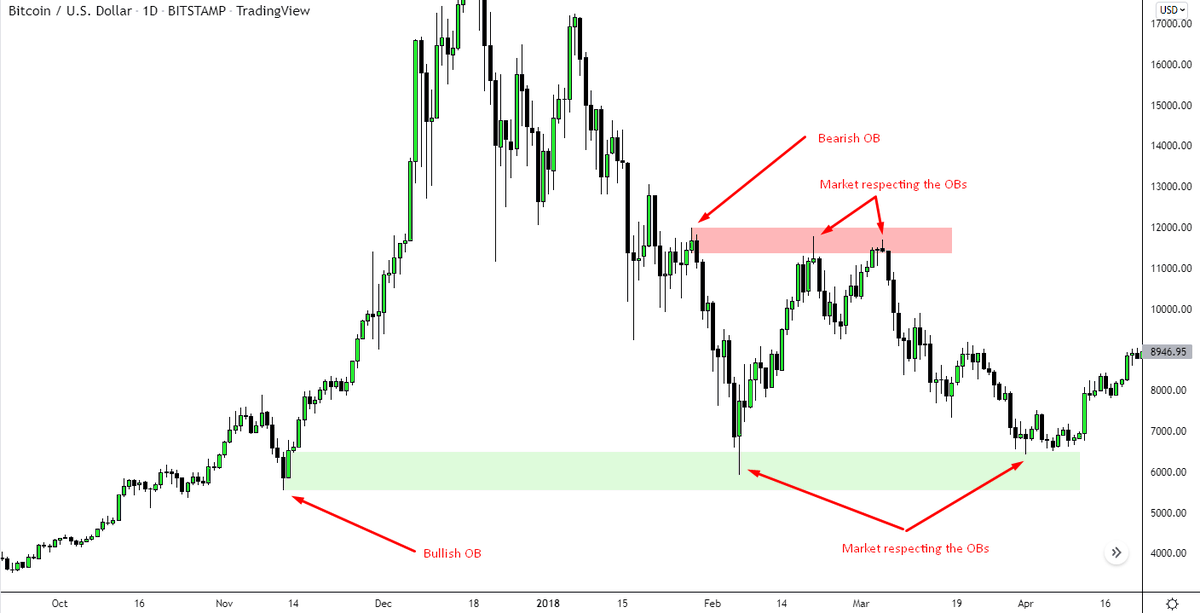

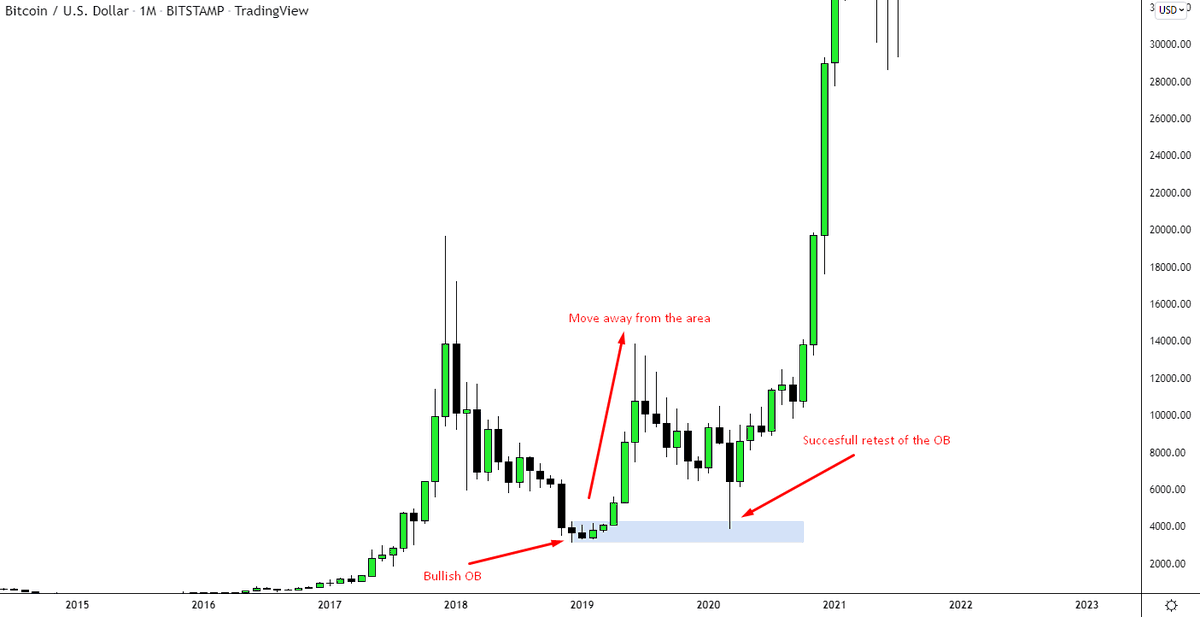

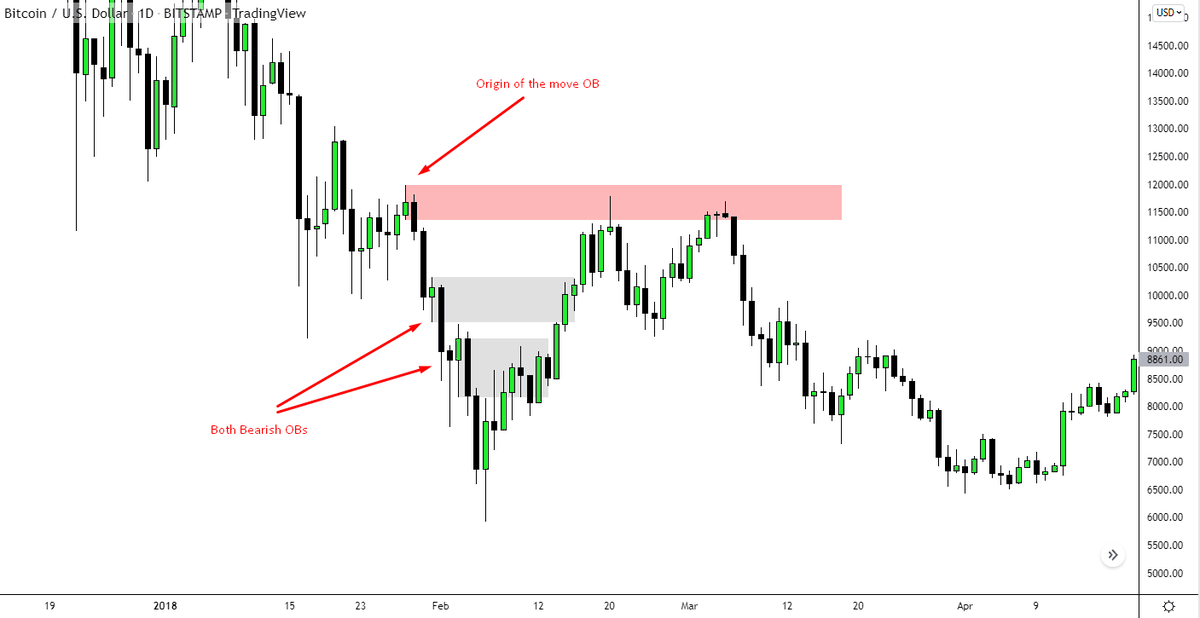

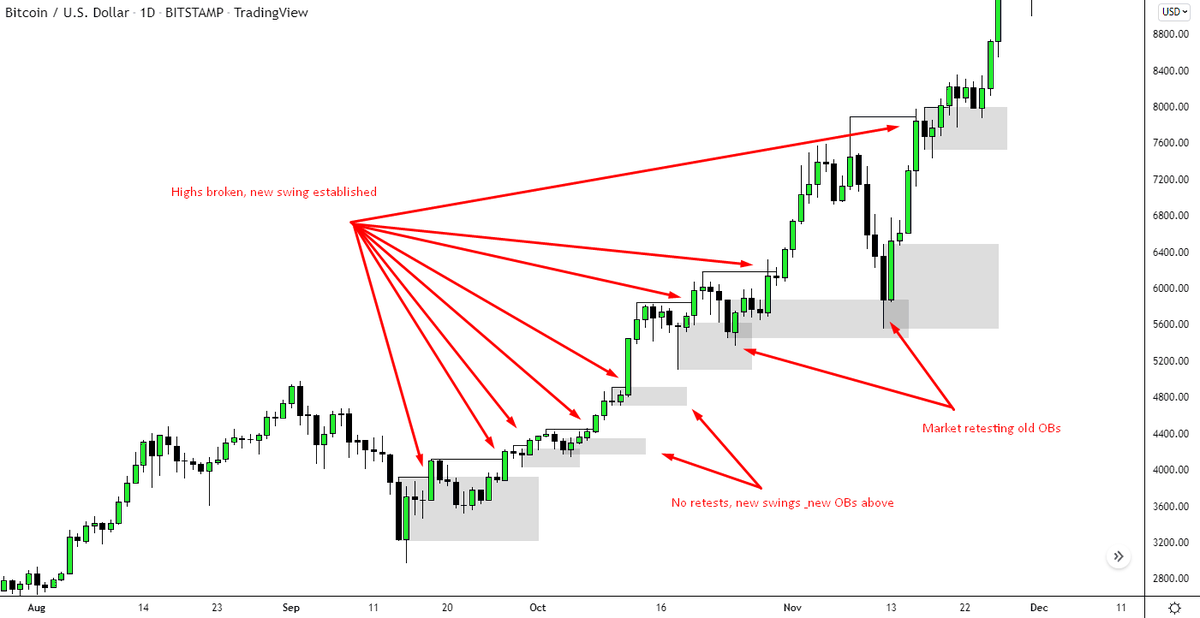

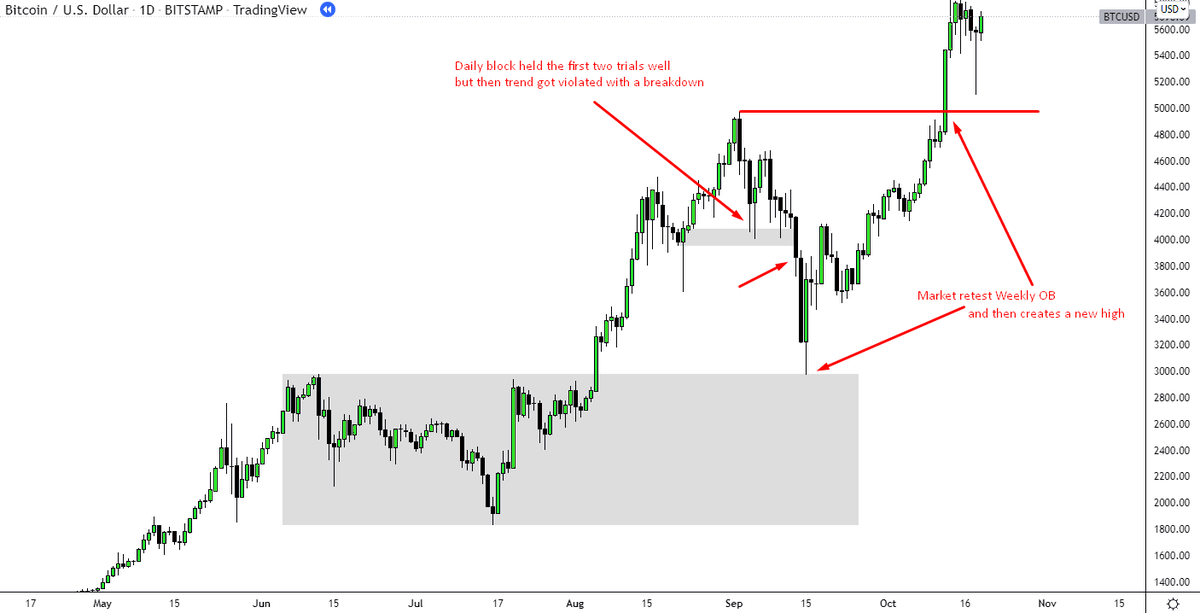

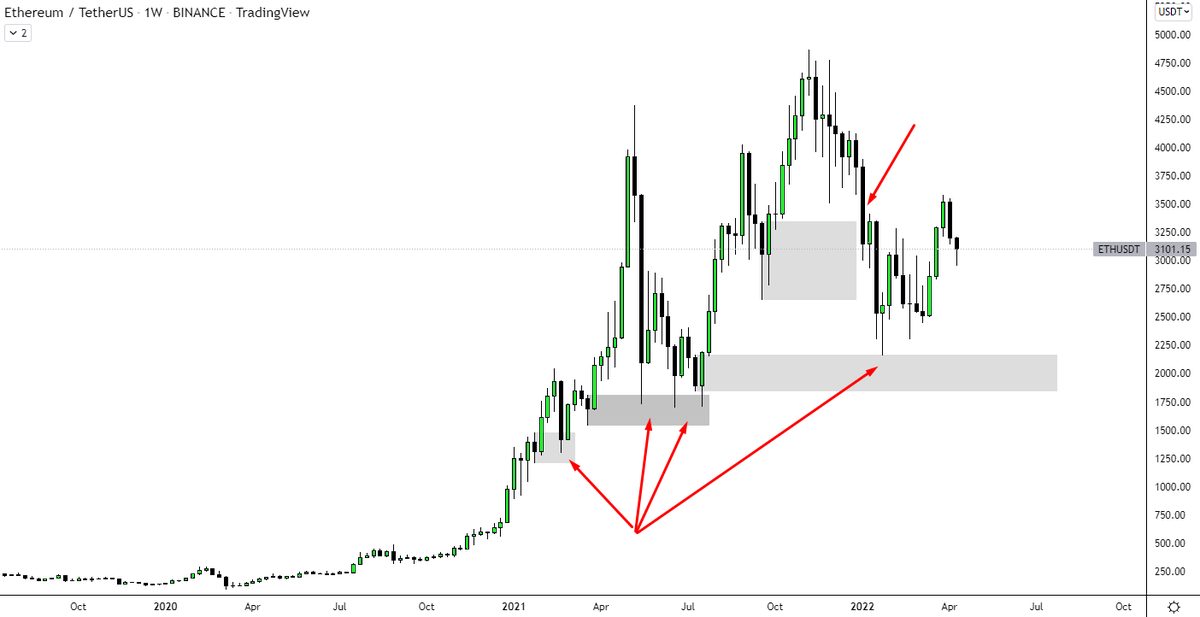

2/ An Orderblock (OB) was widely introduced by an (in)famous trader ICT and through the years its concept has spread across the Crypto Twitter like a wildfire.

Nowadays they are being used by many traders on the platform in various ways.

Nowadays they are being used by many traders on the platform in various ways.

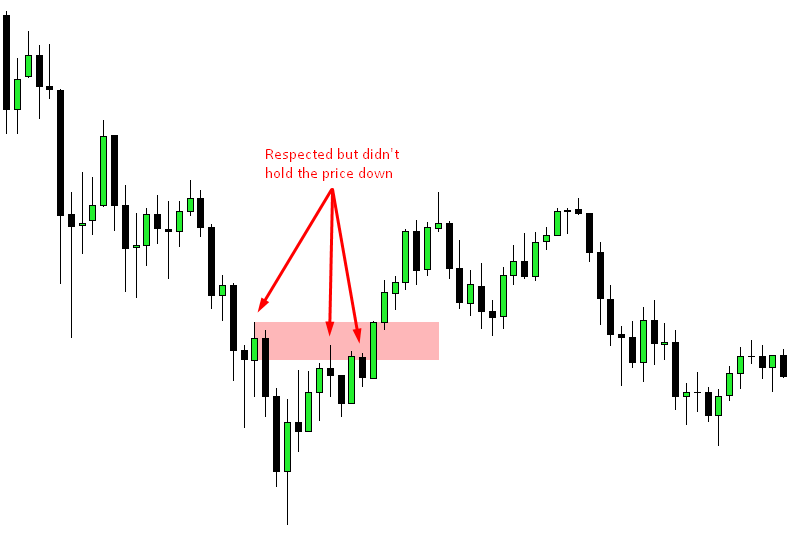

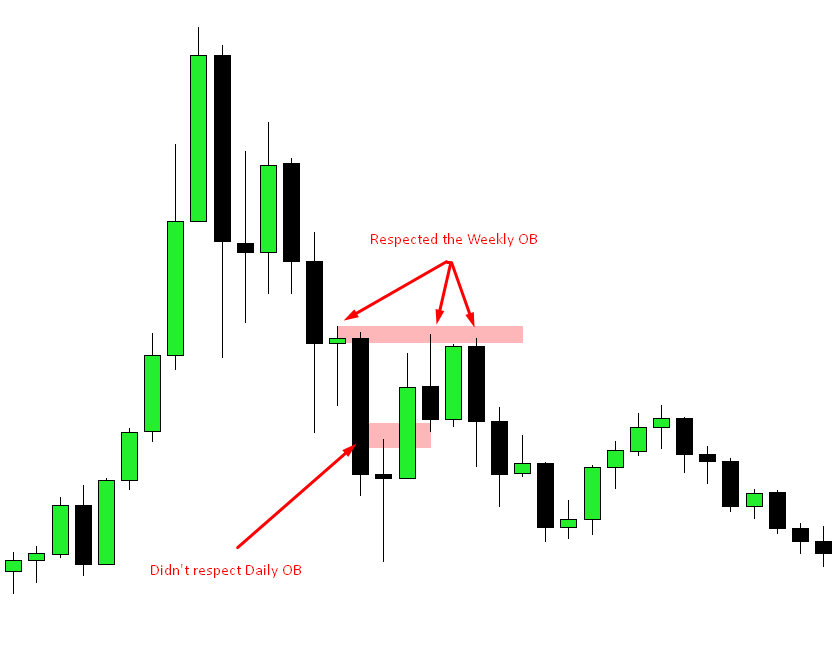

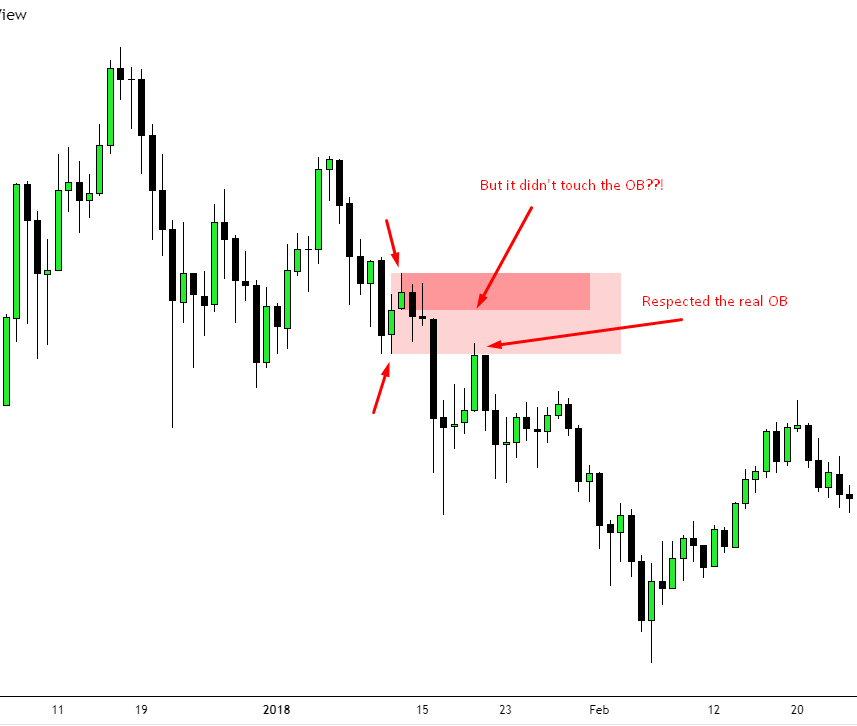

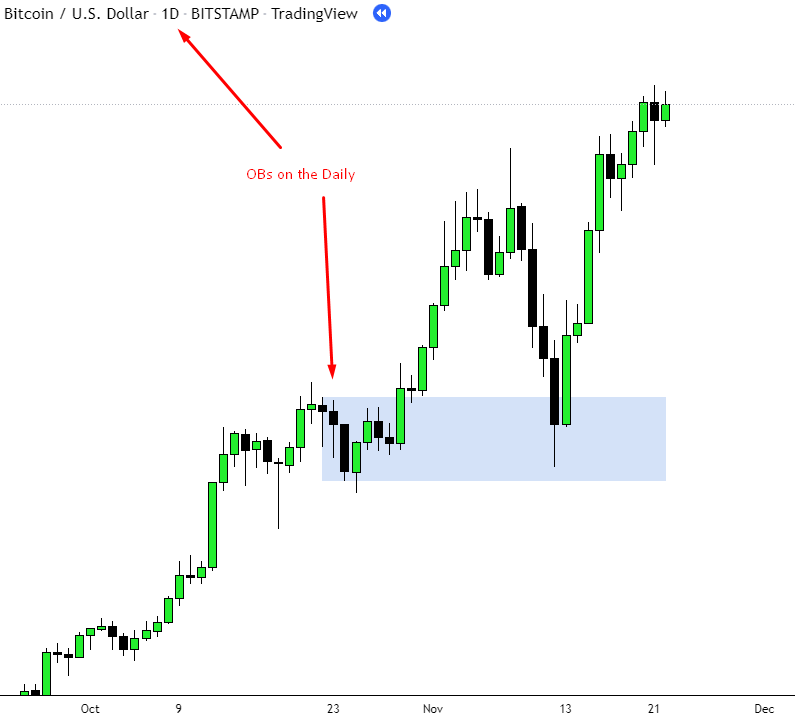

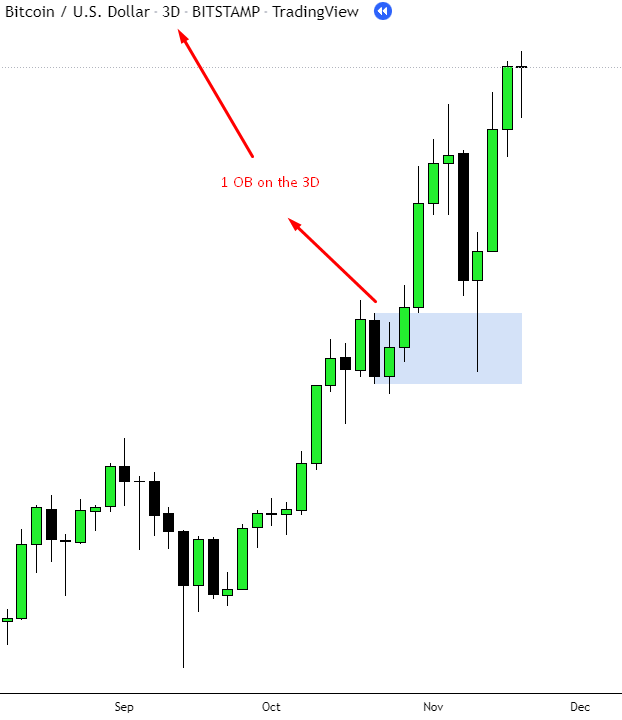

12/ Just like anything in trading it has its strength & weaknesses

OBs are a super powerful tool in a trending market and not so good one in a ranging market.

To know if you are in a trend or not you can use EMAs as a great tool:

OBs are a super powerful tool in a trending market and not so good one in a ranging market.

To know if you are in a trend or not you can use EMAs as a great tool:

جاري تحميل الاقتراحات...