Does $LUNA have a problem because of the @anchor_protocol ?

Is the whole @terra_money system in danger?

Full Thread 🧵 🧐

Is the whole @terra_money system in danger?

Full Thread 🧵 🧐

@anchor_protocol @terra_money 2.

$LUNA generates value from the growth of the Terra Ecosystem. So the more demand for $UST the more value Luna gets. The protocol which generates the biggest demand for $UST is without a doubt @anchor_protocol with TVL over 10 bln UST.

$LUNA generates value from the growth of the Terra Ecosystem. So the more demand for $UST the more value Luna gets. The protocol which generates the biggest demand for $UST is without a doubt @anchor_protocol with TVL over 10 bln UST.

3.

Let’s start with how the @anchor_protocol works right now. Anchor is a protocol where you can earn on your $UST and you can borrow $UST using your $LUNA or $ETH as collateral.

Let’s start with how the @anchor_protocol works right now. Anchor is a protocol where you can earn on your $UST and you can borrow $UST using your $LUNA or $ETH as collateral.

5.

If @anchor_protocol earns more than it needs to pay for depositors then additional money is sent to yield reserve. If Anchor doesn't generate enough money, it is being taken from the yield reserve.

CC: @shivsakhuja 🙏

If @anchor_protocol earns more than it needs to pay for depositors then additional money is sent to yield reserve. If Anchor doesn't generate enough money, it is being taken from the yield reserve.

CC: @shivsakhuja 🙏

9.

LFG was capitalized by 50 mln of $LUNA. Sounds like @stablekwon wants to add part of this money to the Yield Reserve of Anchor - even 300 mln $. Remember it’s only around 10% of the fund.

LFG was capitalized by 50 mln of $LUNA. Sounds like @stablekwon wants to add part of this money to the Yield Reserve of Anchor - even 300 mln $. Remember it’s only around 10% of the fund.

10.

Few days ago there was an #AMA with the Anchor Team soundcloud.com During this talk they have revealed more information about Anchor V2.

Few days ago there was an #AMA with the Anchor Team soundcloud.com During this talk they have revealed more information about Anchor V2.

11.

What is the biggest change? Right now if @anchor_protocol wants to add a new type of collateral it needs around 3 months. After changes it will need three days to add a new type of collateral. So we can assume that more borrowing will come to the protocol.

What is the biggest change? Right now if @anchor_protocol wants to add a new type of collateral it needs around 3 months. After changes it will need three days to add a new type of collateral. So we can assume that more borrowing will come to the protocol.

12.

Still questions remain - whether @anchor_protocol is going to be sustainable? Lastly, a lot of people talk about it feeling they discover SOMETHING NEW.

Still questions remain - whether @anchor_protocol is going to be sustainable? Lastly, a lot of people talk about it feeling they discover SOMETHING NEW.

13.

First of all - there’s NOTHING new about it. @stablekwon and Anchor team fully understand it. So if we know that they are fully aware about the current unsustainability, why don’t they lower the yield for depositors?

12% is also a lot!

(yields on @AaveAave below)

First of all - there’s NOTHING new about it. @stablekwon and Anchor team fully understand it. So if we know that they are fully aware about the current unsustainability, why don’t they lower the yield for depositors?

12% is also a lot!

(yields on @AaveAave below)

14.

Let’s change the perspective and focus on things which Anchor delivers for @terra_money.

If you want to earn 19.5% it forces you to educate yourself on Terra Ecosystem.

Let’s change the perspective and focus on things which Anchor delivers for @terra_money.

If you want to earn 19.5% it forces you to educate yourself on Terra Ecosystem.

16.

@anchor_protocol was the main factor behind the growth of $LUNA. With growing popularity more devs came to the space. More projects were built. Terra ecosystem grew.

@anchor_protocol was the main factor behind the growth of $LUNA. With growing popularity more devs came to the space. More projects were built. Terra ecosystem grew.

17.

What will happen if Anchor v2 goes cross chain? People from other ecosystems will start to use it: @solana , $Atom, $Dot and others. The user base is going to be even bigger than it is right now. The goal was always to gain mass adoption. Few people understand it.

What will happen if Anchor v2 goes cross chain? People from other ecosystems will start to use it: @solana , $Atom, $Dot and others. The user base is going to be even bigger than it is right now. The goal was always to gain mass adoption. Few people understand it.

18.

Confirmation: listen carefully to the answer to the question asked in 25:35

soundcloud.com

The most important part is on the transcript below.

Confirmation: listen carefully to the answer to the question asked in 25:35

soundcloud.com

The most important part is on the transcript below.

19.

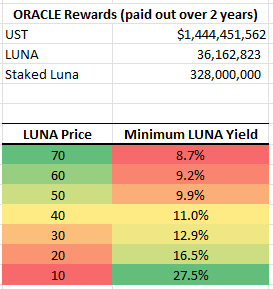

Ok, TVL will grow but it’s going to be hard to keep sustainability. What’s then? In my opinion @anchor_protocol will lower their yield, but still yield will be highly competitive.

Ok, TVL will grow but it’s going to be hard to keep sustainability. What’s then? In my opinion @anchor_protocol will lower their yield, but still yield will be highly competitive.

22.

The cause of $LUNA dump was liquidation of collateral which happened on @anchor_protocol .

The cause of $LUNA dump was liquidation of collateral which happened on @anchor_protocol .

28.

@TeamKujira allows users to make liquidation bids. It means that you are able to buy someone’s liquidated collateral cheaper than you would buy $Luna on the market. Also Kujira after you stake 300 tokens give you statistics which helps in navigating the market.

@TeamKujira allows users to make liquidation bids. It means that you are able to buy someone’s liquidated collateral cheaper than you would buy $Luna on the market. Also Kujira after you stake 300 tokens give you statistics which helps in navigating the market.

جاري تحميل الاقتراحات...