1/ Disclaimer: this is not a beginner friendly strategy, I have stopped using it because it requires a lot of "maintenance" and I am trying to switch to more passive strategies. But some of you might find it handy.

2/ I want to tell you about one of the most undervalued things in DeFi. It is leveraged synthetic assets (leveraged perpetual swaps). You can get access to them without over-collateralization or liquidation risks with @float_capital on #avalanche and #polygon chains.

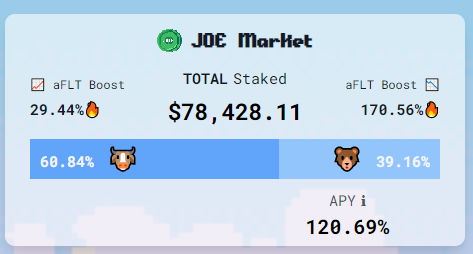

3/ How does it work? There is a funding fee on the Float which is paid to the underbalanced side of the pool. So if there are more people who minted long position than short, then longs pay funding fee to shorts and vice versa.

4/ But how to build a delta neutral strategy? You can perform short or long farming. Let's go through some examples.

5/ Short farming with $Joe on #avalanche. You need to buy $Joe and mint short position worth half of $Joe USD value (2x leverage). Now you have zero exposure to the price movement of $Joe. But what are you gaining from it?

6/ Assume that you have 1200$, buy 800$ worth of $Joe and stake it for $xJoe 40% APR, then single stake $xJoe for 16% APR, total 56% APR. With the remaining 400$ mint 2x short position on @float_capital and gain 120% APY on it.

8/ Note: technically the exposure isn't always 2x. The exposure on each side of a market floats, alongside the APY. The APY is actually an incentive to balance the markets and keep exposure high.

9/ So if the exposure on short JOE is 100% with the 2x leverage, then you need a position worth 50% your $JOE stake. If it's less than 100%, then you'll need more than 50%.

In case the math gets tricky there is a calculator here: #gid=0" target="_blank" rel="noopener" onclick="event.stopPropagation()">docs.google.com

In case the math gets tricky there is a calculator here: #gid=0" target="_blank" rel="noopener" onclick="event.stopPropagation()">docs.google.com

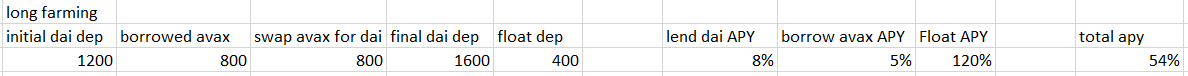

10/ Above was an example of short farming, let's go through the long farming on Float. When there is less long exposure you can short an asset and mint 2x long position. Starting with 1200$ again.

11/ Lend full amount on any lending-borrowing market where you can borrow an asset you are going to long farm on Float. For example we will borrow $AVAX on @BenqiFinance. After you deposited 1200$ $DAI, borrow 800$ worth of $AVAX.

13/ Long farming is less attractive as you are not getting high APR on the non-stable token farming, mostly your profit is coming from the Float APY alone.

14/ There are many different strategies you can perform with synthetic assets and on different platforms. And we will speak about them later. What else I love about @float_capital is their Discord channel where admins are really willing to help you and answer any question.

16/ And there is an exciting blog with explanations and strategies for beginners docs.float.capital

17/ There is no token yet for the project but when using the platform you are getting $aFLT which can be exchanged to $FLT in the future.

18/ As I told in the beginning this is a high maintenance - high reward strat. The team is currently working on fixed exposure vaults, to keep exposure on positions steady, and bot APIs that will allow you to automate delta neutral yield farming.

19/ Please, do your own research if you decide to use this platform and calculate all the risks associated. Thank you and stay safe!

20/ If you liked this thread, I would love it if you could share it by retweeting the first tweet:

Thank you!

Thank you!

جاري تحميل الاقتراحات...