Reading Etherscan is the basics for being a Crypto Analyst.

But most people sucks on this and think It's meant for experts.

Here are the 5 free Tools that will help you interpret information on Etherscan easily:

But most people sucks on this and think It's meant for experts.

Here are the 5 free Tools that will help you interpret information on Etherscan easily:

The Average Crypto Analyst earns $75k Annually.

Being a Maestro with these tools can give you that opportunity.

Here's our recipe for today:

• Bubblemaps

• Debank

• Bread Crumbs

• Arkham Intelligence

• Dune Analytics

Being a Maestro with these tools can give you that opportunity.

Here's our recipe for today:

• Bubblemaps

• Debank

• Bread Crumbs

• Arkham Intelligence

• Dune Analytics

1️⃣ Bubblemaps @bubblemaps

This is one of the newest innovative tools that dissects data from etherscan easily and not just that, but data from several blockchains (BSC Chain, Fantom, Avalanche e.t.c).

This is one of the newest innovative tools that dissects data from etherscan easily and not just that, but data from several blockchains (BSC Chain, Fantom, Avalanche e.t.c).

It also covers the DeFI and NFTs Sector, with BubbleMaps, you're one step away from being an on-chain detective.

This helps you to:

• Check token distribution

• Explore wallets (VCs)

• Reveal Connections

• Identify Rugs

• Spot Wash Trade

This helps you to:

• Check token distribution

• Explore wallets (VCs)

• Reveal Connections

• Identify Rugs

• Spot Wash Trade

Let’s take some few practical examples with this.

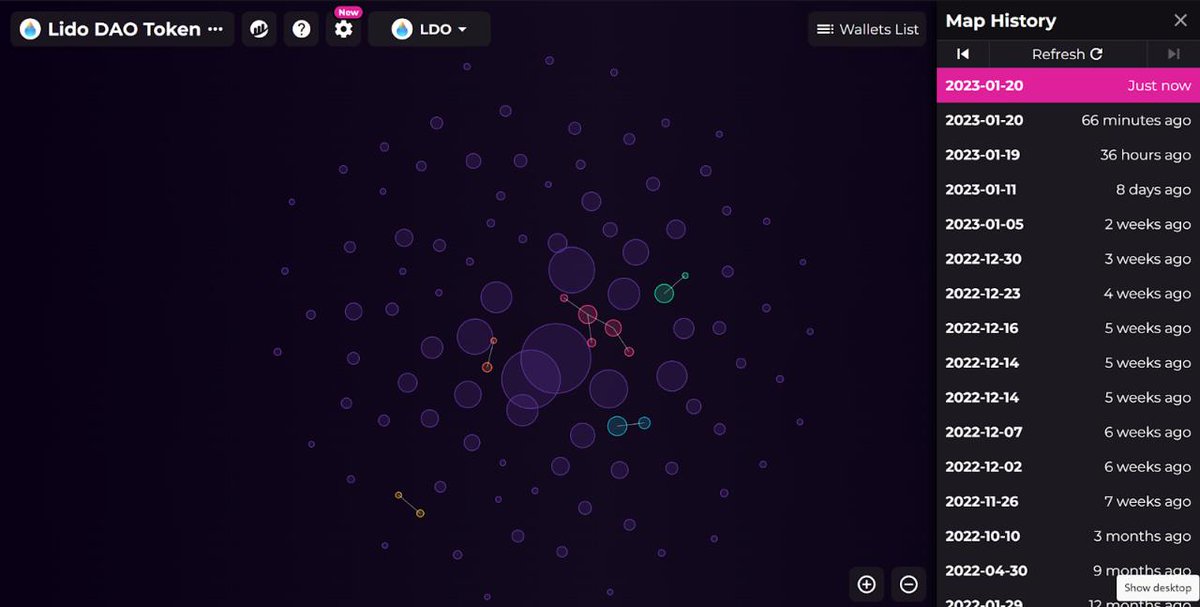

Using $LDO as a case study, we can explore wallets, reveal connections and check token distributions.

Using $LDO as a case study, we can explore wallets, reveal connections and check token distributions.

From the image above, it shows:

1. LIDO token is evenly distributed, The bubbles shows Top addresses ranked from #1 - #150 based on Amounts.

2. The bigger bubbles show the addresses with the highest amount and Vice Versa

1. LIDO token is evenly distributed, The bubbles shows Top addresses ranked from #1 - #150 based on Amounts.

2. The bigger bubbles show the addresses with the highest amount and Vice Versa

3. There aren't many clusters; clusters are used to indicate transfers between wallets (ETH, USDC or LDO in this case) The more clusters, the more activities the address has with other addresses and which can be suspicious in most cases.

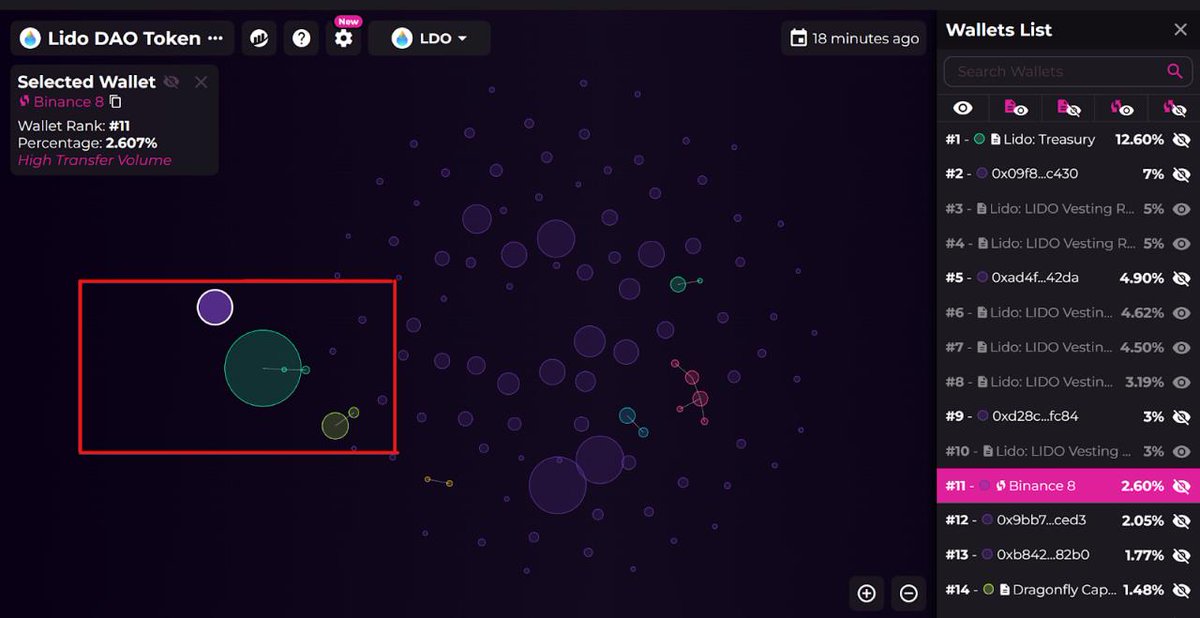

I particularly singled out these 3 wallets in the red block to give a clear explanation on how to explore VCs wallets.

The three wallets are:

The three wallets are:

1. Binance (The purple bubble): holds 2.60% of $LDO supply

2. Lido Treasury ( The dark green bubble): This is LIDO Treasury and 12.60% of its supply is locked

3. Dragonfly Capital (The small light green bubble): This is another VC like Binance, holding 1.48% supply of $LDO.

2. Lido Treasury ( The dark green bubble): This is LIDO Treasury and 12.60% of its supply is locked

3. Dragonfly Capital (The small light green bubble): This is another VC like Binance, holding 1.48% supply of $LDO.

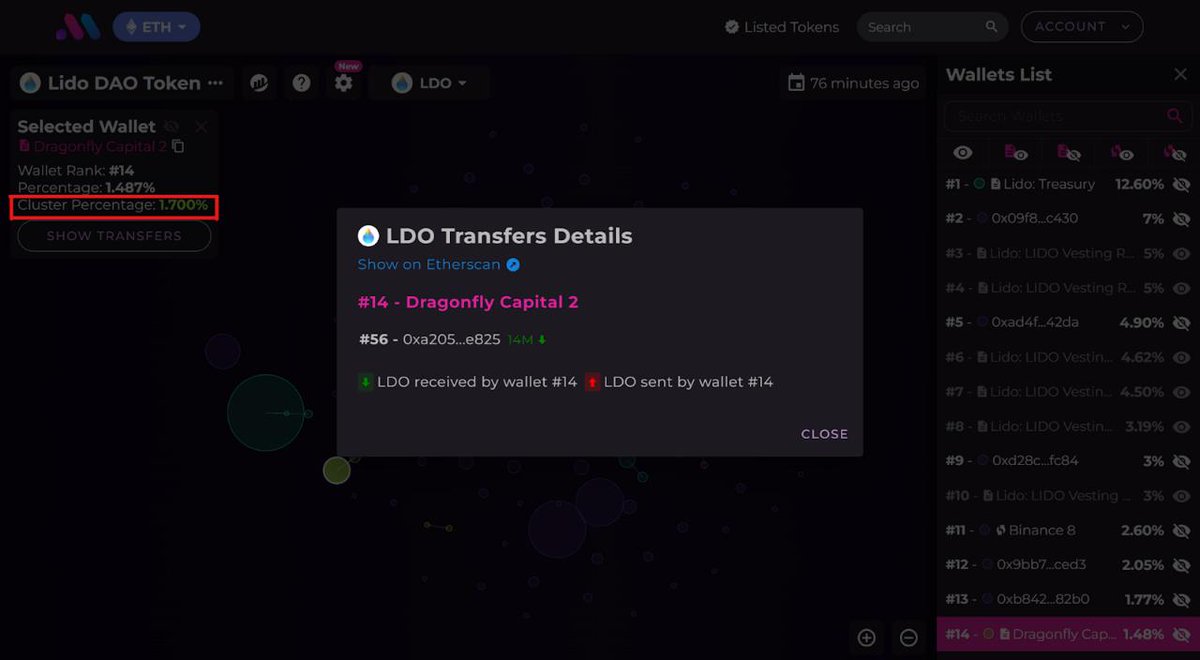

From the image above, it shows the following:

1. Dragonfly Capital has only received 14M $LDO.

1. Dragonfly Capital has only received 14M $LDO.

2. The cluster percentage is 1.70% which shows no suspicious activity as the address has no other transactions and interactions from other addresses except 0xa2…e825 that moved the token to Dragonfly Capital and the token hasn’t been moved since 183 days.

3. You can also view this info on ether scan to verify

etherscan.io

etherscan.io

Now, Here’s a little secret for you, you can keep an eye on Dragonfly Capital whenever you start seeing clusters, you know what it means.

That’s all for bubble maps now.

The next thread will be coming on how to identify rugs and spot wash trades.

That’s all for bubble maps now.

The next thread will be coming on how to identify rugs and spot wash trades.

2️⃣ Debank @DebankDeFI

This has remained one of the few notable portfolio management and wallet tracker across all DeFI protocols.

With this, you can:

• Track your assets across different chains

• Monitor whales wallet

• Watch what VCs are investing

• Track NFTs

This has remained one of the few notable portfolio management and wallet tracker across all DeFI protocols.

With this, you can:

• Track your assets across different chains

• Monitor whales wallet

• Watch what VCs are investing

• Track NFTs

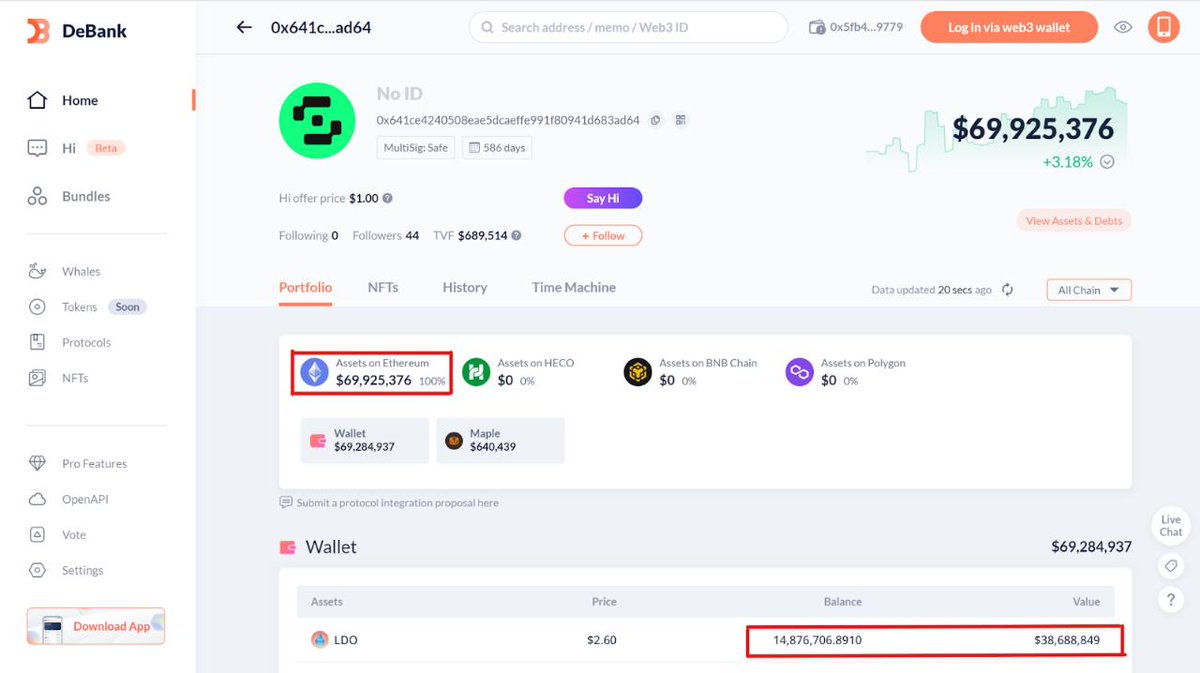

From the image above, it shows the following:

1. Total Wallet balance

2. Asset Chain (Ethereum Only)

3. Assets on Chain (you can see $LDO like how we saw on BubbbleMap)

4. Other Assets On-Chain

Being an expert in combining all these tools will give you an edge On-chain.

1. Total Wallet balance

2. Asset Chain (Ethereum Only)

3. Assets on Chain (you can see $LDO like how we saw on BubbbleMap)

4. Other Assets On-Chain

Being an expert in combining all these tools will give you an edge On-chain.

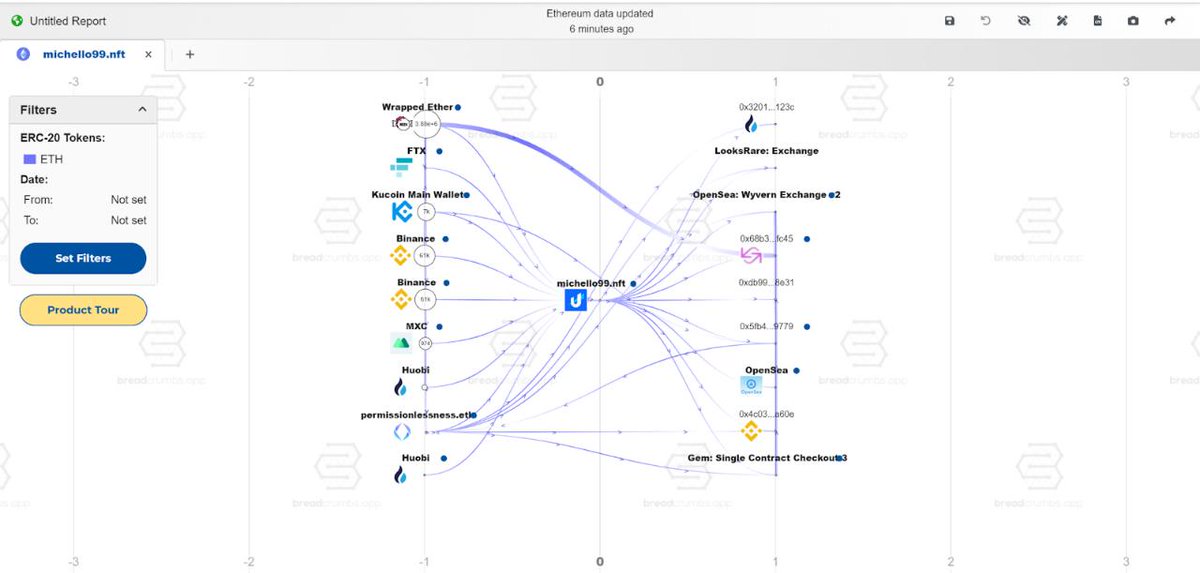

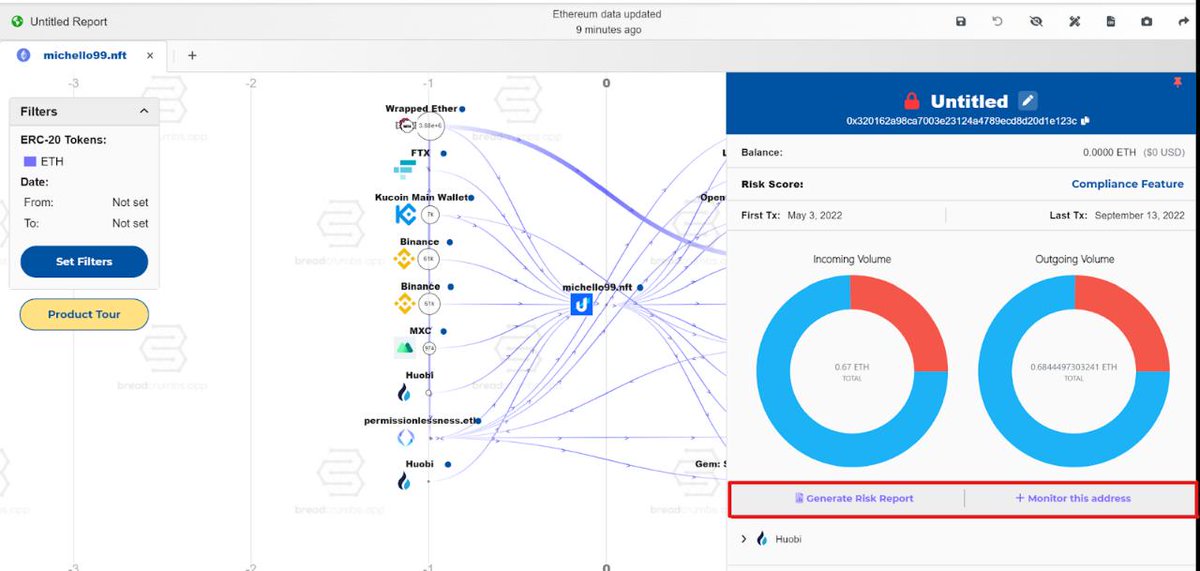

3️⃣ Breadcrumbs app @AppBreadcrumbs

Talking about On-chain analytics tools without involving breadcrumbs is an understatement.

@zachXBT has used this tool to its full potential to identify rugs, scams and trace hacks.

Talking about On-chain analytics tools without involving breadcrumbs is an understatement.

@zachXBT has used this tool to its full potential to identify rugs, scams and trace hacks.

With Breadcrumbs you can:

• Track important entities

• Trace Connections

• Trace hacks and spot rugs/scams

• Create dashboard (private, public & team)

• Set Alerts and add condition

• Generate Risk Report e.t.c

• Track important entities

• Trace Connections

• Trace hacks and spot rugs/scams

• Create dashboard (private, public & team)

• Set Alerts and add condition

• Generate Risk Report e.t.c

Major features in this tool is free, you can play around it to get used to it

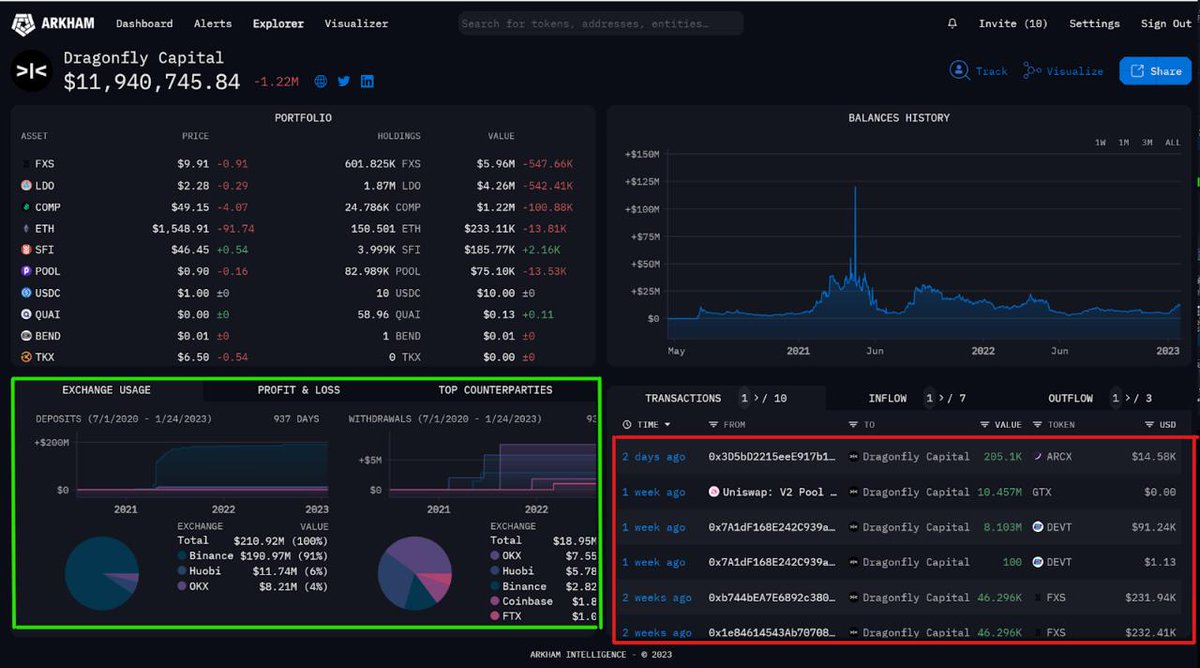

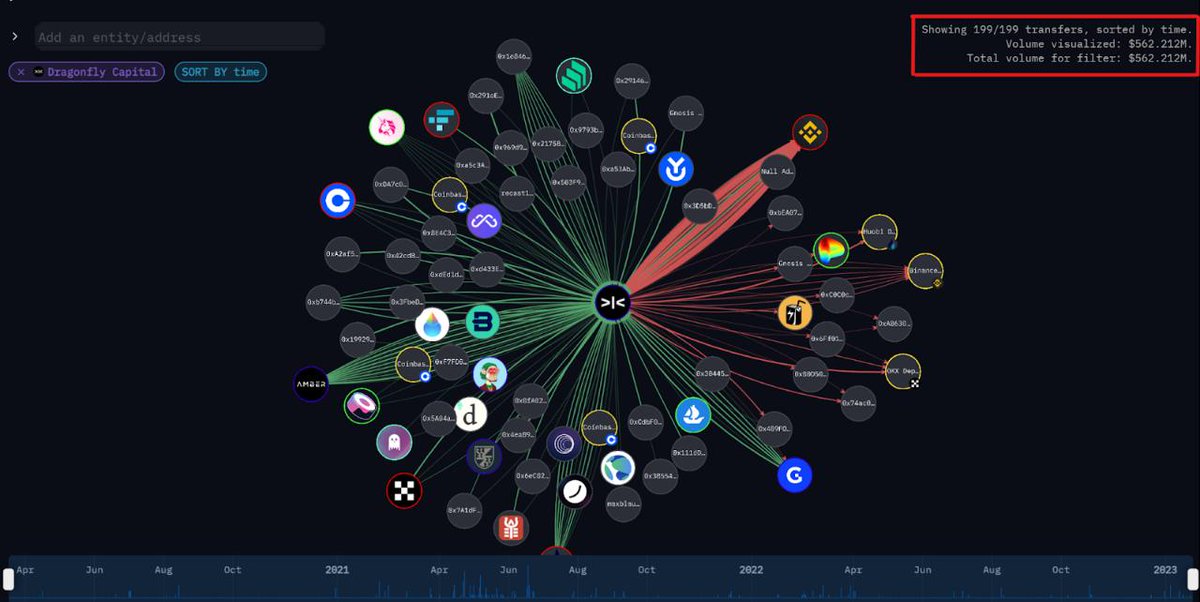

4️⃣ Arkham @arkhamintel

This is another great On-chain tool with many Features in which you can use to monitor what entities are doing in-real time, set alerts e.t.c

It also has its in-built explorer and also a visualizer for flow of Txns from different entities.

This is another great On-chain tool with many Features in which you can use to monitor what entities are doing in-real time, set alerts e.t.c

It also has its in-built explorer and also a visualizer for flow of Txns from different entities.

With Arkham, you can:

• Observe flow of funds (On-Chain sleuthing)

• Portfolio tracking

• Real-Time market insights

• Market movement predictions e.t.c

• Observe flow of funds (On-Chain sleuthing)

• Portfolio tracking

• Real-Time market insights

• Market movement predictions e.t.c

From the image above, we can see:

1. Dragonfly Capital portfolio

2. The Txns (Dragonfly started accumulating $FXS 2 weeks ago and $ARCX 2 days ago)

Also, the green block which shows CEX

3. Deposits and Withdrawals to the Address.

1. Dragonfly Capital portfolio

2. The Txns (Dragonfly started accumulating $FXS 2 weeks ago and $ARCX 2 days ago)

Also, the green block which shows CEX

3. Deposits and Withdrawals to the Address.

From the image above, we can:

1. See entities dragonfly has interacted with.

2. The green line represents inflow and the red line represents outflow.

1. See entities dragonfly has interacted with.

2. The green line represents inflow and the red line represents outflow.

3. From the red block, you can find important info such as total transfers and Volume.

4. Also, you can sort by time and filter these interactions to get historical data.

4. Also, you can sort by time and filter these interactions to get historical data.

5️⃣ Dune Analytics @DuneAnalytics

Everyone’s favorite, Dune is a blockchain analytics and metrics tool to get data stats and query across NFTs and DeFI protocols.

With dune, you can:

• Create, find & fork dashboards

• Visualize and explore data from different blockchains

Everyone’s favorite, Dune is a blockchain analytics and metrics tool to get data stats and query across NFTs and DeFI protocols.

With dune, you can:

• Create, find & fork dashboards

• Visualize and explore data from different blockchains

Some of my favorite Dashboard and Dashboard creators

I highly recommend paying attention to these free tools. I started this way as a content writer with zero knowedge till up to this level.

So you’ve got nothing holding you, start today if you want to make it in web3

So you’ve got nothing holding you, start today if you want to make it in web3

If you love this thread, That means you’ll love my newsletter,

Subscribe as it’s totally free

thedefisaint.substack.com

Also, there are 5 free premium slots for Bubble Maps, I'll pick from the comments 😉

Subscribe as it’s totally free

thedefisaint.substack.com

Also, there are 5 free premium slots for Bubble Maps, I'll pick from the comments 😉

That's a wrap and if you enjoyed this thread,

1. Give a like and retweet to the first post

2. Follow me for more of these

Tagging some On-chain Analyzooors

• @zachxbt

• @OnChainWizard

• @lookonchain

• @defi_mochi

• @Dynamo_Patrick

1. Give a like and retweet to the first post

2. Follow me for more of these

Tagging some On-chain Analyzooors

• @zachxbt

• @OnChainWizard

• @lookonchain

• @defi_mochi

• @Dynamo_Patrick

جاري تحميل الاقتراحات...