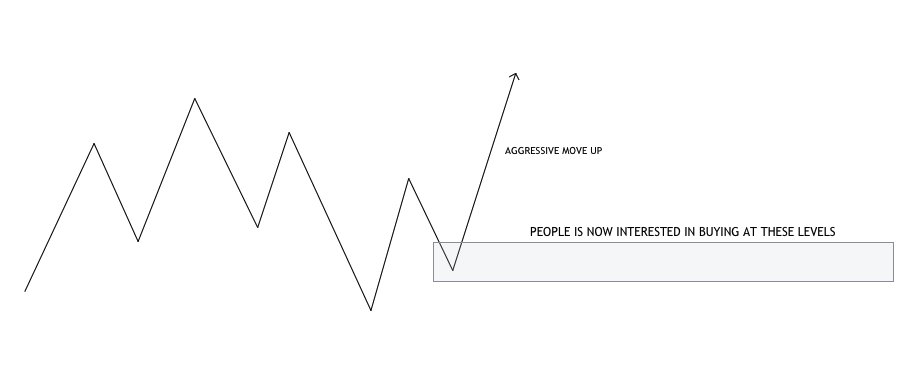

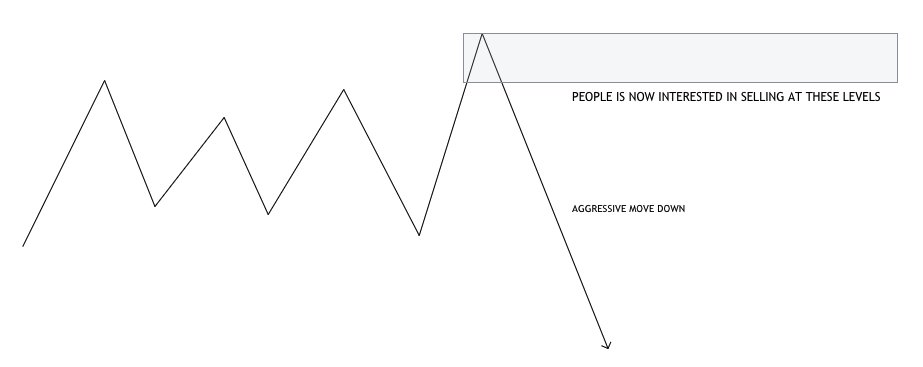

Orderblocks constitute supply and demand areas in a visual way. They offer precise entries and easy invalidation levels; therefore, they are a fundamental pillar to price action trading.

In orderblocks, liquidity is injected to be used at a future time, therefore the reaction from them is usually aggressive.

Now, how can we identify an oderblock in our charts?

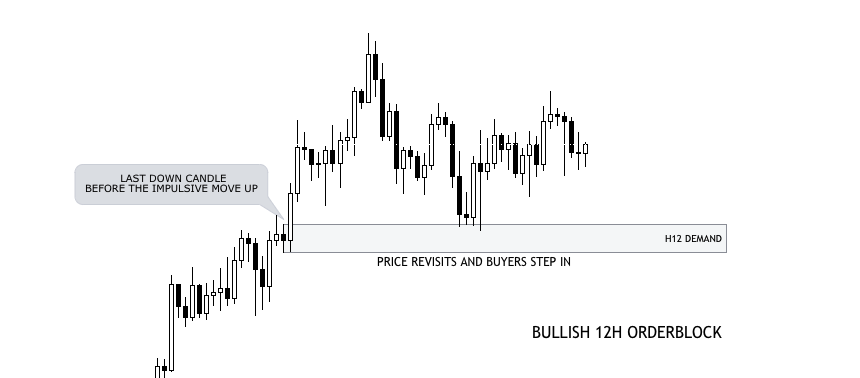

An orderblock is a down/up candle near a key level that preceded an impulsive move up/down.

Now, how can we identify an oderblock in our charts?

An orderblock is a down/up candle near a key level that preceded an impulsive move up/down.

But not all orderblocks are tradeable orderblocks. What makes an orderblock valid? Well, there is some criteria to it.

For an Orderblock to be valid (personal criteria)

1. It should be located near a HTF support or resistance level (at least on a directional bias timeframe)

2. The orderblock must precede a break in market structure

3. The rally preceded by the orderblock must be two times the OB

1. It should be located near a HTF support or resistance level (at least on a directional bias timeframe)

2. The orderblock must precede a break in market structure

3. The rally preceded by the orderblock must be two times the OB

It doesnt have to fit the three of them, but the more you have, the better. Executing involves a lot of context and is expected from you to add some.

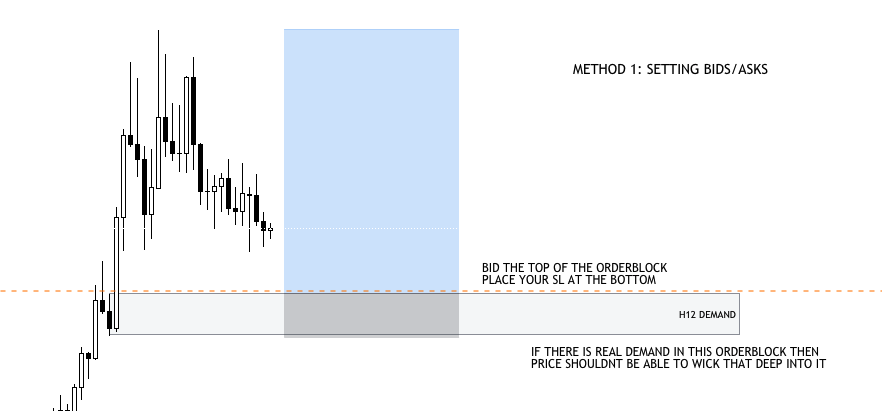

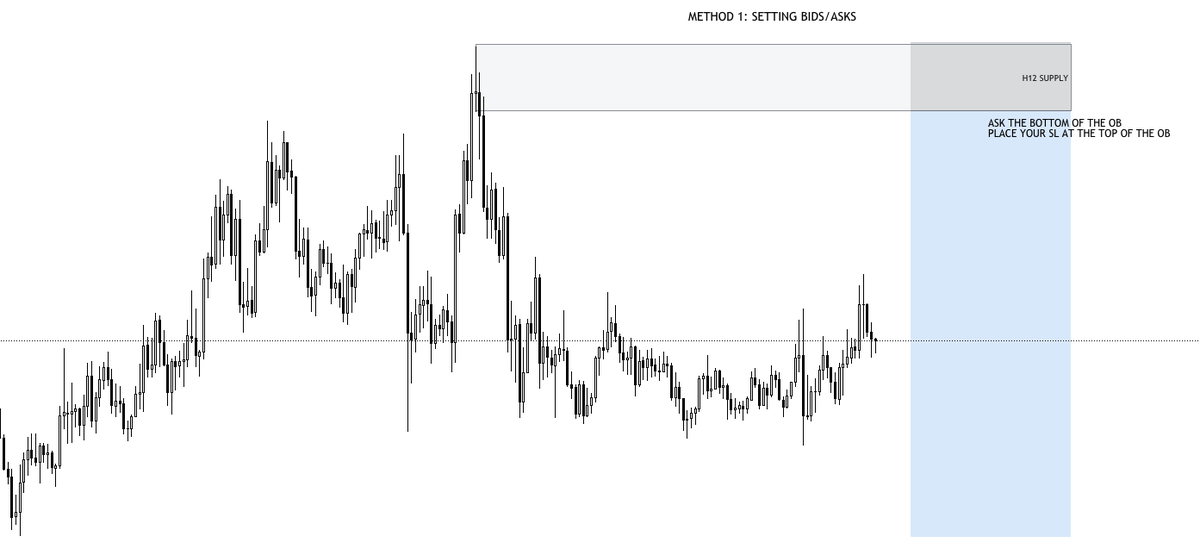

How can you execute on them? There is two ways to approach orderblocks.

How can you execute on them? There is two ways to approach orderblocks.

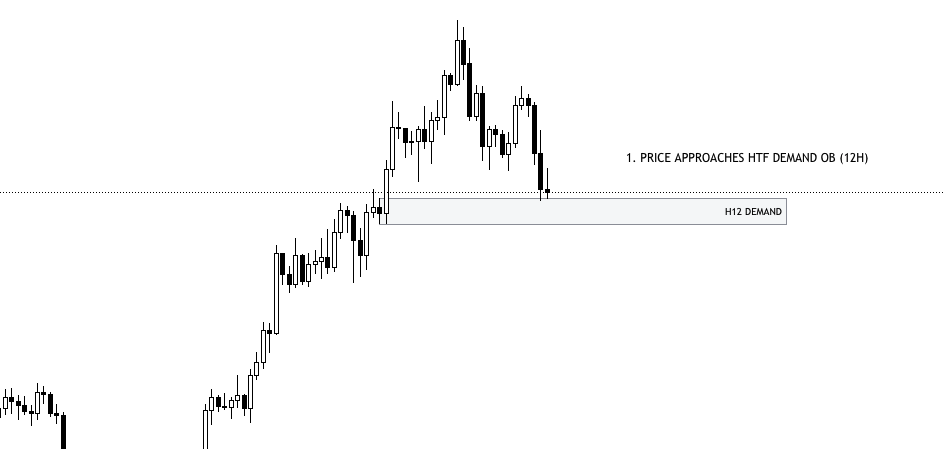

Now some examples on method 2, using past price action.

Here, you just must monitor price action as it approaches your orderblocks. @JoS7821 made an excellent thread on how to time tops and bottoms using this technique.

Here, you just must monitor price action as it approaches your orderblocks. @JoS7821 made an excellent thread on how to time tops and bottoms using this technique.

@JoS7821 What's the logic behind it?

If price is coming near a demand OB after a retracement then you’d like to see a shift in structure in lower timeframes for you to bid the demand orderblock/breaker from where price rallied. Its utilizing method 1 but executing based on the reaction.

If price is coming near a demand OB after a retracement then you’d like to see a shift in structure in lower timeframes for you to bid the demand orderblock/breaker from where price rallied. Its utilizing method 1 but executing based on the reaction.

@JoS7821 Remember utilizing context and adding extra criteria to your analysis, it’s all about enhancing the probabilities of your setups.

Adding this confluence to your orderblocks will increase the probabilities of them being successful. And if not, well, we'll always have breakers.

Adding this confluence to your orderblocks will increase the probabilities of them being successful. And if not, well, we'll always have breakers.

جاري تحميل الاقتراحات...