There have been a few analyses of football club debt published recently, which are at best misleading, if not downright incorrect. So it’s once again time to wheel out my explanation of why debt figures should be treated with caution, as there are so many different definitions.

For the purpose of this review I will take the 2020/21 audited accounts of those clubs featuring in the Deloitte Money League (with the exception of Zenit St Petersburg, where I have not managed to source the details).

At the narrowest extreme, we have just bank debt, but the broadest extreme covers total liabilities, which includes all financial obligations, including transfer debt, staff payables, tax liabilities, trade creditors, provisions, accrued expenses and even deferred income.

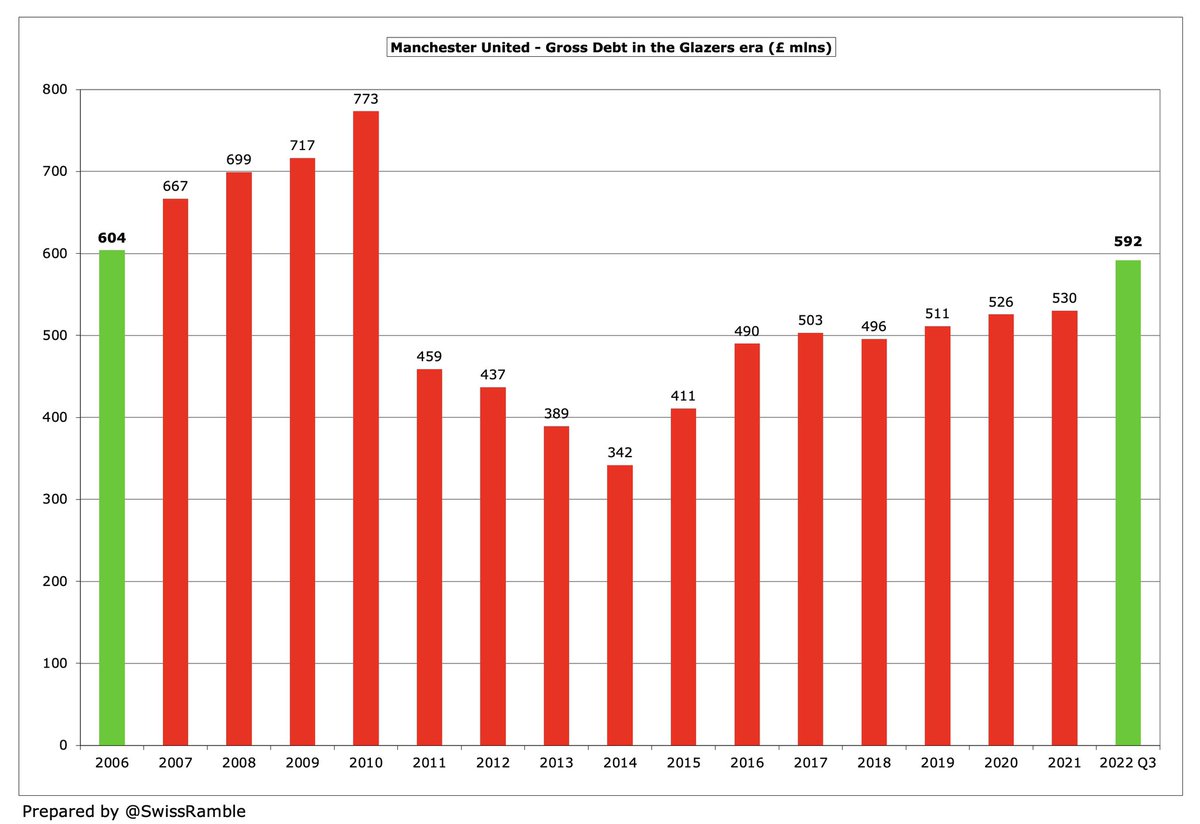

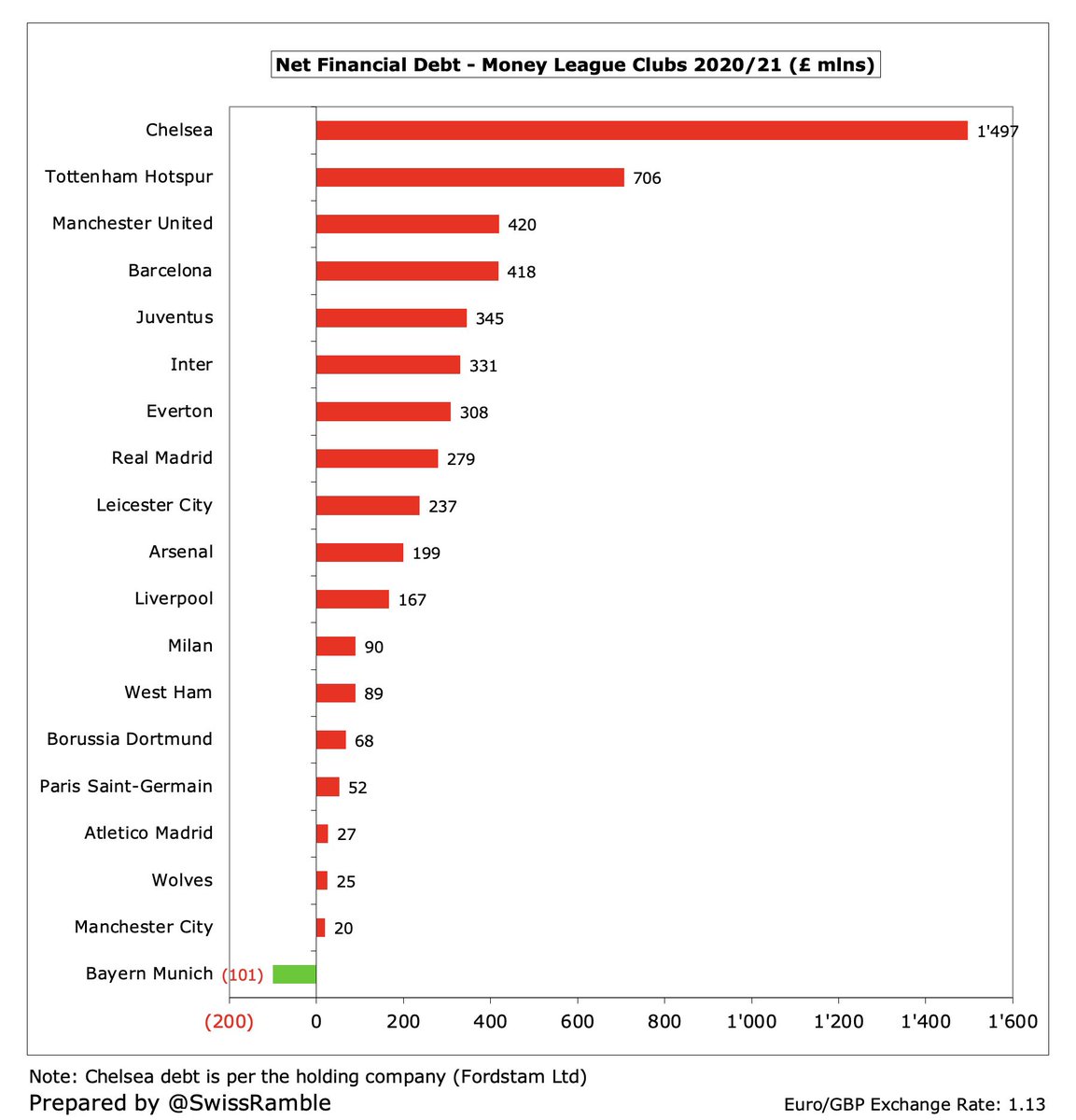

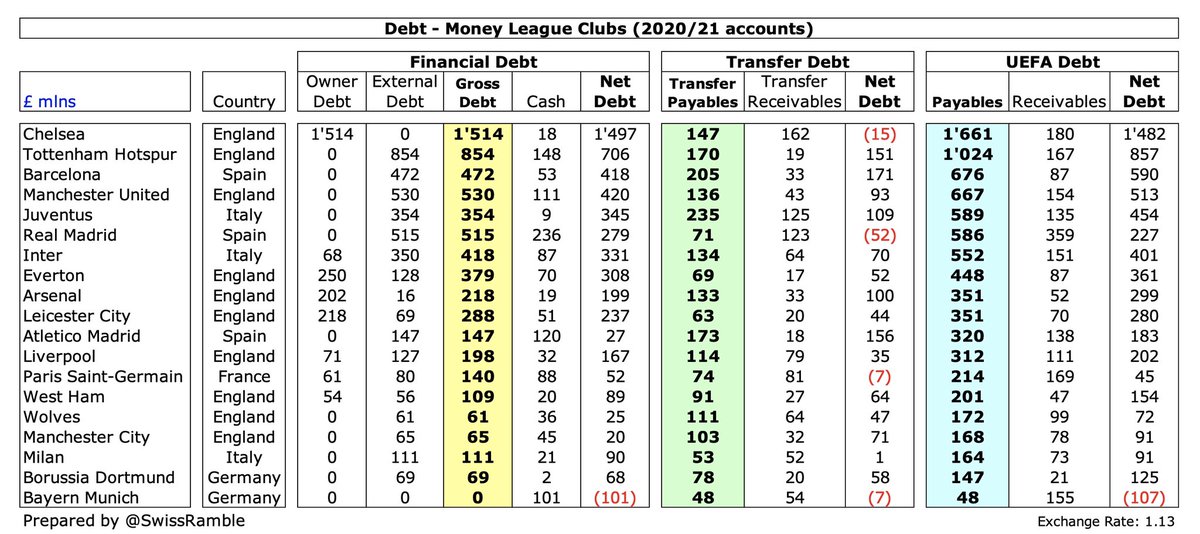

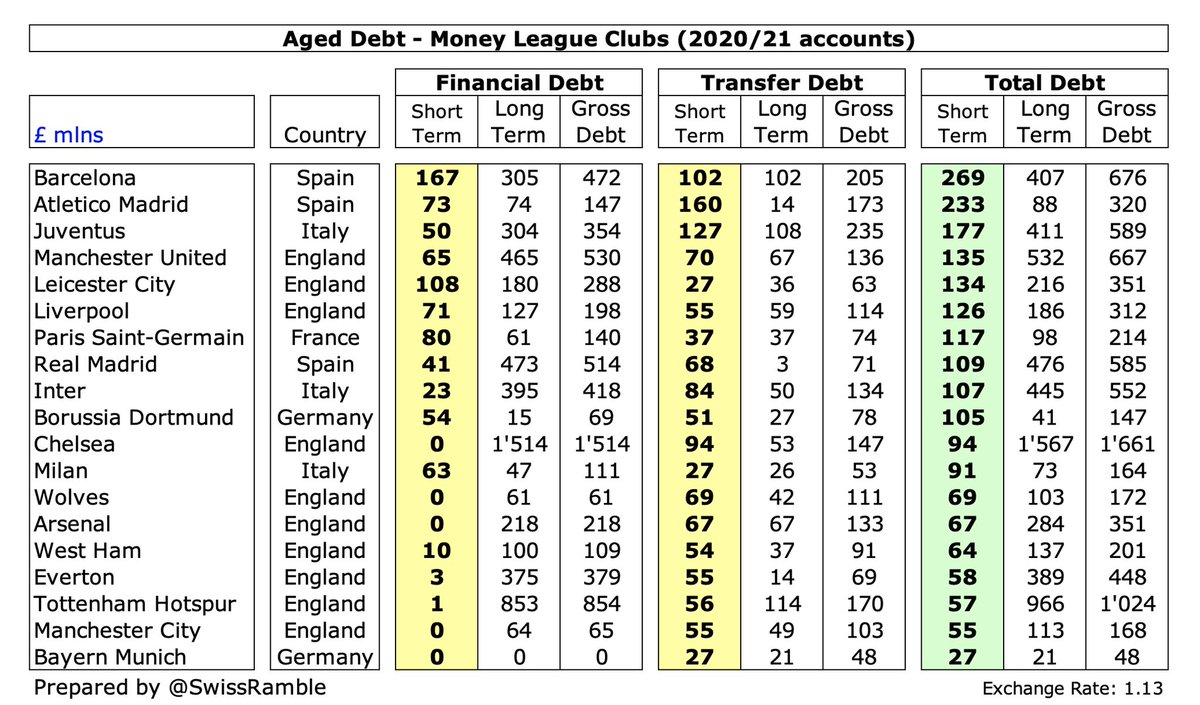

On that basis, three English clubs have the largest gross debt: #CFC £1.5 bln (Abramovich funding), #THFC £854m (new stadium) and #MUFC £530m (Glazers’ leveraged buy-out). Then come the Spanish giants: #RealMadrid £515m and #FCBarcelona £472m. #FCBayern have zero financial debt.

#THFC have highest external debt of £854m, though their new stadium will be a major revenue generator and it’s a long-term loan at a low interest rate. Next highest are #MUFC £530m, #RealMadrid £515m and #FCBarcelona £472m.

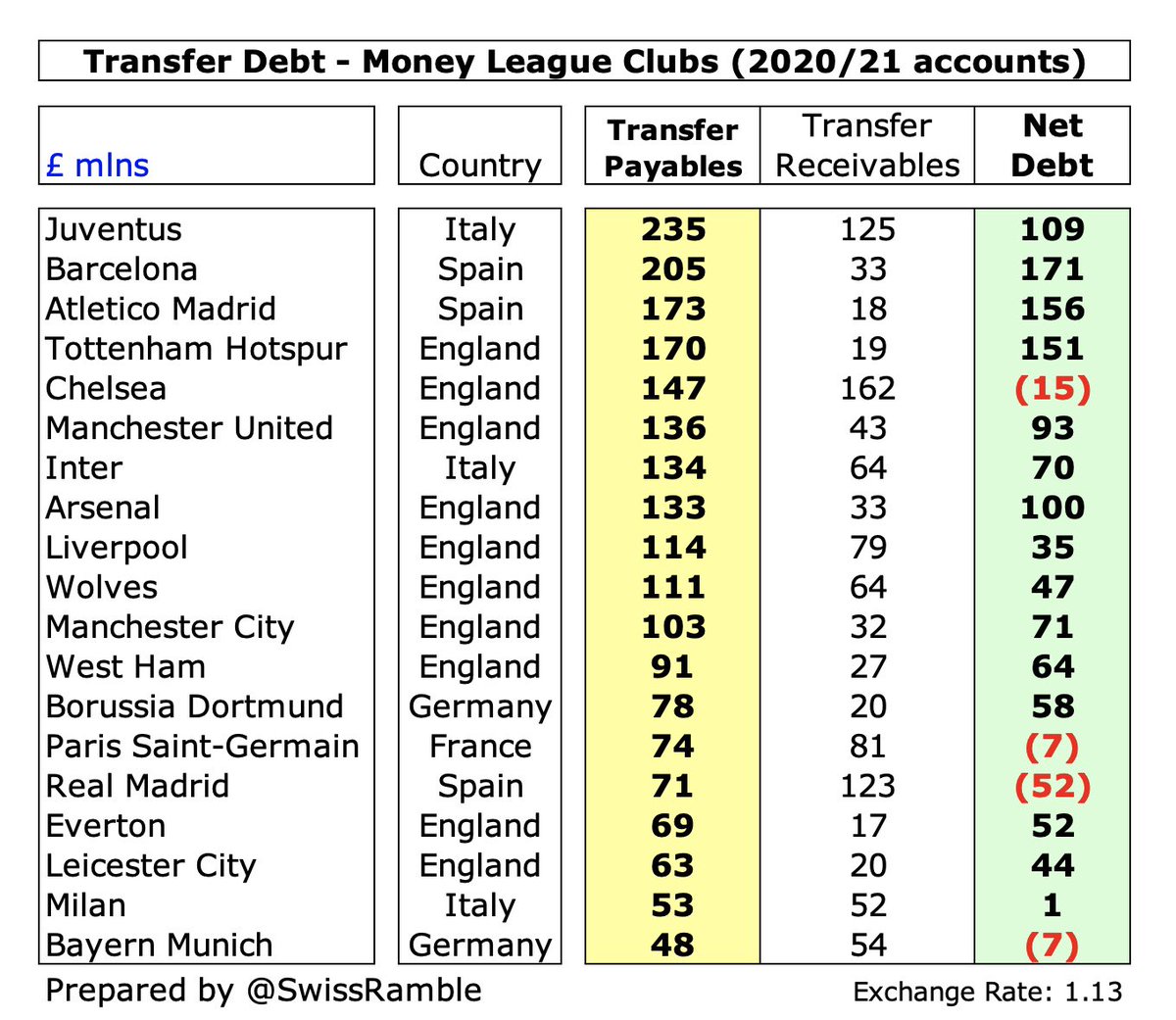

European clubs have been financing transfers in this way for years, so no surprise to see #Juventus £235m, #FCBarcelona £205m & #Atleti £173m at the top. Those that were puzzled how #THFC could finance player purchases with all the stadium debt, the answer is £170m transfer debt.

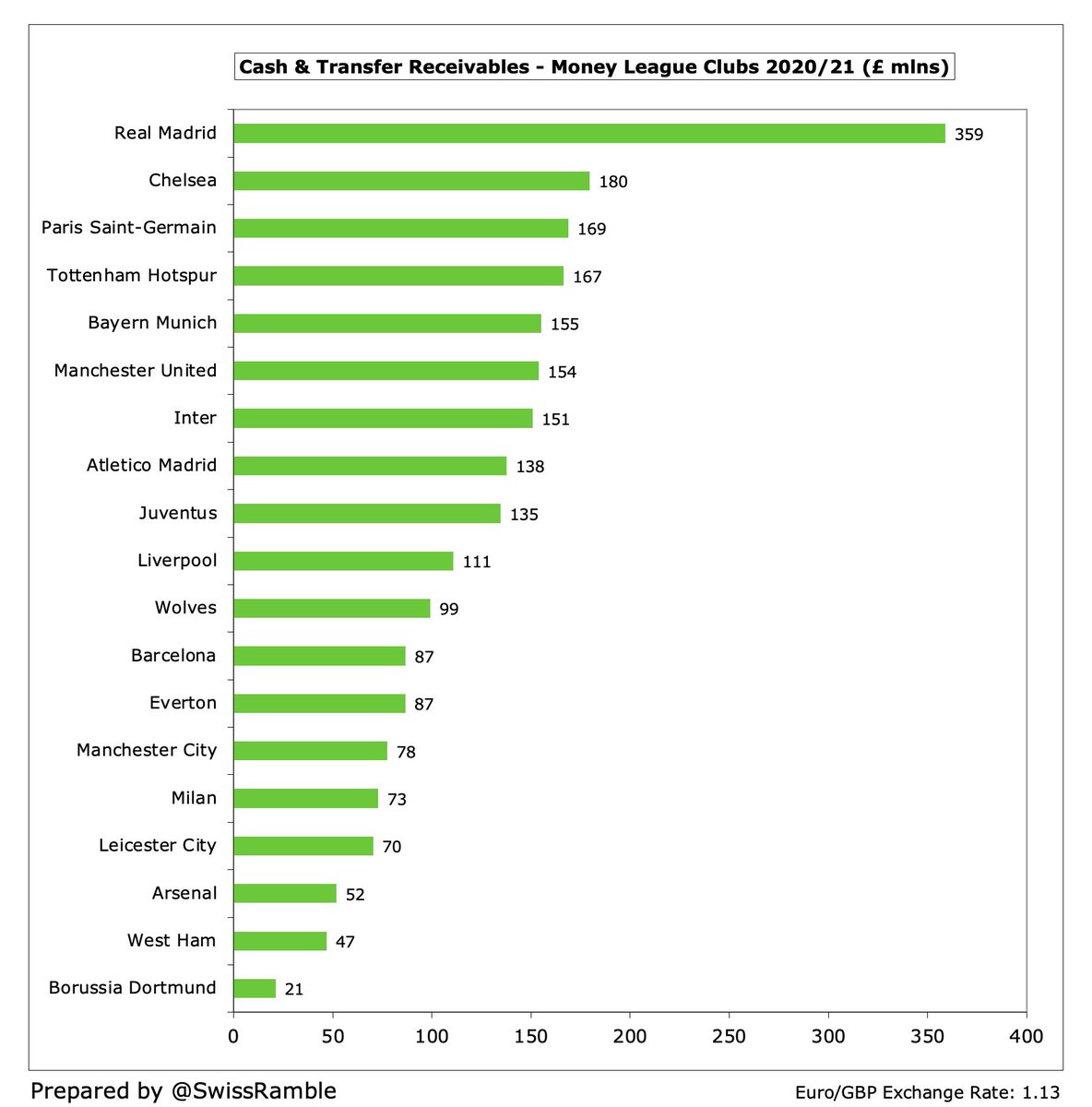

However, this approach to transfers works both ways. Highest receivables (amounts owed for player sales to other clubs) are at #CFC £162m, #Juventus £125m, #RealMadrid £123m and #PSG £81m.

Consequently, there are only 5 clubs here with a net transfer debt above £100m: #FCBarcelona £171m, #Atleti £156m, #THFC £151m, #Juventus £109m and #AFC £100m. #RealMadrid actually had £52m net receivables.

With this UEFA definition, 7 clubs have over half a billion of gross debt: #CFC £1.7 bln, #THFC £1.0 bln, #FCBarcelona £676m, #MUFC £667m, #Juventus £589m, #RealMadrid £586m and #Inter £552m. The lowest amounts owed are at the 2 German clubs: #BVB £147m and #FCBayern £48m.

Using UEFA’s definition of net financial and transfer debt, the highest amounts owed are actually at two English clubs, namely #CFC £1.5 bln and #THFC £857m, with #FCBarcelona in third place with “only” £590m. So, again, why is debt such an issue at Barca?

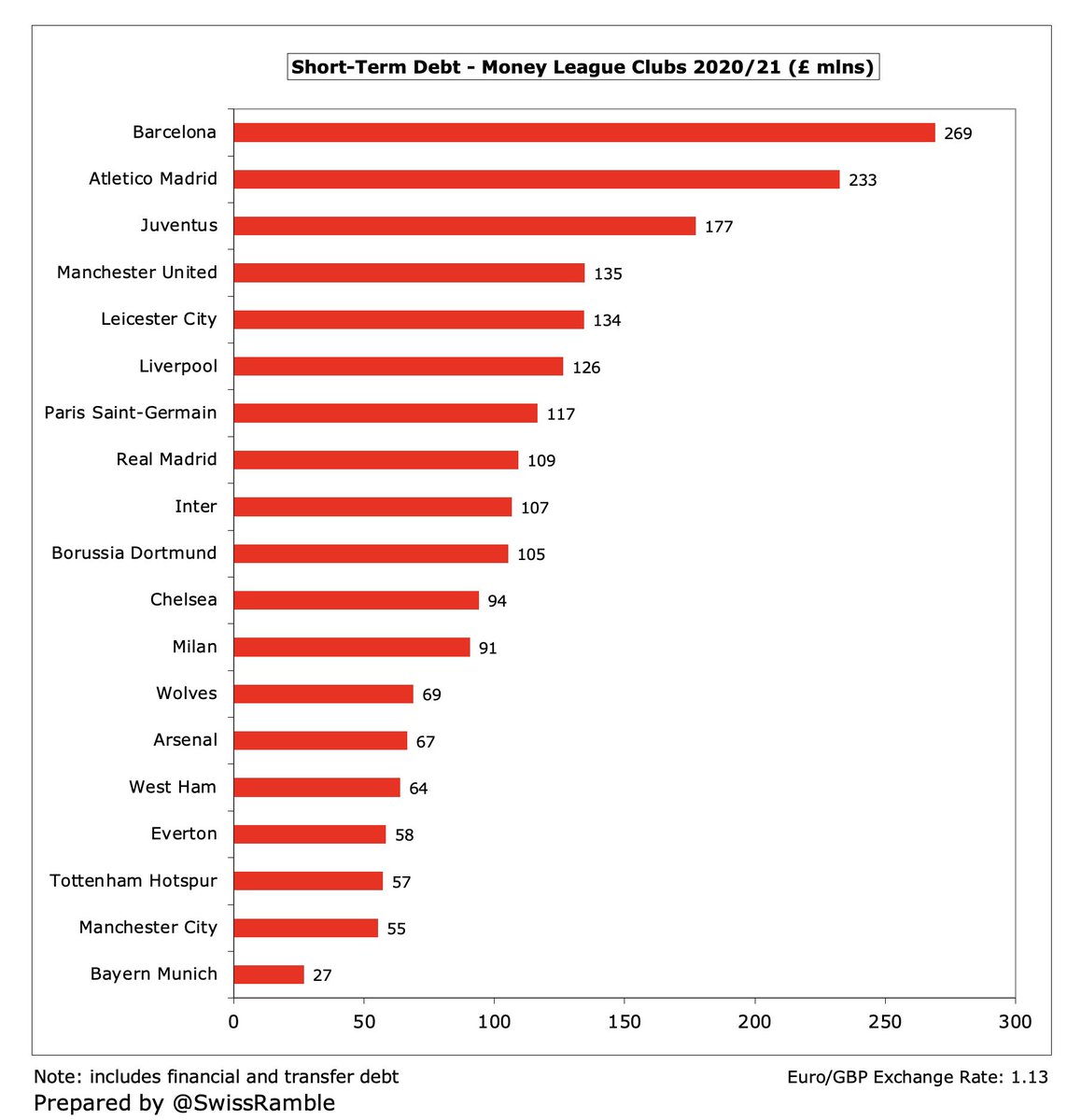

One reason why #FCBarcelona have more problems with debt than English clubs is that so much of it is short-term, i.e. needs to be repaid within the next 12 months. £269m of Barca’s £676m is short-term, while for #CFC it is only £94m of £1.5 bln, and for #THFC £57m of £1.0 bln.

#FCBarcelona £269m short-term debt is easily the highest, comprising £167m bank loans and £102m transfer fees, followed by #Atleti £233m and #Juventus £167m. The highest English club is #MUFC £135m.

The reason that debt is not so immediately problematic for the leading English clubs is that so much of it is structured via long-term financing, e.g. #THFC owe just over a billion in financial/transfer debt, but £966m is long-term with bank loans only maturing in 22 years.

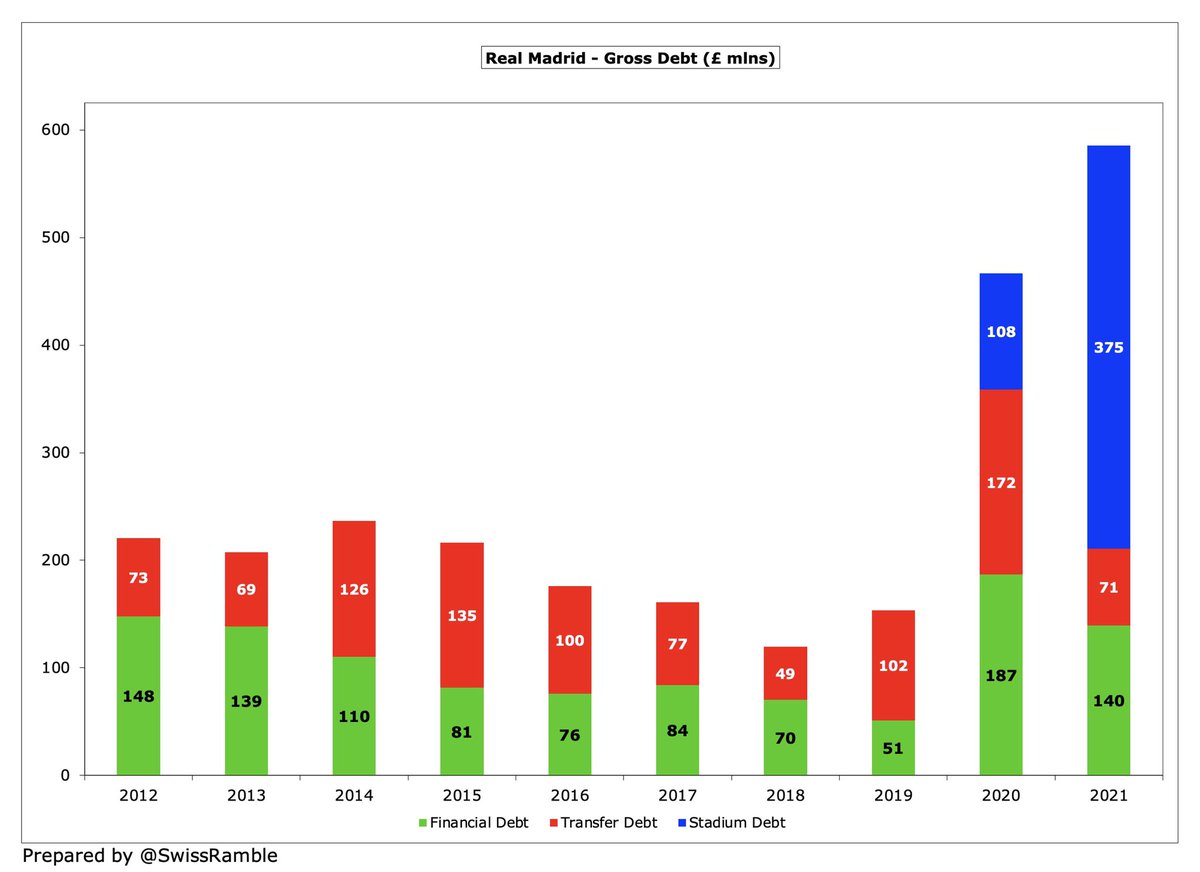

It will probably come as no surprise that debt has steeply increased since the pandemic struck with financial and transfer debt rising £1.2 bln (16%) since 2019. That said, 90% of this growth is at just 4 clubs: #RealMadrid £432m, #THFC £278m, #FCBarcelona £207m and #LCFC £163m.

However, financial debt has shot up £1.2 bln in the last two years, led by #RealMadrid £463m, #FCBarcelona £232m, #LCFC £196m and #THFC £196m. Only 4 clubs reduced debt in this period: #WWFC £70m, #Juventus £63m, #Atleti £50m and #MCFC £8m.

Both Spanish giants have seen significant debt growth, but there are different drivers, #RealMadrid debt has risen £466m to £586m since 2018, mainly due to £375m stadium debt. #FCBarcelona debt is up £575m to £676m in just 4 years, largely spent on players (transfers and wages).

In the same way, #CFC £1.5 bln debt should have been written-off since these 2020/21 accounts, as per Roman Abramovich’s statement that he would “not be asking for any loans to be repaid” as part of the Chelsea sale.

That adds up to another £2.5 bln of debt, mostly at the Spanish clubs: #Atleti £515m, #FCBarcelona £342m and #RealMadrid £203m. Note: #PSG are shown here as £315m, but that figure is over-stated, as the accounts I have do not split other debt and other liabilities.

Other debt includes staff debt, which is high at Spanish clubs (#FCBarcelona £213m, #Realmadrid £120m and #Atleti £83m), as they often pay wages twice a year, so high cash balances when accounts are published end-June can be misleading, as this is largely needed to make payroll.

Total debt is where the figures get a bit concerning. Excluding Abramovich-funded #CFC, two clubs have more than a billion of total debt: #THFC £1,195m and #FCBarcelona £1,018m. They are followed by #Atleti £835m, #RealMadrid £788m, #MUFC £780m, #Juventus £743m and #Inter £733m.

Also includes deferred income for payments received for services not yet provided, e.g. season ticket revenue for matches to be played in future. Booked as a liability, as cash received has not yet being fully earned, but it is clearly not a debt that will have to be repaid.

Therefore, total liabilities is a somewhat academic definition of debt, but for the purposes of completeness, this metric shows that #CHFC have the highest liabilities with £1.8 bln, followed by #THFC £1.5 bln, #FCBarcelona £1.3 bln and #MUFC £1.0 bln.

While it is important to be able to ultimately pay off debt, the ability to service the debt via interest expenses is absolutely crucial. The highest interest payments (in cash terms) in 2020/21 were #FCBarcelona £29m, #Atleti £23m, #MUFC £21m, #THFC £18m and #Inter £15m.

That concludes this year’s version of “Everything you always wanted to know about debt, but were afraid to ask”. As we have seen, debt is an innocent four-letter word, but it has many different meanings, so always read the small print.

جاري تحميل الاقتراحات...