The very unique lending design was recently proposed by @THORChain and I couldn't resist speaking about it.

Thread 🧵

Thread 🧵

1/ First of all what is ThorChain?

TC is an L1 based on the @cosmos and its main feature is that it allows native L1 cross-chain swaps.

For example, you can swap BTC for ETH.

TC is an L1 based on the @cosmos and its main feature is that it allows native L1 cross-chain swaps.

For example, you can swap BTC for ETH.

2/ Why is it important?

At the moment users can exchange native L1 tokens only within the CEX. If we expect more normies to use decentralized finance then there should be a way to allow them to use cross-chain swaps outside CEXes.

At the moment users can exchange native L1 tokens only within the CEX. If we expect more normies to use decentralized finance then there should be a way to allow them to use cross-chain swaps outside CEXes.

3/ Now back to the lending design.

In traditional lending protocols, the system is safe when the debt is within the CDR limit.

In traditional lending protocols, the system is safe when the debt is within the CDR limit.

4/ If the collateral price goes down then the protocol will liquidate the position. However, liquidating collateral creates very poor UX (distressed sales at the bottom and liquidation cascades).

ThorChain lending is working the opposite.

ThorChain lending is working the opposite.

5/ ThorChain wants you never to repay the debt, protocol actually benefits if the collateral value drops below the debt value.

That's why there are no Liquidations, Interests or Expiry.

That's why there are no Liquidations, Interests or Expiry.

6/ Unique to this design, it is irrelevant if the collateral drops below the debt value because the collateral is the liability, not the debt. If the collateral goes to zero, the liability also goes to zero.

7/ Let me explain the mechanism in a very simplified way without taking into account any fees etc.

At the end of the thread, I will drop a link with a thorough video explanation.

At the end of the thread, I will drop a link with a thorough video explanation.

8/ Loan open process

The user deposits 2 BTC ($40k) and borrows $10k USDC (400% CR).

The user deposits 2 BTC ($40k) and borrows $10k USDC (400% CR).

9/ What happens in the background:

Let's say 1 Rune = $1

• 2 BTC are swapped for $40k worth of $Rune

• This Rune is burnt

• 10k Rune is minted and swapped for USDC

The net inflation of Rune is -30k

Let's say 1 Rune = $1

• 2 BTC are swapped for $40k worth of $Rune

• This Rune is burnt

• 10k Rune is minted and swapped for USDC

The net inflation of Rune is -30k

10/ Loan close process

The user pays back the $10k USDC debt and withdraws his 2 BTC ($40k) collateral.

The user pays back the $10k USDC debt and withdraws his 2 BTC ($40k) collateral.

11/ What happens in the background:

• $10k USDC is swapped for Rune

• This Rune is burnt

• 40k Rune is minted and swapped for 2 BTC $40k)

If Rune and BTC prices didn't change then the net inflation of Rune didn't change except for burnt fees.

• $10k USDC is swapped for Rune

• This Rune is burnt

• 40k Rune is minted and swapped for 2 BTC $40k)

If Rune and BTC prices didn't change then the net inflation of Rune didn't change except for burnt fees.

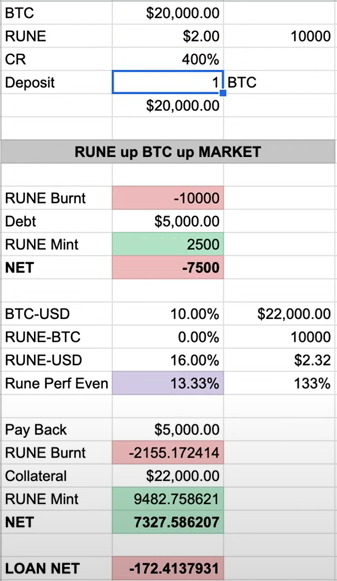

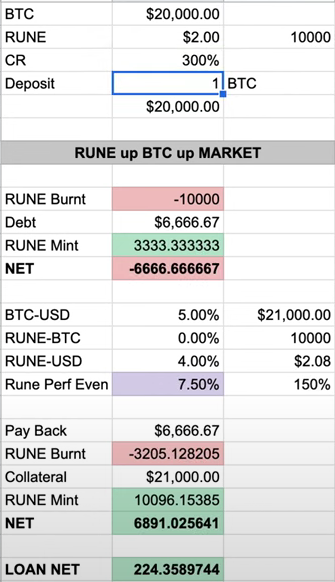

12/ But what happens if the price of the collateral and Rune change?

If Rune price is outperforming the collateral then Rune supply stays net deflationary.

Credit to @CBarraford

If Rune price is outperforming the collateral then Rune supply stays net deflationary.

Credit to @CBarraford

14/ Rune has to outperform the collateral on average.

To keep the system safe, the CR has to be high and will increase with the increase of loans taken.

However, there are plenty of safety backstops including circuit breakers, loan caps, high CR, etc.

To keep the system safe, the CR has to be high and will increase with the increase of loans taken.

However, there are plenty of safety backstops including circuit breakers, loan caps, high CR, etc.

15/ This design also limits the variety of collaterals.

If the collateral is a low-cap coin that can moon hard, then this can end badly for the protocol.

Ideally, the collaterals should be BTC and ETH only.

If the collateral is a low-cap coin that can moon hard, then this can end badly for the protocol.

Ideally, the collaterals should be BTC and ETH only.

16/ Conclusion

The design is very unique & new to DeFi, but it really fits TC allowing not only cross-chain swaps but also lending.

At the same time, it will drive a lot of trading volume to Rune LPs and a heavy burning rate.

The design is very unique & new to DeFi, but it really fits TC allowing not only cross-chain swaps but also lending.

At the same time, it will drive a lot of trading volume to Rune LPs and a heavy burning rate.

17/ If you have 50 minutes of spare time and are interested in the deep video explanation check out a great video from @GrassRootsio

youtu.be

youtu.be

18/ That’s a wrap.

If you enjoyed this thread:

1. Follow @DeFi_Made_Here for more helpful threads

2. RT the tweet below to share this thread with your audience

If you enjoyed this thread:

1. Follow @DeFi_Made_Here for more helpful threads

2. RT the tweet below to share this thread with your audience

جاري تحميل الاقتراحات...