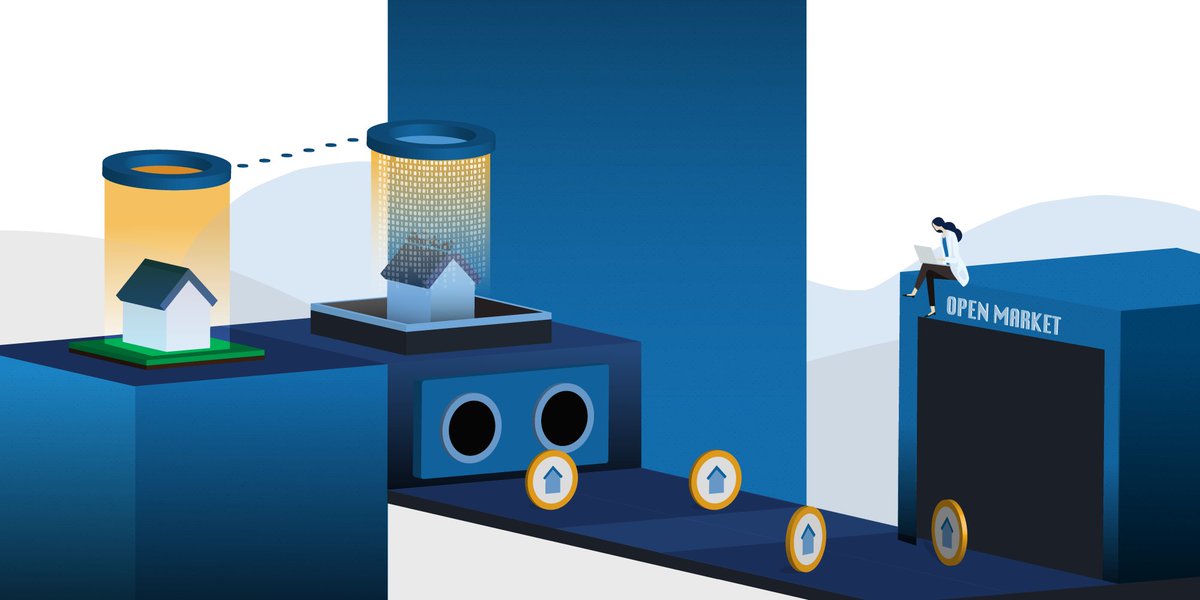

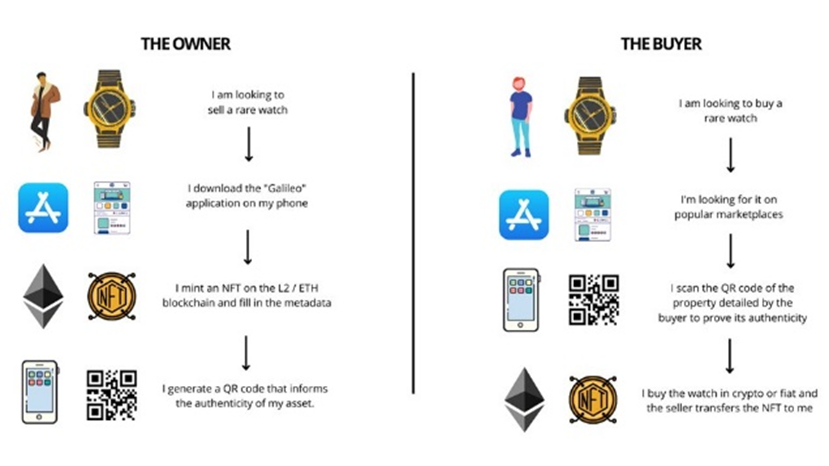

What is $LEOX?

· $LEOX is an open-source infrastructure developed

by @galileoprotocol for executing smart contracts.

· It allows the creation of "pNFTs" representing

physical goods, issued on multiple chains & can

interact with any blockchain.

· $LEOX is an open-source infrastructure developed

by @galileoprotocol for executing smart contracts.

· It allows the creation of "pNFTs" representing

physical goods, issued on multiple chains & can

interact with any blockchain.

What is $THEO?

· $THEO / @TheopetraLabs is a #RWA project that is

utilising decentralised technology.

· $THEO tackles the world's housing affordability

crisis.

· $THEO / @TheopetraLabs is a #RWA project that is

utilising decentralised technology.

· $THEO tackles the world's housing affordability

crisis.

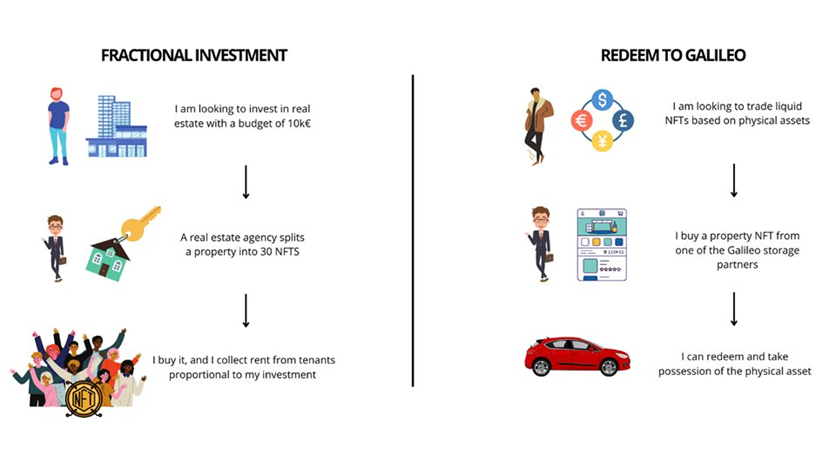

2. $LABS

· Fractional investment of real estates

· Tokenization of real estates as property owners

· Through @staynexcom it'll soon be possible to

purchase usage rights from resorts around the

world

· Fractional investment of real estates

· Tokenization of real estates as property owners

· Through @staynexcom it'll soon be possible to

purchase usage rights from resorts around the

world

2. $LABS

· No working products.

· Fractional investment in real estate

· Interesting use case with @staynexcom and the

rights to use resorts.

· Partnership with @Arsenal gives some security.

· No working products.

· Fractional investment in real estate

· Interesting use case with @staynexcom and the

rights to use resorts.

· Partnership with @Arsenal gives some security.

6) Conclusion

All in all, it's relevant to identify for yourself what kind of project you want to invest in.

Not all RWA projects are the same.

Accordingly, I find the statement that these projects combine the real world with DeFi too superficial & meaningless.

All in all, it's relevant to identify for yourself what kind of project you want to invest in.

Not all RWA projects are the same.

Accordingly, I find the statement that these projects combine the real world with DeFi too superficial & meaningless.

I focus on projects with unique technologies & ideas.

I consider which project has the greatest potential for a successful future.

If the project has workig products, this is a plus for me.

Don't jump in every shitty RWA project.

Think about it!

I consider which project has the greatest potential for a successful future.

If the project has workig products, this is a plus for me.

Don't jump in every shitty RWA project.

Think about it!

جاري تحميل الاقتراحات...