Mark your calendars and set an alarm!!

📢 G[r]eeks! 🏛️, the 2nd @ArchimedesFi Leverage round has been announced!!

You don’t want to miss this.

Not up to speed on the project? I got you covered.

🏛️🧵 1/17

📢 G[r]eeks! 🏛️, the 2nd @ArchimedesFi Leverage round has been announced!!

You don’t want to miss this.

Not up to speed on the project? I got you covered.

🏛️🧵 1/17

In this thread I will cover

• What is Archimedes

• What is a Leverage Round

• 2nd Round details

• How to participate

2/17

• What is Archimedes

• What is a Leverage Round

• 2nd Round details

• How to participate

2/17

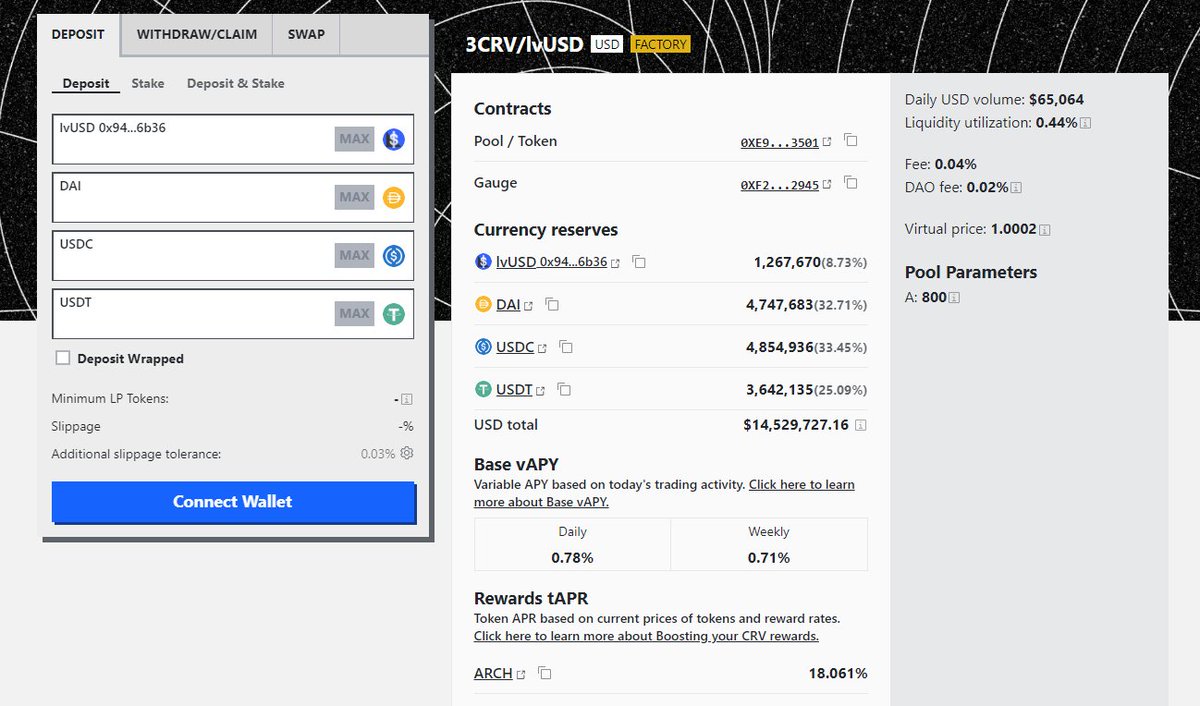

-What is Archimedes-

Archimedes is an experimental lending and borrowing platform built on top of Curve.

The token, $ARCH has just been launched and is tradeable on Uniswap.

The project serves 2 users

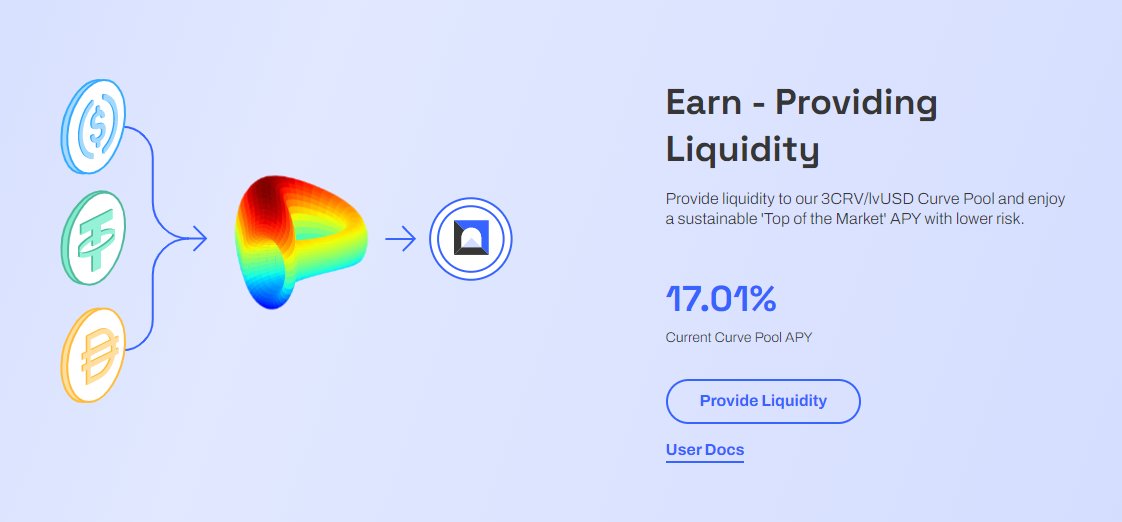

1. Lenders (Liquidity Providers)

2. Borrowers (Leverage Takers)

3/17

Archimedes is an experimental lending and borrowing platform built on top of Curve.

The token, $ARCH has just been launched and is tradeable on Uniswap.

The project serves 2 users

1. Lenders (Liquidity Providers)

2. Borrowers (Leverage Takers)

3/17

You might be asking yourself- we have Curve, why do we need Archimedes?

Curve has become the bedrock of DeFi but it is starting to encounter scaling issues due to Curve emissions. Yields get diluted due to inflows of capital and therefore active LP management is required.

7/17

Curve has become the bedrock of DeFi but it is starting to encounter scaling issues due to Curve emissions. Yields get diluted due to inflows of capital and therefore active LP management is required.

7/17

Archimedes is designed to support the long term growth of Curve by facilitating large investments into stablecoin pools whilst also maintaining long term sustainable yields.

8/17

8/17

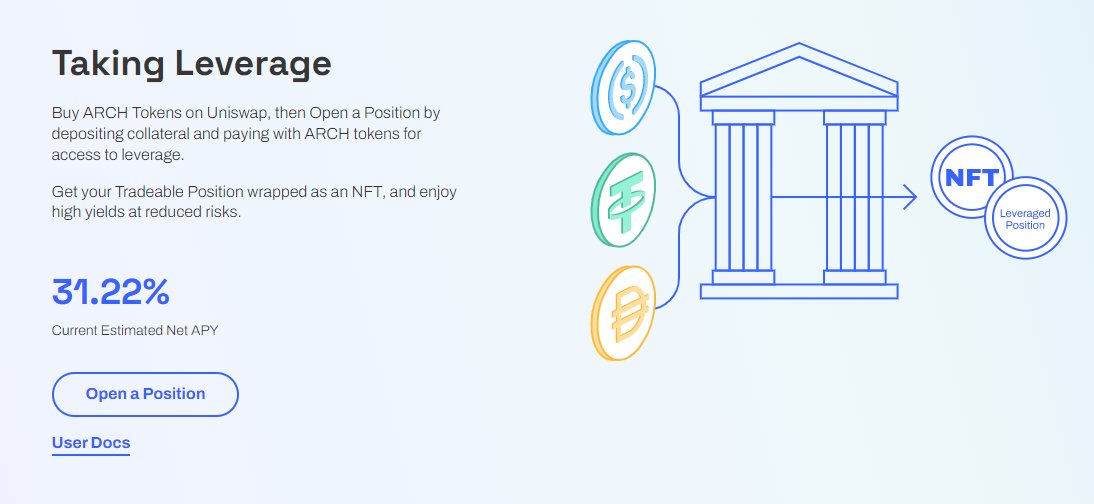

-What is a Leverage Round-

In order to take out Leverage on Archimedes, you need to buy lvUSD through a Leverage Round.

Each round is announced at certain TVL milestones by the team.

A leverage round is essentially an auction where you can purchase leverage.

9/17

In order to take out Leverage on Archimedes, you need to buy lvUSD through a Leverage Round.

Each round is announced at certain TVL milestones by the team.

A leverage round is essentially an auction where you can purchase leverage.

9/17

At the start of the G(r)eek auction, the initial price of lvUSD will start at a higher set price and decrease over time until all leverage is sold.

During the round...

• $ARCH purchasing power increases ⬆️

• Leverage becomes cheaper ⬇️

10/17

During the round...

• $ARCH purchasing power increases ⬆️

• Leverage becomes cheaper ⬇️

10/17

So if you are feeling lucky, you can wait till right at the end of the round to try and purchase leverage when it is cheapest.

However, you run the risk of the leverage all being sold before you get to buy. Clever mechanics.

11/17

However, you run the risk of the leverage all being sold before you get to buy. Clever mechanics.

11/17

Check out the results from the 1st Leverage round that started earlier this week.

Update: First round has now been fully completed! ✅

12/17

Update: First round has now been fully completed! ✅

12/17

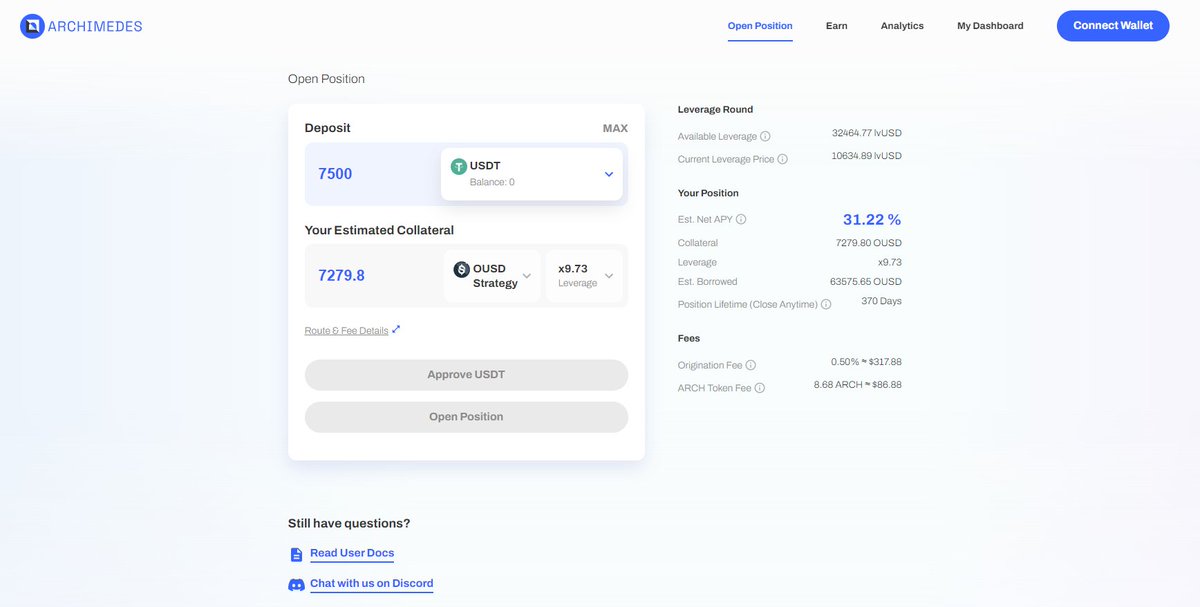

-Leverage Round 2 details-

🏛️ Projected APY after Performance Fees: ~33% 🤤

🏛️ At least $1M of Leverage

⌚ When? Thu Feb 23rd, 4pm PST

Check out the official announcement below. More details will be announced on Thursday 30 min prior to round start- follow @ArchimedesFi

13/17

🏛️ Projected APY after Performance Fees: ~33% 🤤

🏛️ At least $1M of Leverage

⌚ When? Thu Feb 23rd, 4pm PST

Check out the official announcement below. More details will be announced on Thursday 30 min prior to round start- follow @ArchimedesFi

13/17

-How to participate-

Opening a leverage position on Archimedes is relatively easy.

You will need either USDT, USDC or DAI stablecoin- which you can purchase from your favourite DEX (Curve, 1inch etc.)

14/17

Opening a leverage position on Archimedes is relatively easy.

You will need either USDT, USDC or DAI stablecoin- which you can purchase from your favourite DEX (Curve, 1inch etc.)

14/17

Archimedes will then take care of all conversions from the stablecoin to $OUSD and $ARCH that are required for opening a position.

Follow the step by step guide below.

docs.archimedesfi.com

15/17

Follow the step by step guide below.

docs.archimedesfi.com

15/17

For all the latest alpha on the project, follow these accounts.

@CurveCap

@ViktorDefi

@DeFi_Made_Here

@CurveFinance

@ArchimedesFi

@OzDeFiWizard

@tomermayara

@raaguiars

16/17

@CurveCap

@ViktorDefi

@DeFi_Made_Here

@CurveFinance

@ArchimedesFi

@OzDeFiWizard

@tomermayara

@raaguiars

16/17

Some useful links

Curve pool- curve.fi

Dune dashboard- dune.com

Defillama dashboard- defillama.com

Docs/ whitepaper- docs.archimedesfi.com

17/17

Curve pool- curve.fi

Dune dashboard- dune.com

Defillama dashboard- defillama.com

Docs/ whitepaper- docs.archimedesfi.com

17/17

That's a wrap!

If you enjoyed this thread:

1. Follow me @jake_pahor for more of these

2. RT the tweet below to share this thread with your audience

If you enjoyed this thread:

1. Follow me @jake_pahor for more of these

2. RT the tweet below to share this thread with your audience

جاري تحميل الاقتراحات...