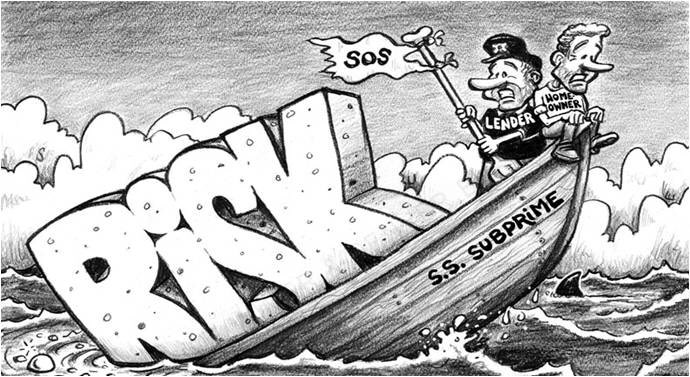

The seeds of the 08’ financial crisis were planted during years of rock-bottom interest rates and loose lending standards that fueled a housing price bubble in the U.S. and elsewhere.

investopedia.com

investopedia.com

Another response to the collapse was Quantitative Easing (or Large-Scale Asset Purchases).

Quantitative easing involves the Fed making new money. It then uses that money to buy bonds (MBS, Treasuries), injecting extra money into the banking system.

vox.com

Quantitative easing involves the Fed making new money. It then uses that money to buy bonds (MBS, Treasuries), injecting extra money into the banking system.

vox.com

Between 2008 and 2015, the Fed's balance sheet, its total assets, ballooned from $900 billion to $4.5 trillion.

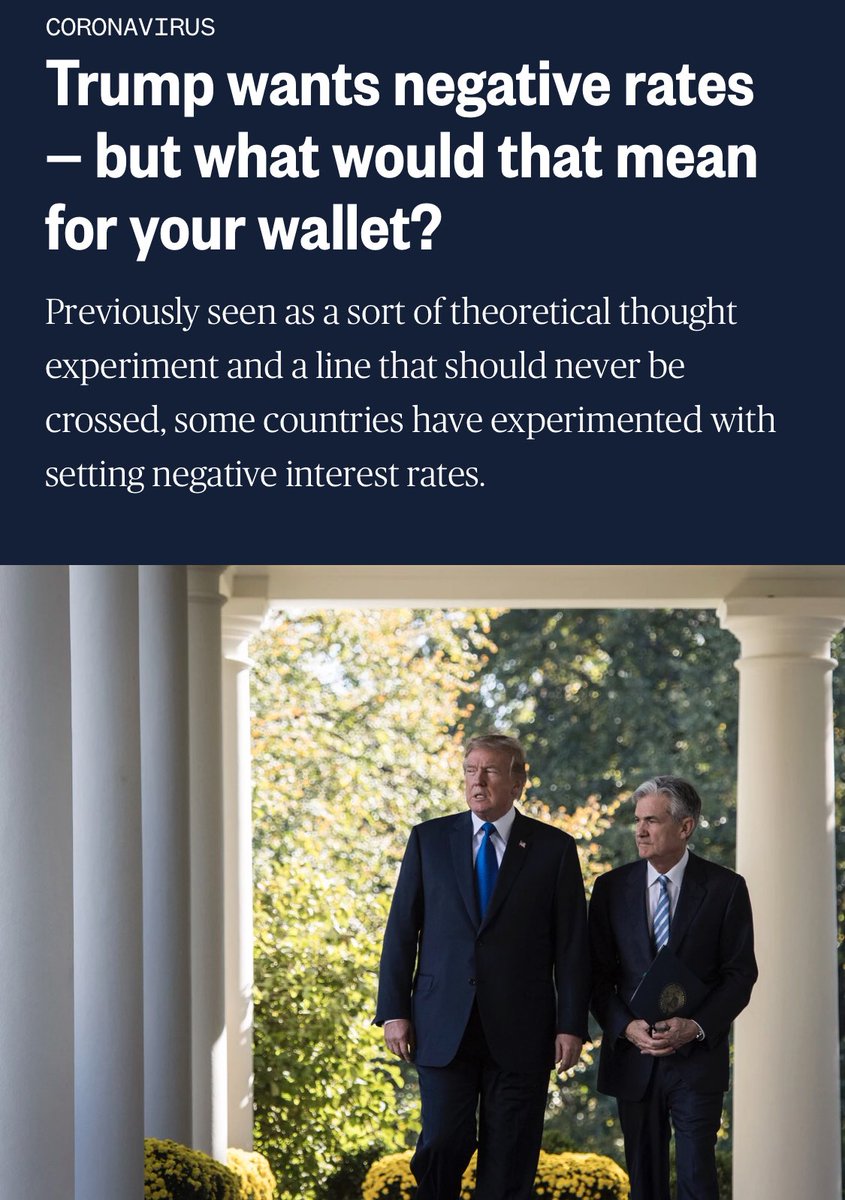

cnbc.com

cnbc.com

In the latest QE round, the Fed’s balance sheet more than doubled from $4.3 trillion in March 2020 to $8.9 trillion in May 2022, when it announced that it would begin to shrink its securities holdings.

brookings.edu

brookings.edu

So what are we currently doing?

The Fed has risen rates to 3-3.25%, wanting it at 4.25-4.5% before 2022 ends.

They are also participating in Quantitive Tightening, the opposite of Quantitative Easing, to reduce the Fed’s balance sheet.

bankrate.com

The Fed has risen rates to 3-3.25%, wanting it at 4.25-4.5% before 2022 ends.

They are also participating in Quantitive Tightening, the opposite of Quantitative Easing, to reduce the Fed’s balance sheet.

bankrate.com

What’s this all mean for the average American? More suffering.

We were told that the current inflation we’re experiencing would be transitory (Inflation increases for short time, but is eventually slowed and levels out). However, Janet Yellen lied.

cnbc.com

We were told that the current inflation we’re experiencing would be transitory (Inflation increases for short time, but is eventually slowed and levels out). However, Janet Yellen lied.

cnbc.com

We were also told by Yellen that we would not experience a crisis or recession (2 Consecutive Quarters Negative GDP), but we have reached that point.

usnews.com

usnews.com

Thus, Wright expects the Fed’s balance sheet to decline only to about $7.5 trillion by the end of 2023 before it starts to grow again.

“My assumption is that QE will never get reversed, or even largely reversed,” Wright said.

brookings.edu

“My assumption is that QE will never get reversed, or even largely reversed,” Wright said.

brookings.edu

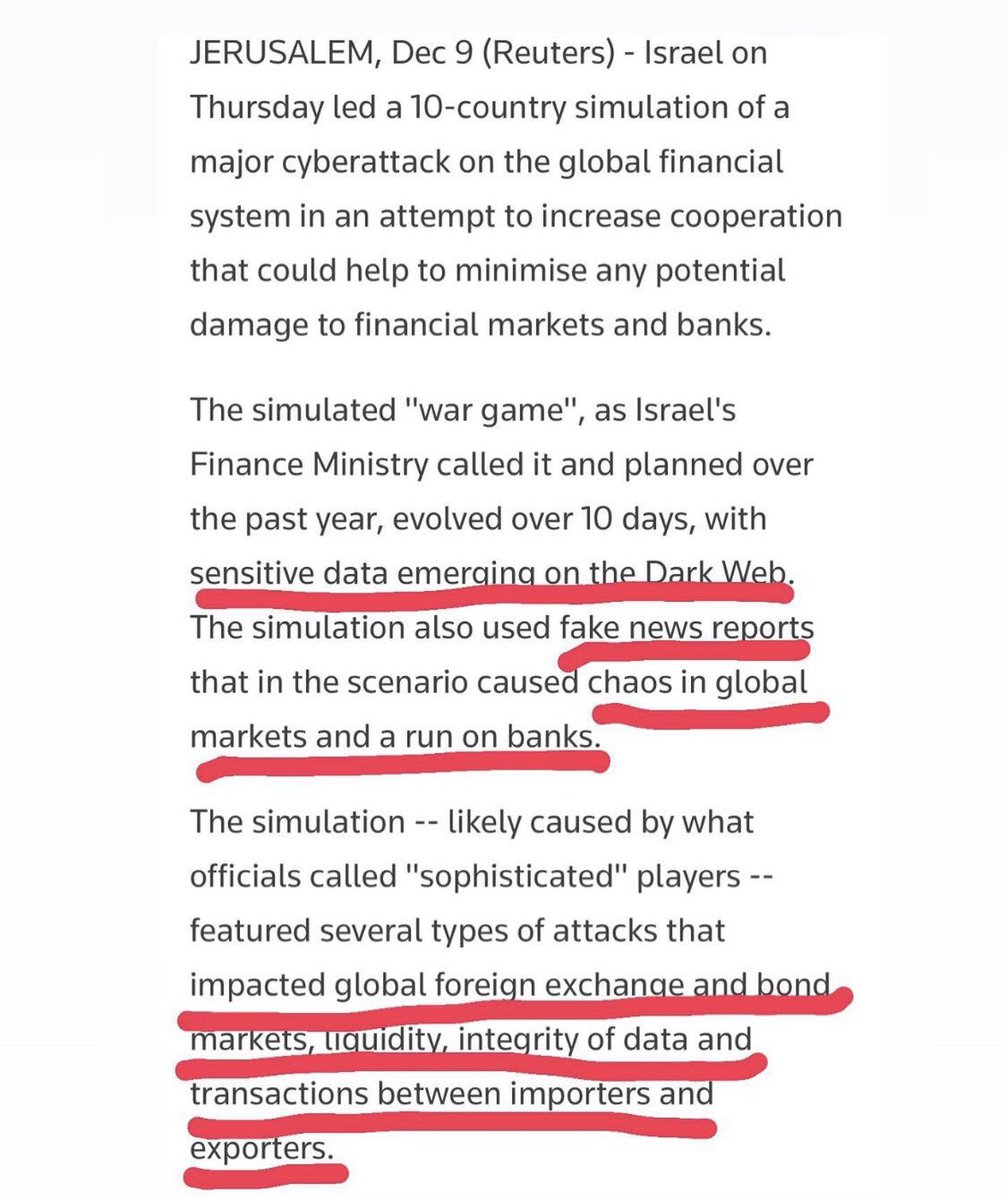

Predictive Programming

- - -

The X-Files: Take Over of America

- - -

The X-Files: Take Over of America

Money and Payments: The U.S. Dollar in the Age of Digital Transformation

federalreserve.gov

federalreserve.gov

جاري تحميل الاقتراحات...