1/ So, the new drastic sanctions on RUS were slapped & will hurt, esp in the long run. Numerous literature on it. Many talk about how energy markets will be effected, so I’m gonna skip this & say a few things about other, less discussed yet very important domains.

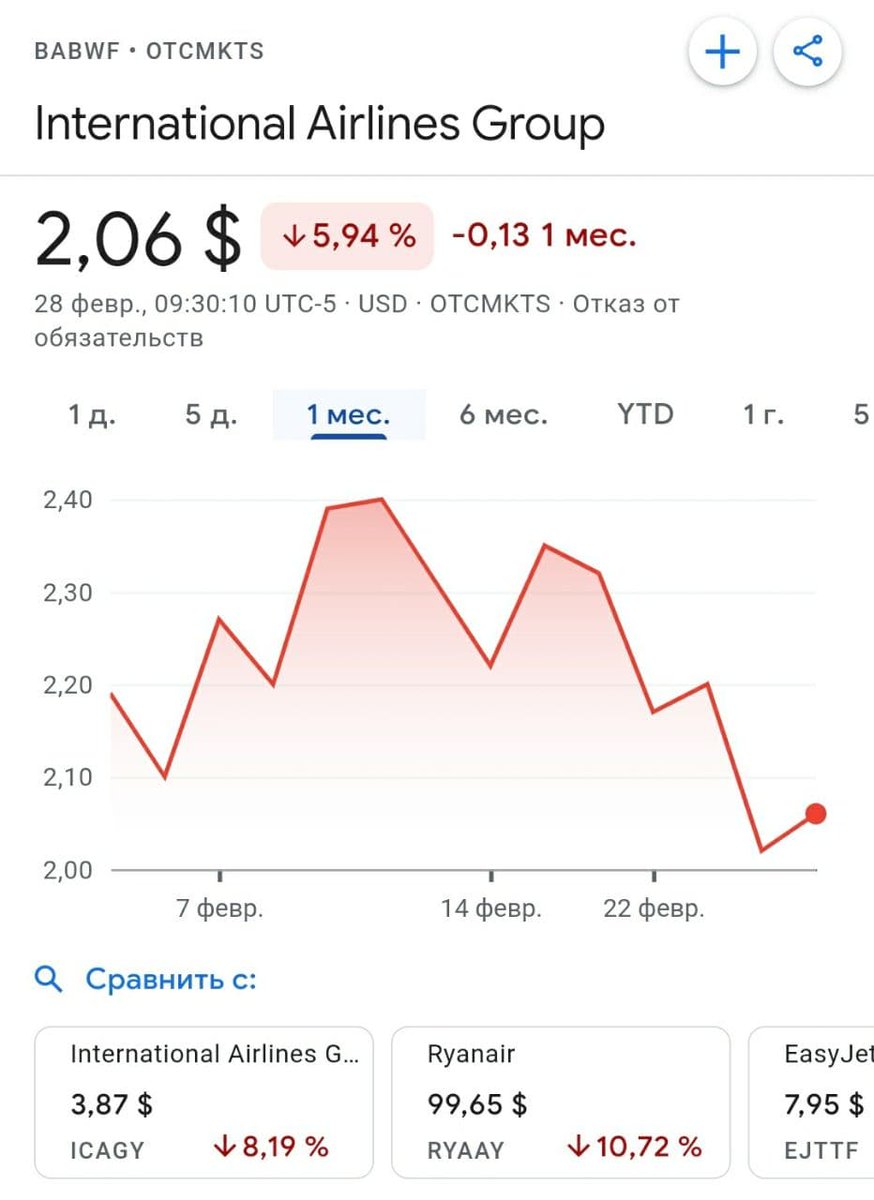

2/ Following sanctions on #Russia’s @Aeroflot_World & airspace,RU closed off its skies for Europe – they gotta take a detour. Shares of most EUR airlines fell from -6% to -32% due to increased costs.

Finnair doing particularly bad but not just that

ft.com

Finnair doing particularly bad but not just that

ft.com

3/ A lot of rejoicing over how RUS planes that were on lease are seized, but there’re a lot of drawbacks on this as well, as I mentioned earlier

4/ #Moscow advises chemical enterprises to suspend export of methanol derivatives to Europe due to logistical issues.Methanol is raw material for pentaerythritol & urotropine. Share of RUS manufacturers in the EU market is 40% (pentaerythritol) and 50% (urotropine).

5/ Without going into scientific details - Europe’s polymer market will down the same pipe as the aviation.

Agriculture - #Russia will suspend the export of fertilizers to EUR until “normal transportation is resumed and deliveries are guaranteed”.

Agriculture - #Russia will suspend the export of fertilizers to EUR until “normal transportation is resumed and deliveries are guaranteed”.

6/ Russia's Trade Ministry says that due to the sabotage of deliveries by some foreign logistics companies, farmers both in Europe and in other countries cannot receive the necessary volumes of fertilizer.

What is means is that..

What is means is that..

.. on the eve of the sowing season, European (& American) farmers are left w/t Russian fertilizers. RUS share in the world market is a little less than a 1/3 of the world production of potash fertilizers, about 10% of nitrogen fertilizers & about 20% of complex fertilizers.

7/ How to fill the gap? The issue coulda been solved by fertilizers from #Belarus but it’s also under sanctions. In Ukraine, the sowing campaign is disrupted. That is, in 6 months the world food market, in particular wheat, has high chances of collapsing.

10/ Semiconductors & computer chips are also interesting.

Today, #Russia accounts for 80 % of the market for sapphire substrates - thin plates made of artificial stone, which are used in opto- & microelectronics to build up layers of various materials, such as silicon.

Today, #Russia accounts for 80 % of the market for sapphire substrates - thin plates made of artificial stone, which are used in opto- & microelectronics to build up layers of various materials, such as silicon.

They are used in every processor in the world - AMD & Intel are no exception.#Russia's position is even stronger in special chip etching chemistry using ultra-clean components. RUS accounts for almost 100% of the world's supply of some rare earth elements used for these purposes

11/ A ban on finished products for #Russia will result in a retaliatory ban on the supply of production components & will cause an acute shortage of processors for the whole world.

For more on that see (in RUS) globalaffairs.ru

For more on that see (in RUS) globalaffairs.ru

12/ Other echoes:

Gas prices going up, just as Moscow expected them to:

aljazeera.com

Diesel getting expensive: theportugalnews.com

Energy bills in Europe rising: reuters.com

Gas prices going up, just as Moscow expected them to:

aljazeera.com

Diesel getting expensive: theportugalnews.com

Energy bills in Europe rising: reuters.com

I dont rejoice any of this – people will lose jobs,have to live harder lives.Neither do I underestimate the gravity of the situation for RUS’s own economy.This is to say that next time you hear ppl say "Russia is a gas station w/ nukes" -judge yourself

But the departure from US dominant world will be faster, so is the de-dollarization. US domestic integrity is also weak & this will be exploited. Regardless of how UKR settled, US-RUS standoff will continue & take dramatic forms – hopefully non-military.

/END

/END

جاري تحميل الاقتراحات...