Many Liverpool fans are unhappy that their club has not bought more players in this summer’s transfer window. This thread looks at where the money has gone, reviews the #LFC business model under FSG and explains why the approach is less restrained at other clubs.

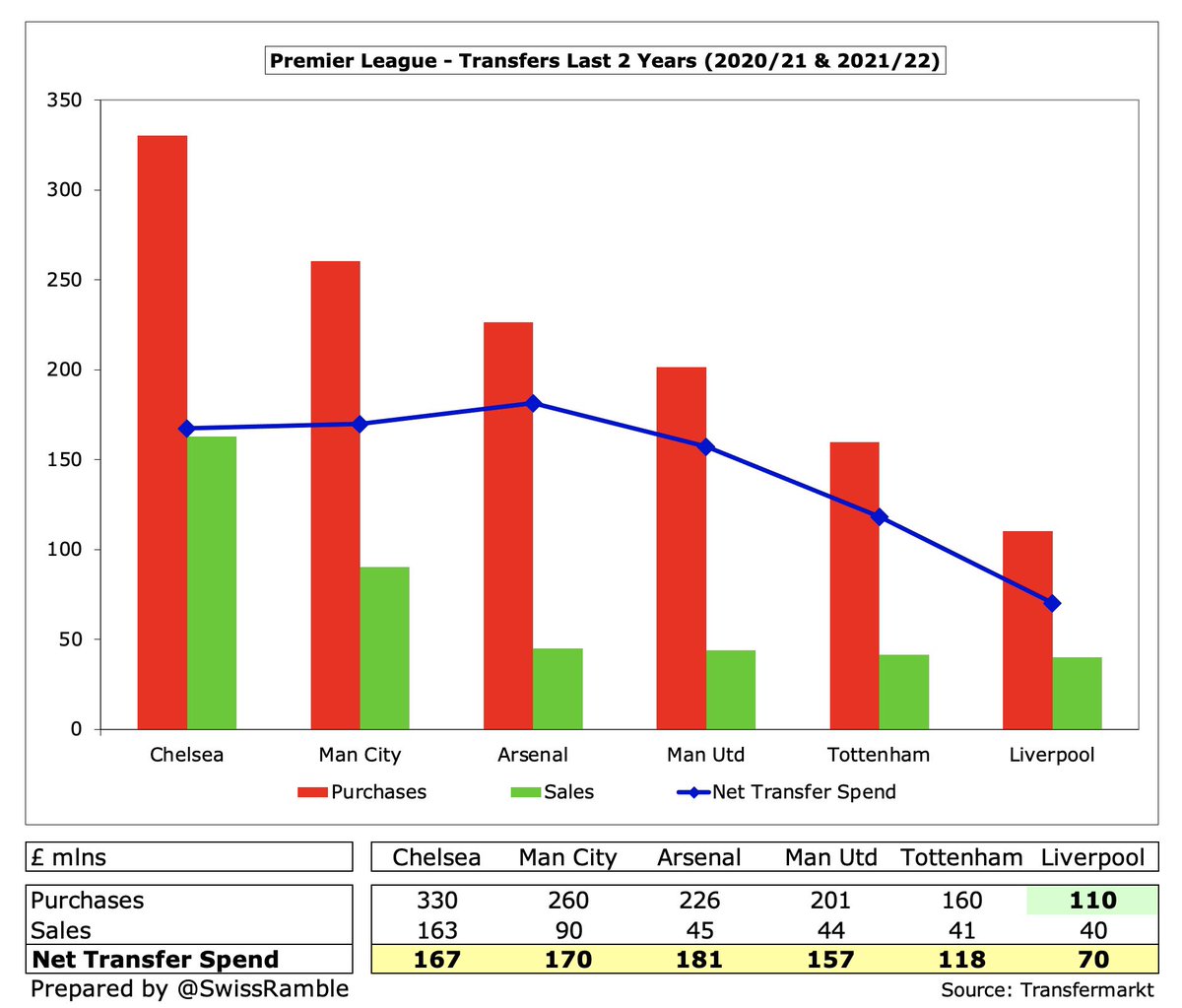

It’s a similar story when comparing #LFC with leading European clubs over past 2 years, though their £110m gross spend is only £4m less than Barcelona £114m and £82m more than Real Madrid. On a net basis, the Reds have spent nearly as much (£70m) as Bayern Munich £88m.

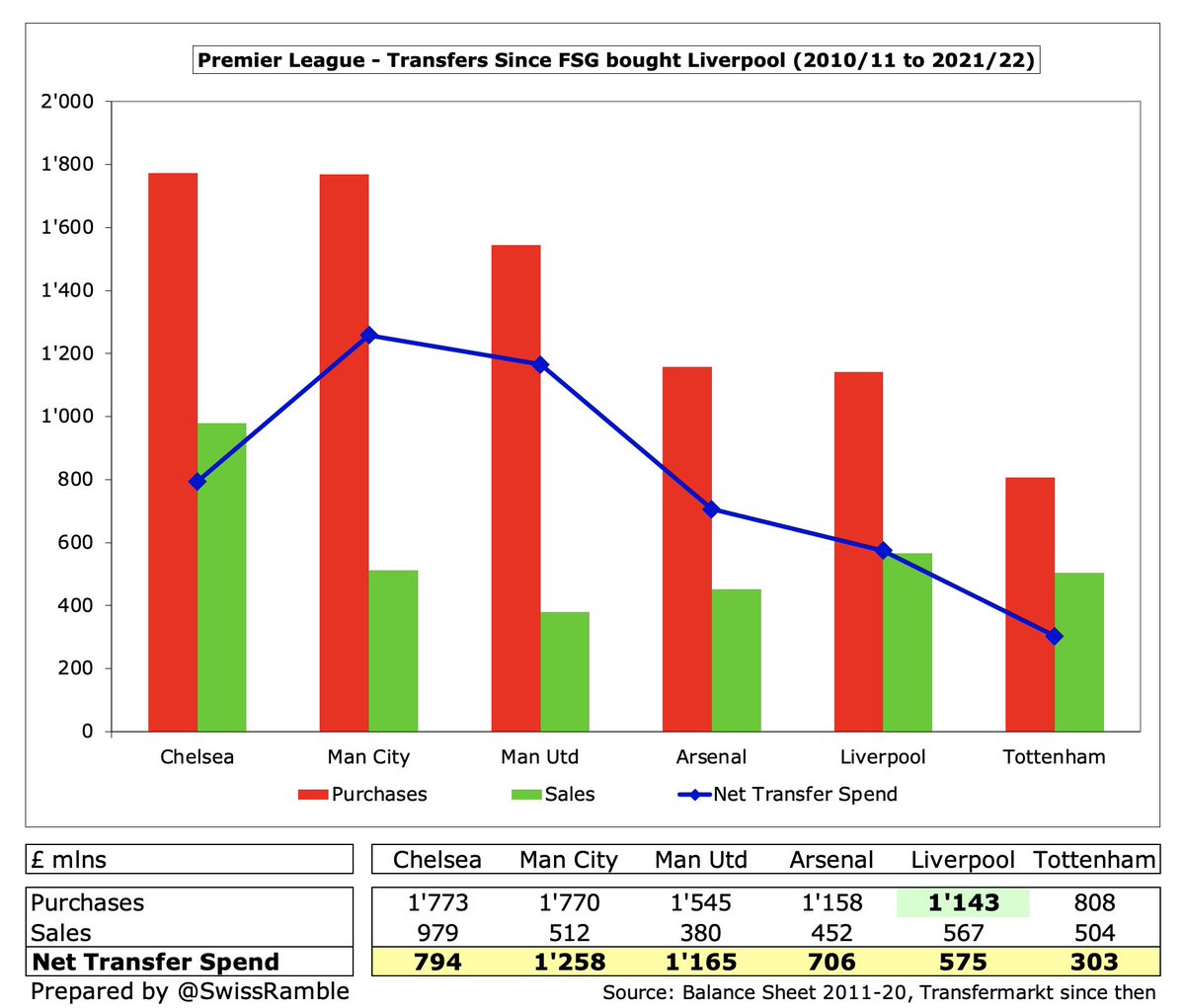

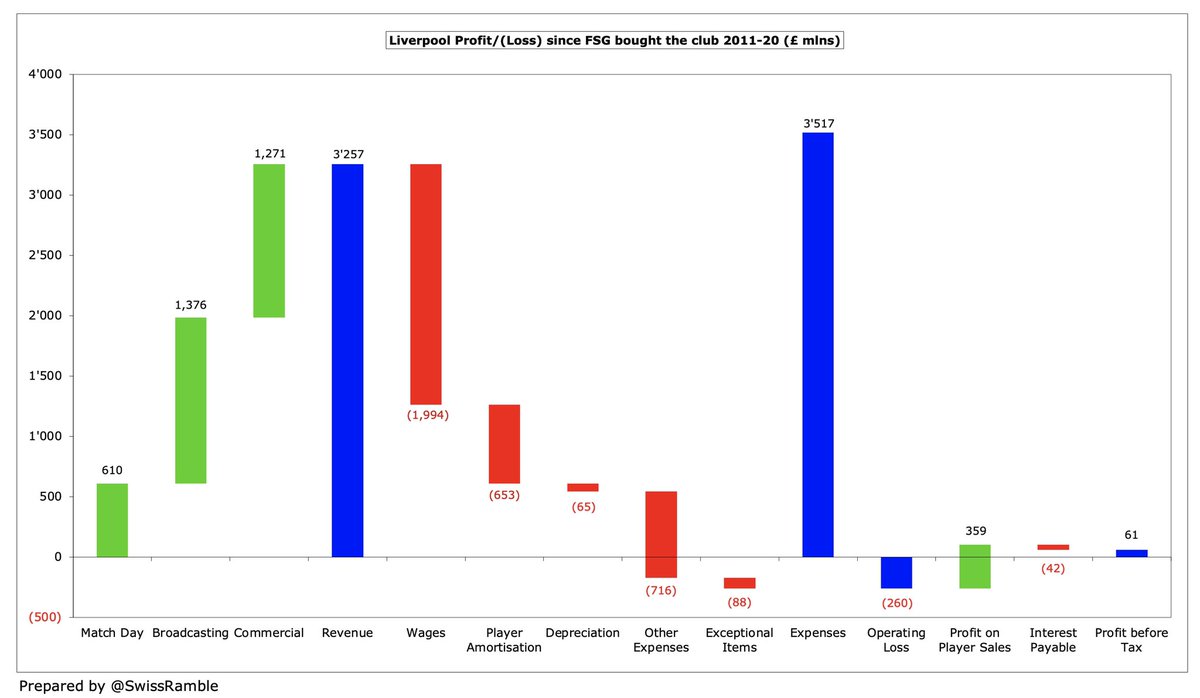

This is somewhat puzzling to #LFC fans, given their success on the pitch (Champions League winners 2019, Premier League title 2020), so let’s look at their financials since FSG arrived. The last published accounts were for 2019/20, so this review covers 10 years from 2010/11.

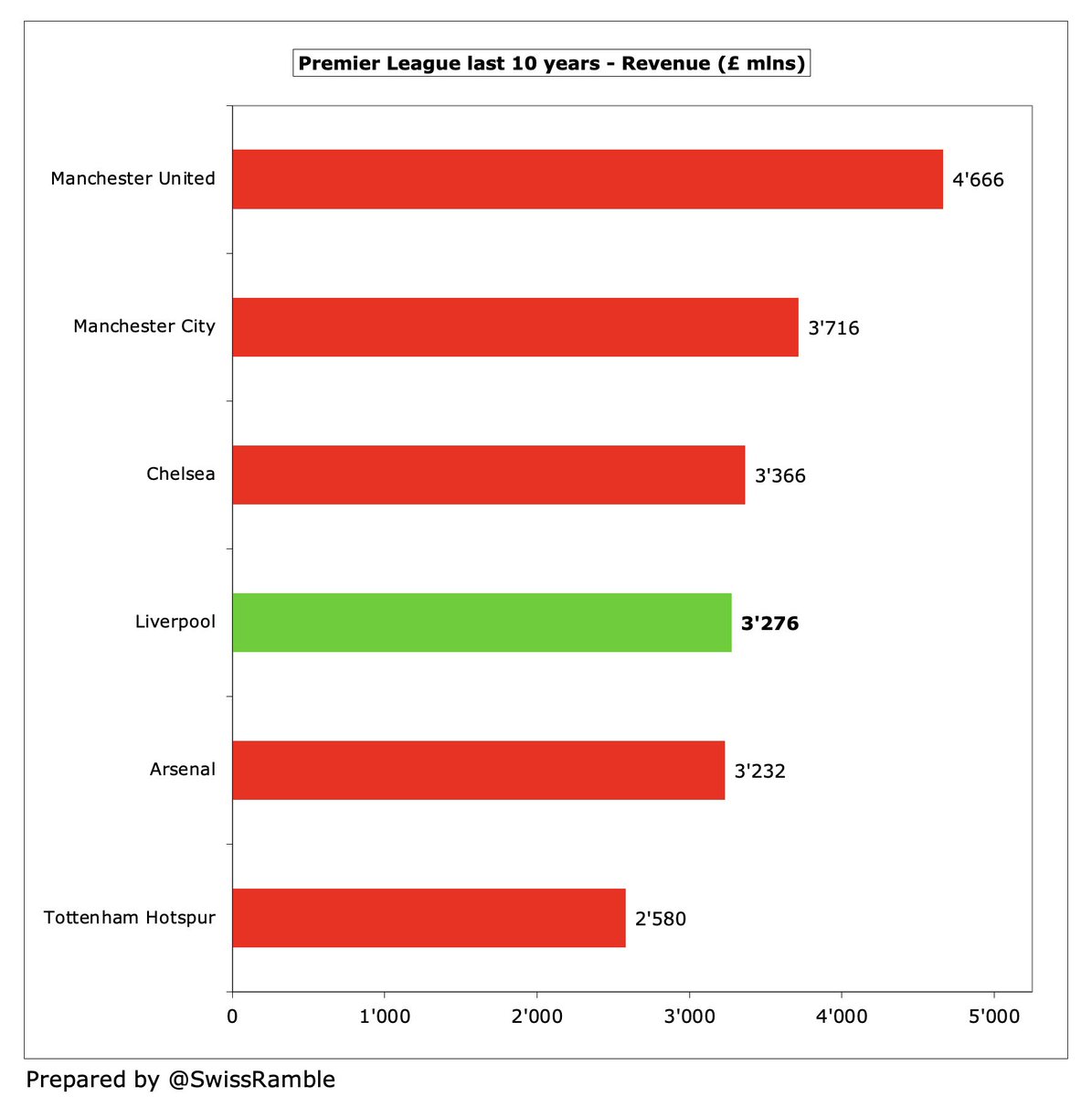

In fact, #LFC £490m is 5th highest revenue in the world per the Deloitte Money League, which is the first time they have been in the top five since back in 2002 and means they have improved 4 places since 2011. However, still miles behind Barcelona and Real Madrid, both £627m.

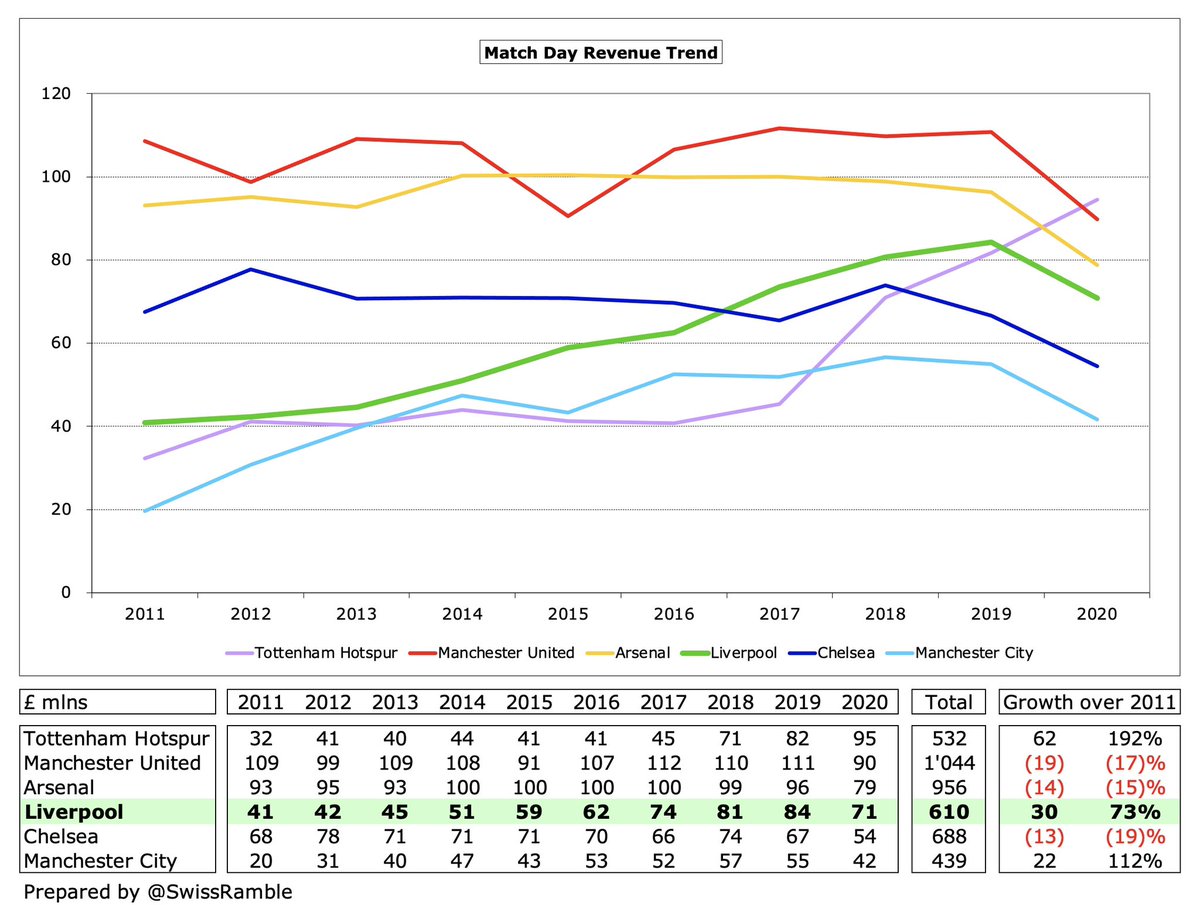

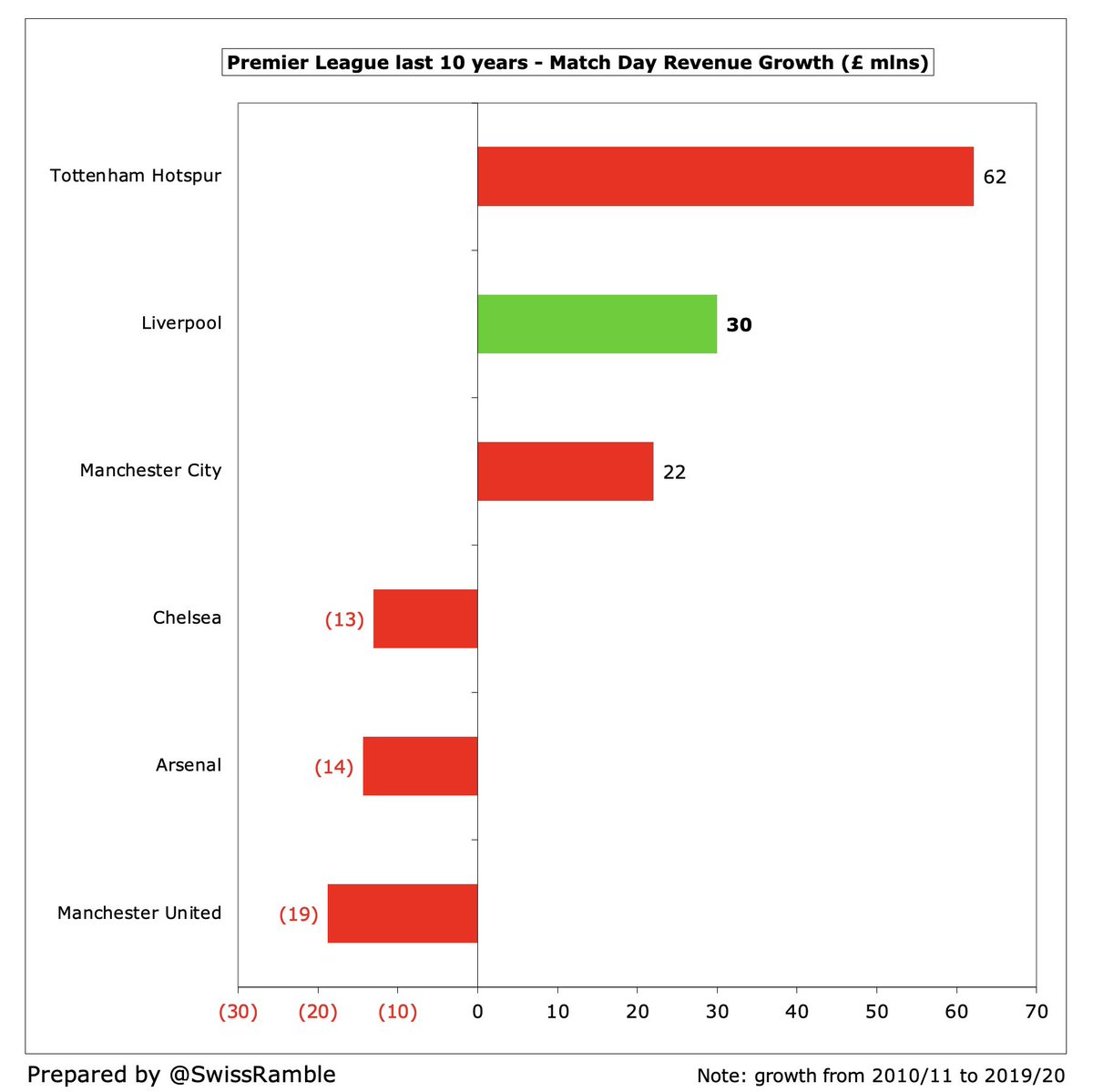

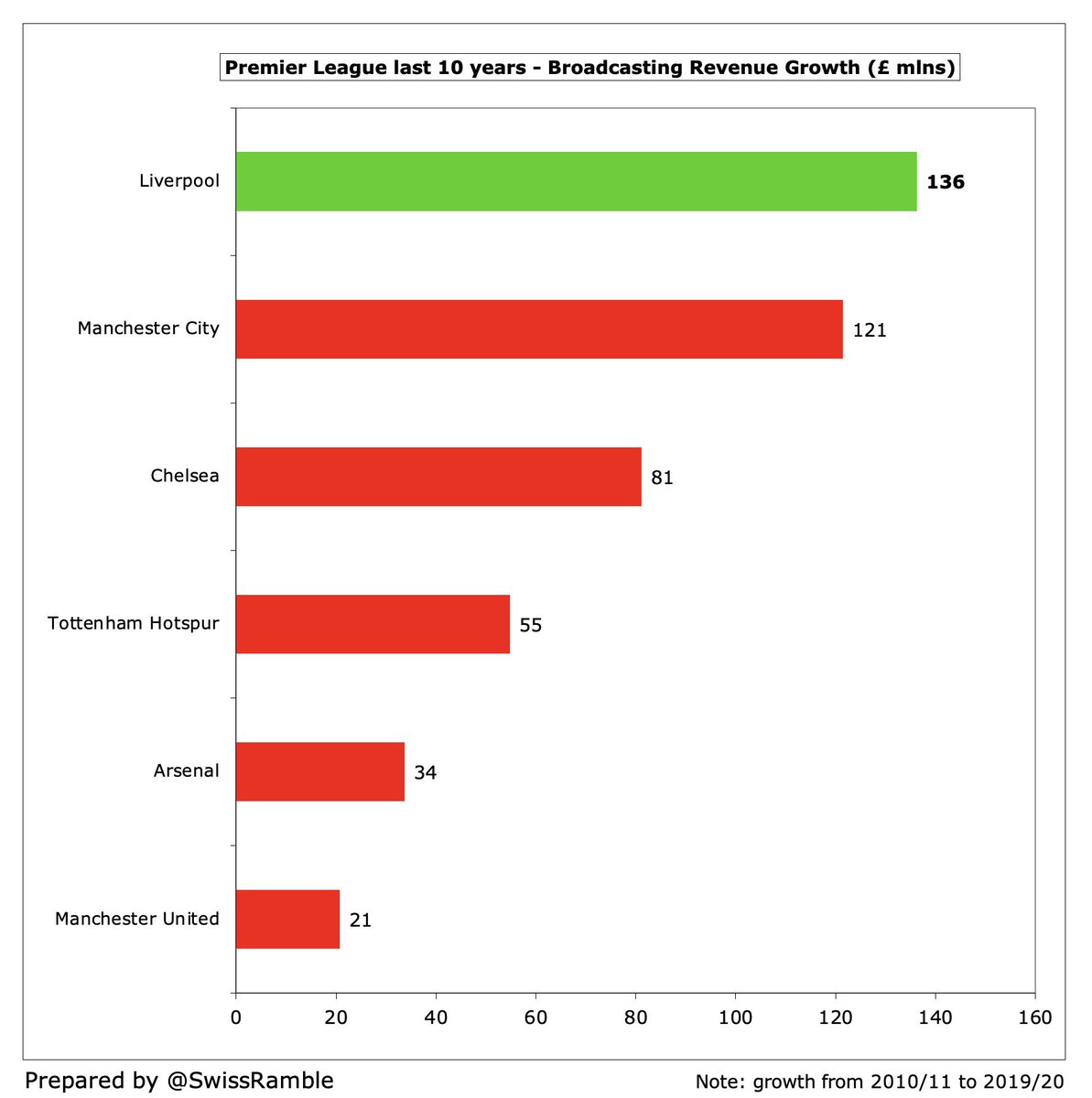

#LFC broadcasting revenue has more than tripled since 2011, rising £136m from £66m to £202m, the highest growth of the Big Six. The 2020 revenue was significantly impacted by COVID rebates and revenue deferred to 2020/21 accounts for games played after 31st May accounting close.

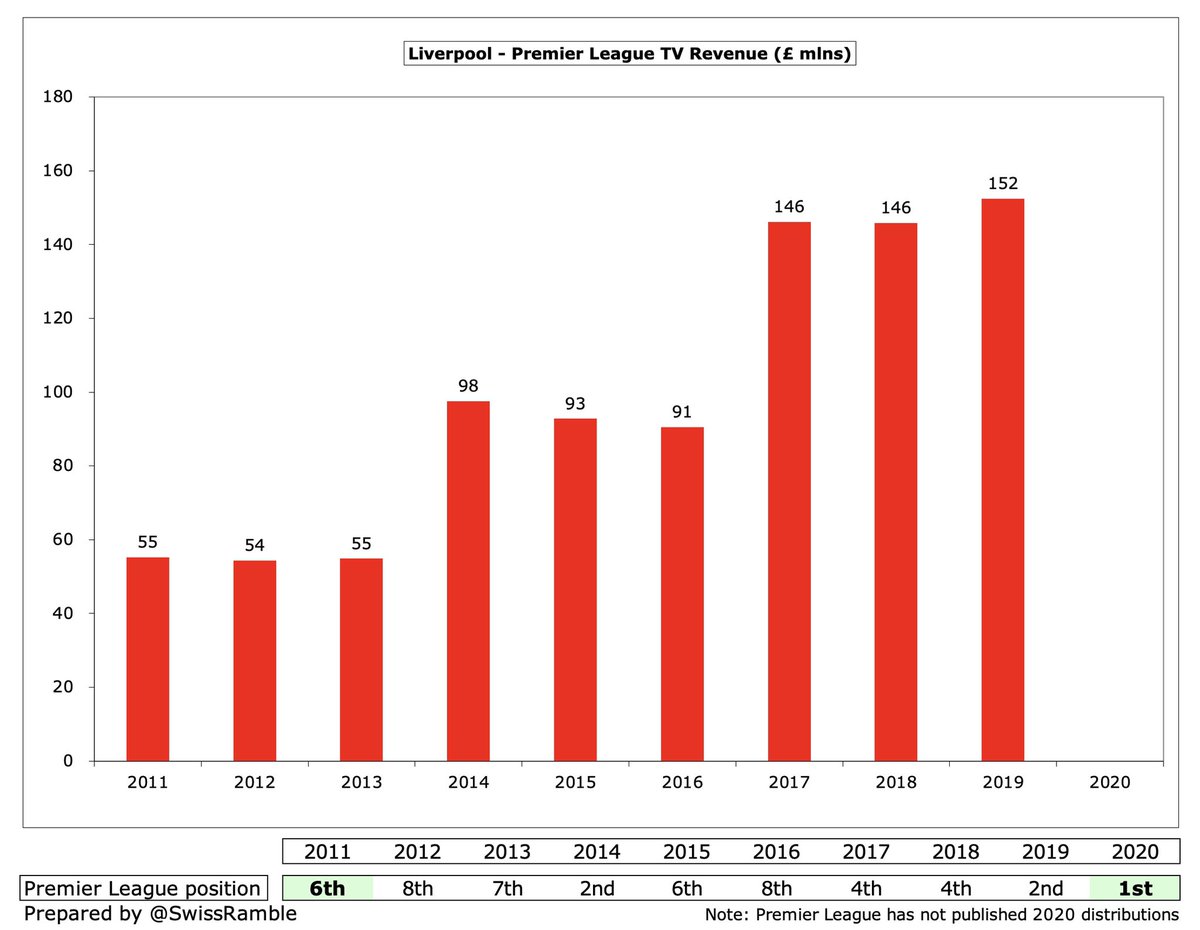

The Premier League has not published details of 2020 TV money distributions, but #LFC grew by £97m from £55m to £152m in 2019, mainly due to new central deals, but also better merit payments. However, as Warren Buffet said, this is a case of “A rising tide floats all boats”

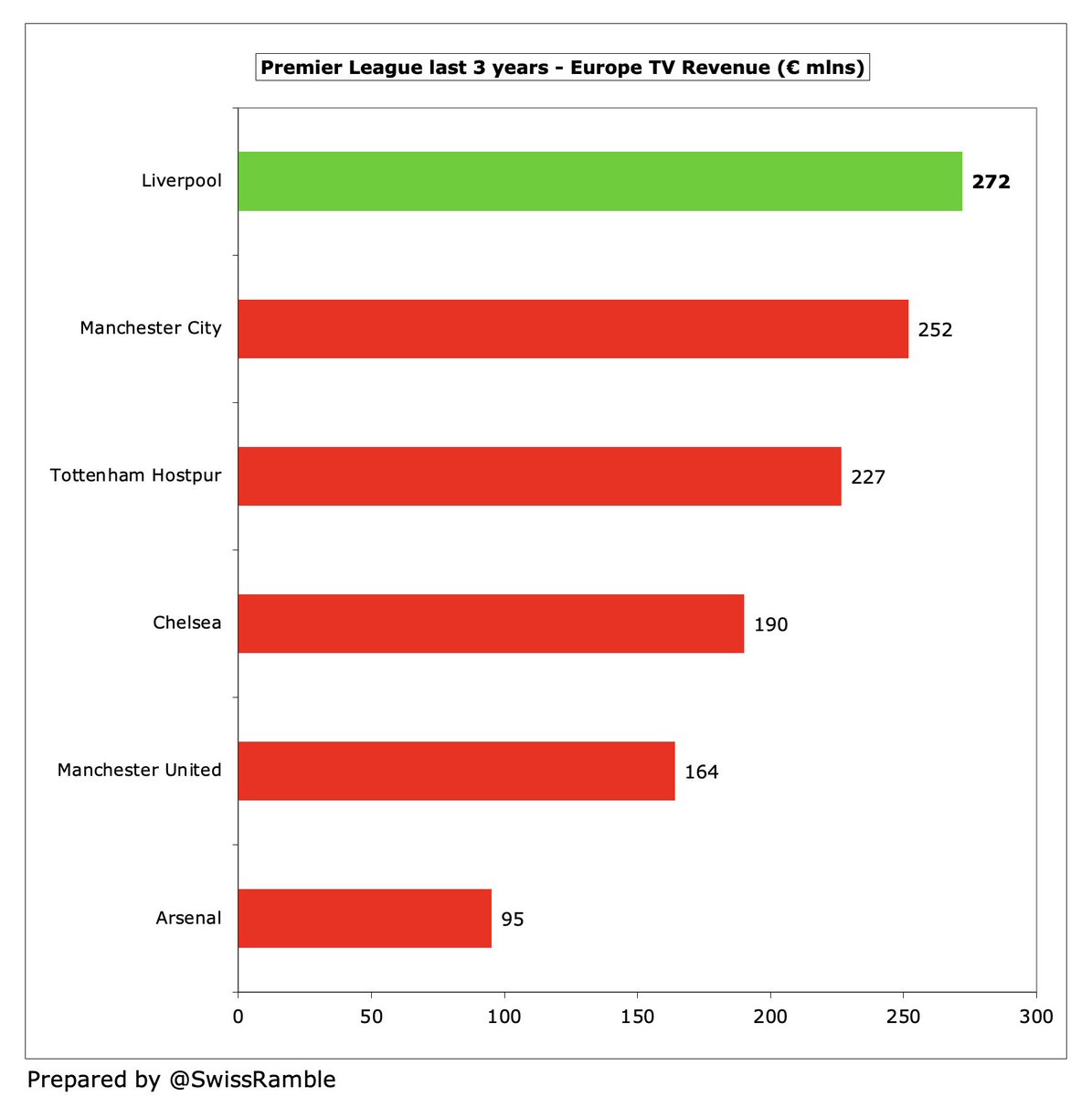

European TV money has seen massive growth with #LFC earning an impressive €272m in the last 3 years, more than any other English club, having won the Champions League and reached the final in this period. I estimate they also got €89m in 2021, so CL qualification is imperative.

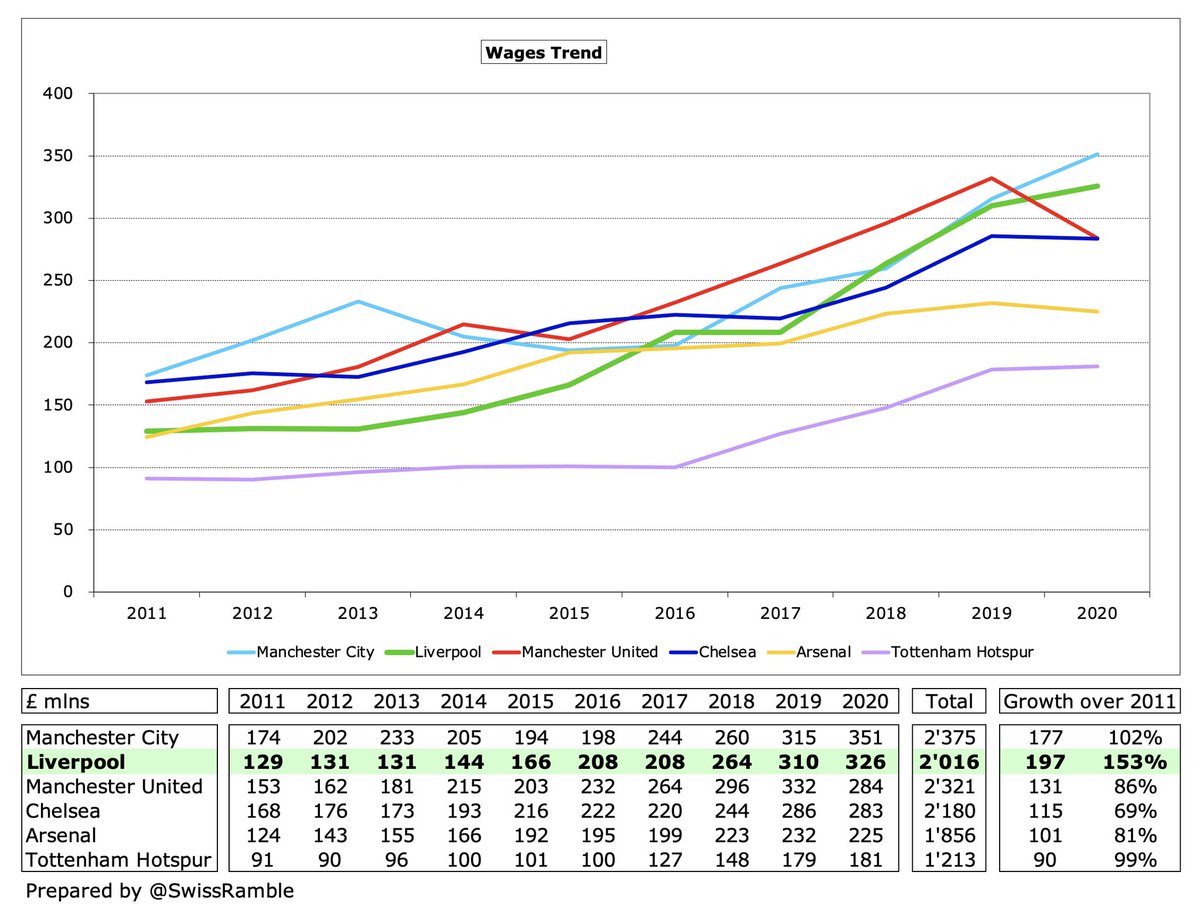

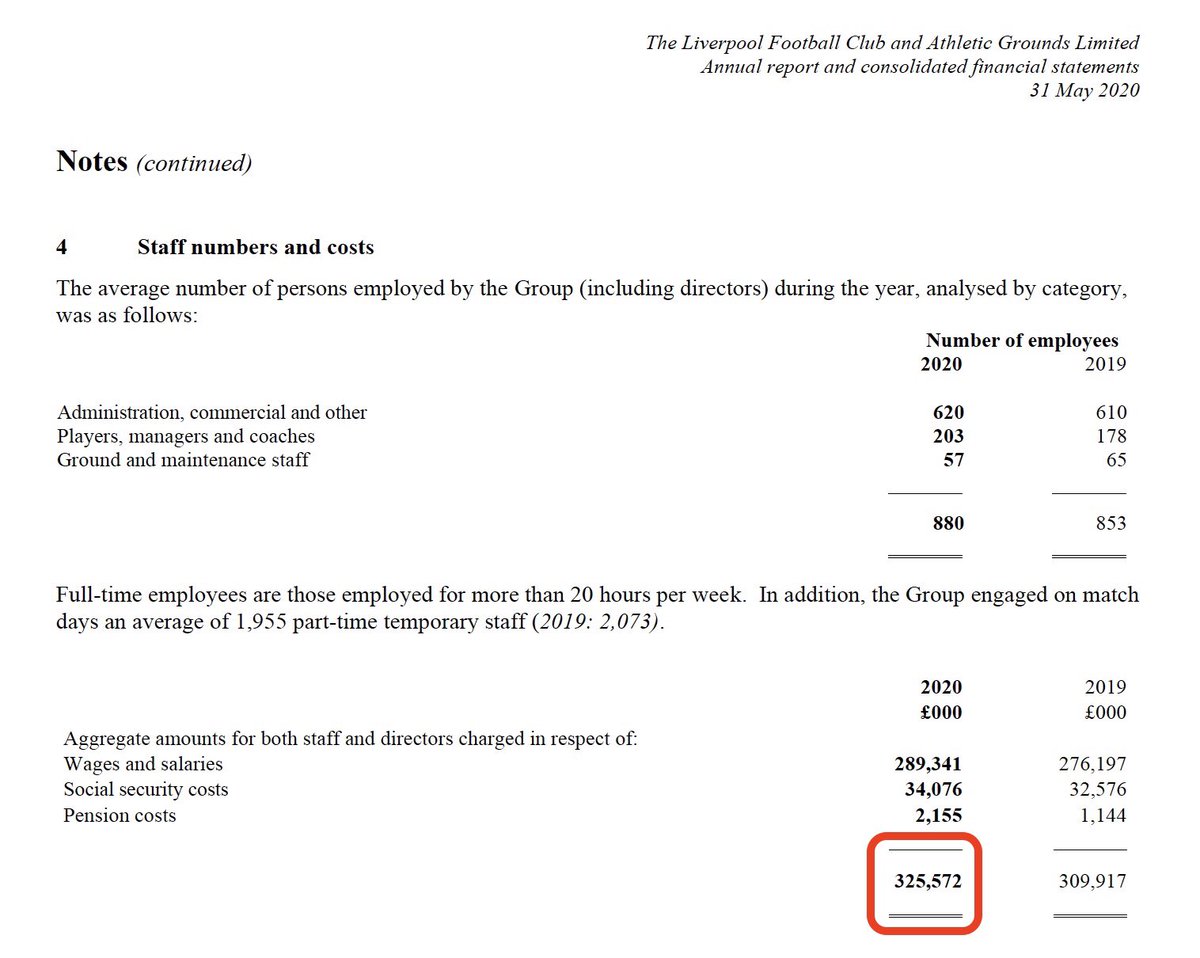

However, here’s the thing. All of the revenue growth has been eaten up by higher costs. In fact. #LFC wages have grown by £197m since 2011, the highest in the Big Six, due to recruiting better quality players and higher bonus payments. The focus has been on extending contracts.

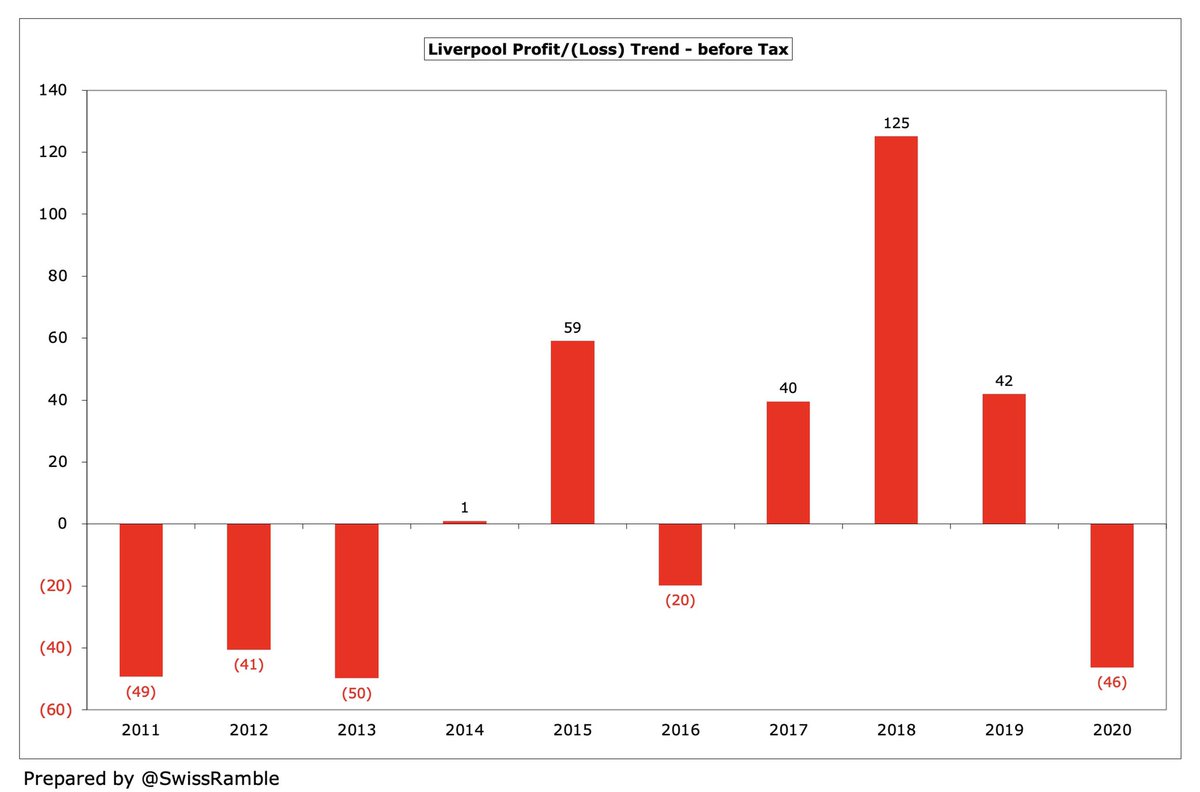

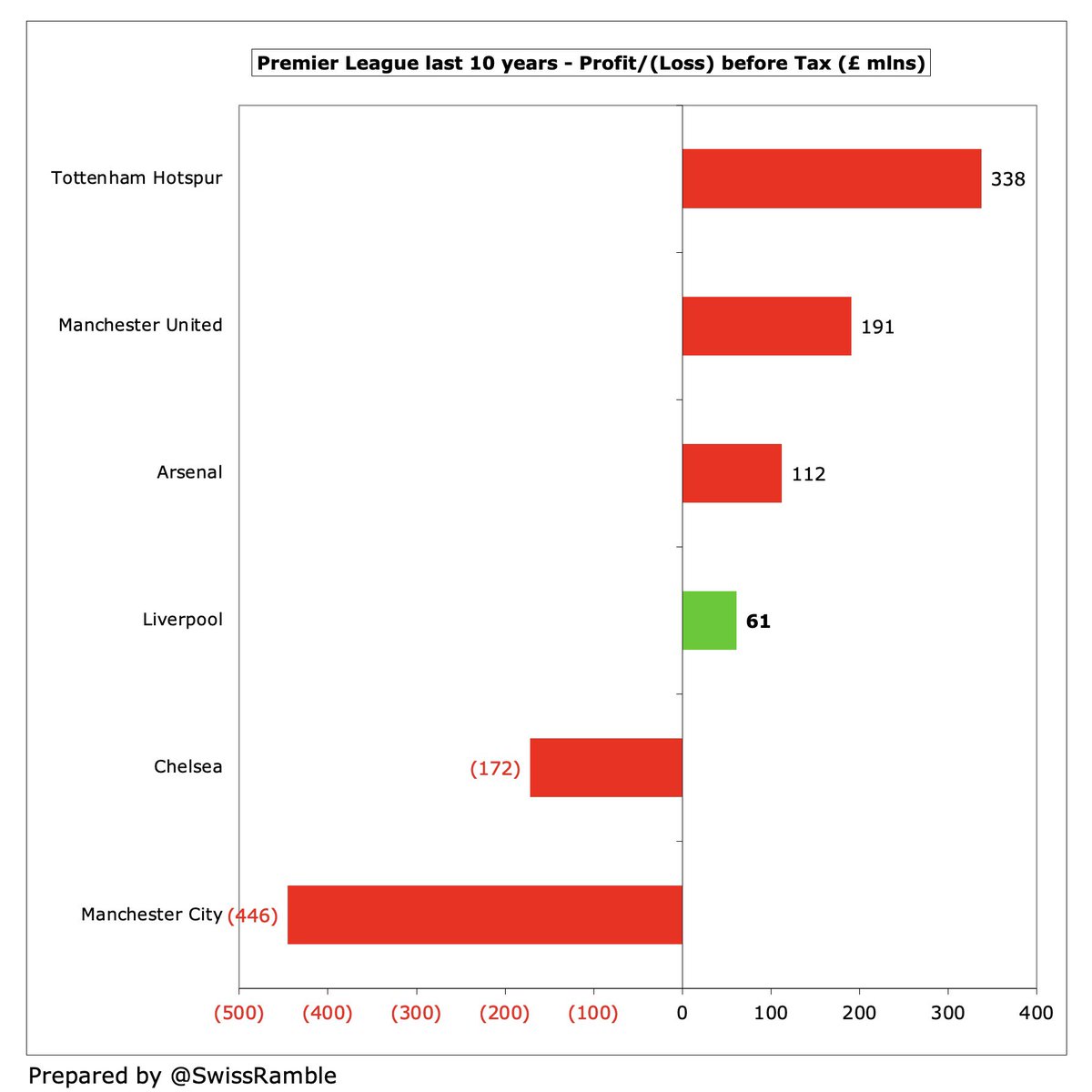

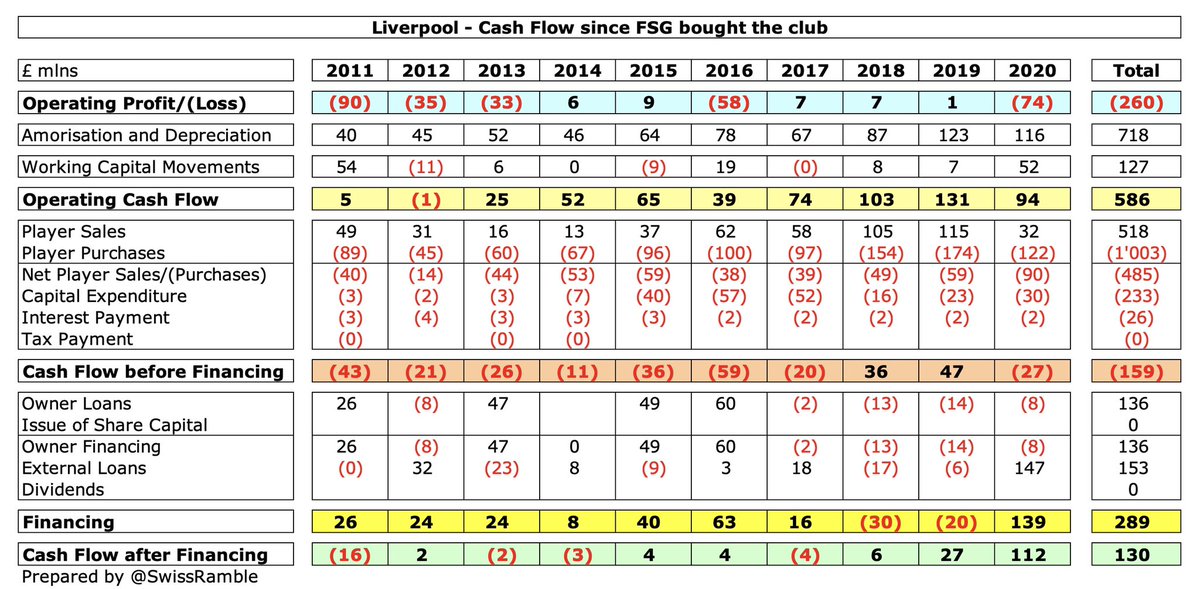

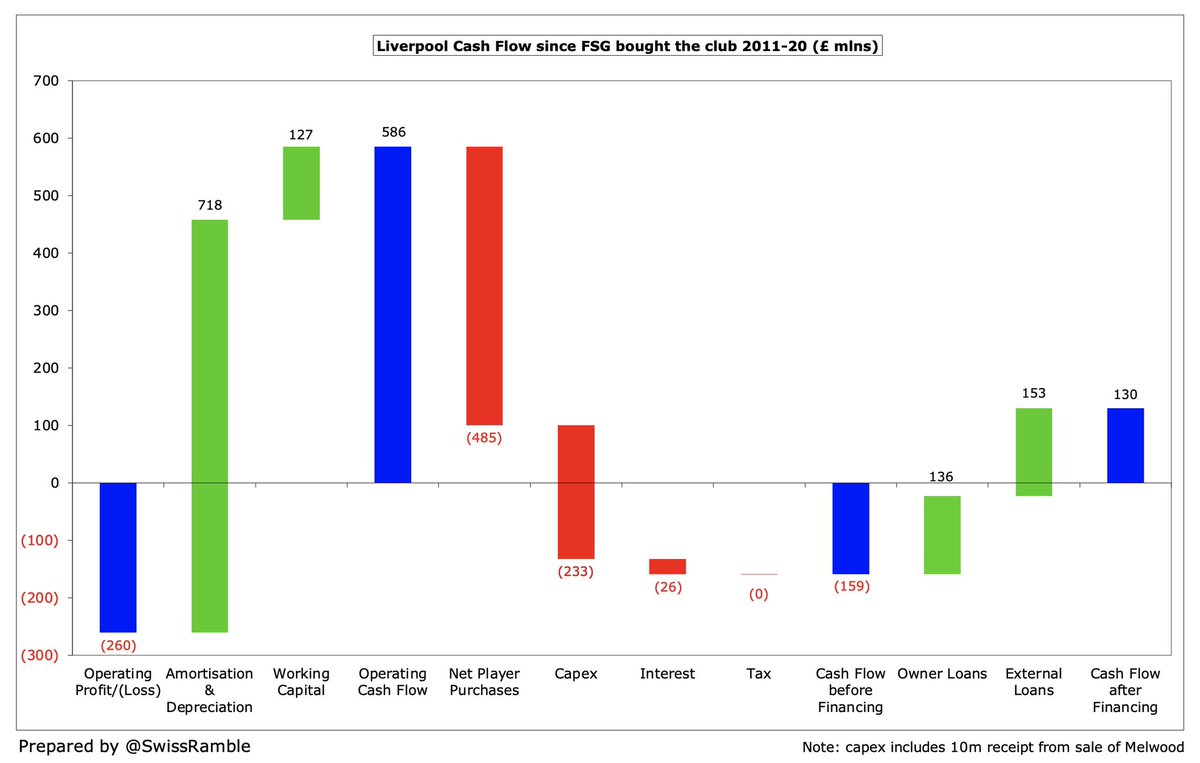

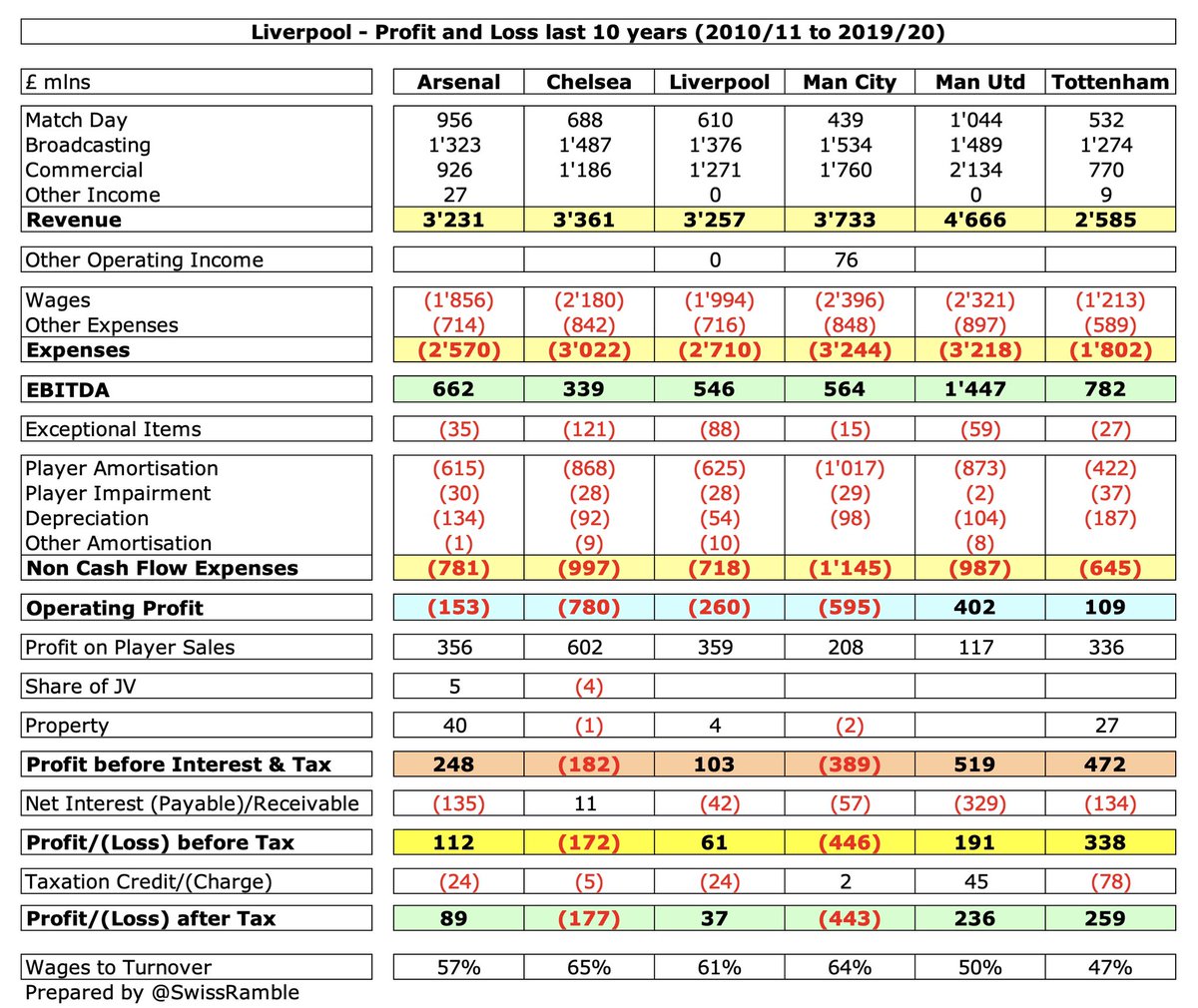

The profit and loss account does not tell the whole story, as it only shows accounting profit, which is very different from actual cash movements. In last 10 years #LFC had £61m pre-tax profit (£260m operating loss), but £130m cash inflow after other expenditure and financing.

For the cash flow statement, we need to do 2 things: (1) first, strip out the non-cash accounting entries, both for player trading, namely profit on player sales and player amortisation, and other depreciation, impairment, etc; (2) then, adjust for working capital movements.

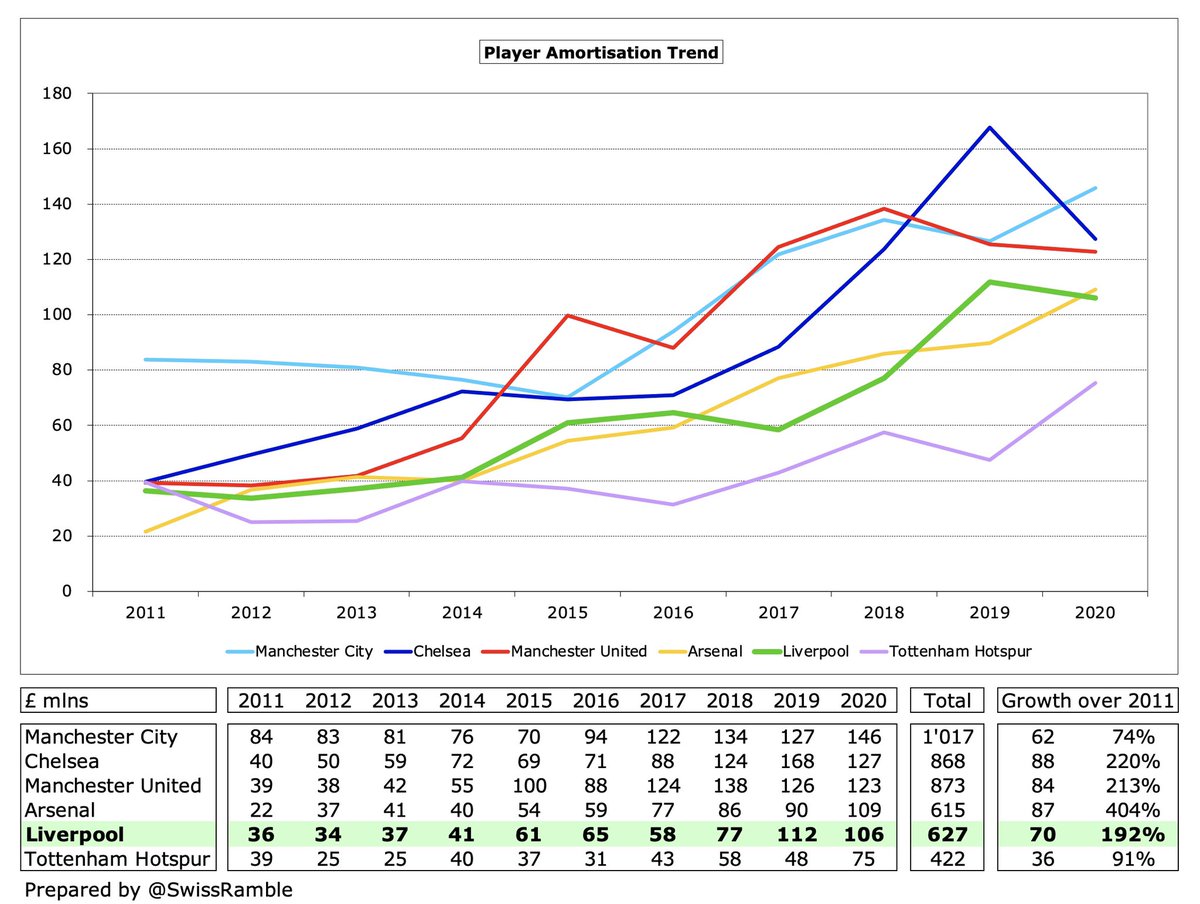

At this stage we should understand how football clubs account for player trading, both for purchases and sales, as the accounting treatment in the profit and loss account is completely different to the actual cash movements.

Football clubs do not fully expense transfer fees in the year a player is purchased, but instead write-off the cost evenly over the length of the player’s contract via player amortisation, while any profit made from selling players is immediately booked to the accounts.

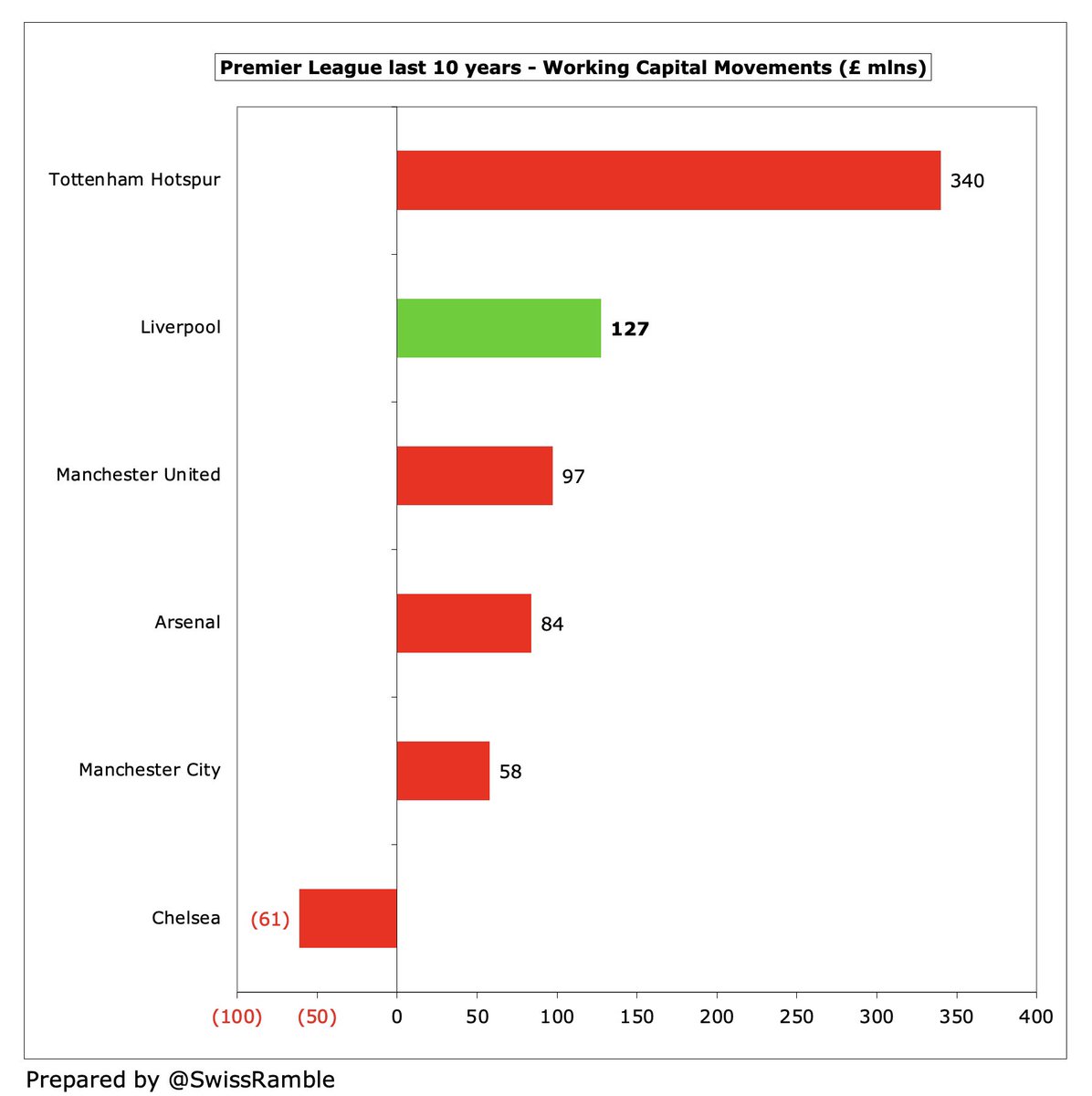

Working capital measures short-term liquidity, defined as current assets less current liabilities. Changes in working capital can cause operating cash flow to differ from net profit, as clubs book revenue and expenses when they occur instead of when cash actually changes hands.

If current liabilities increase, a club is paying its suppliers more slowly, so is holding on to cash (positive for cash flow). On the other hand, if a club’s debtors increase, this means it collected less money from customers than it recorded as revenue (negative for cash flow).

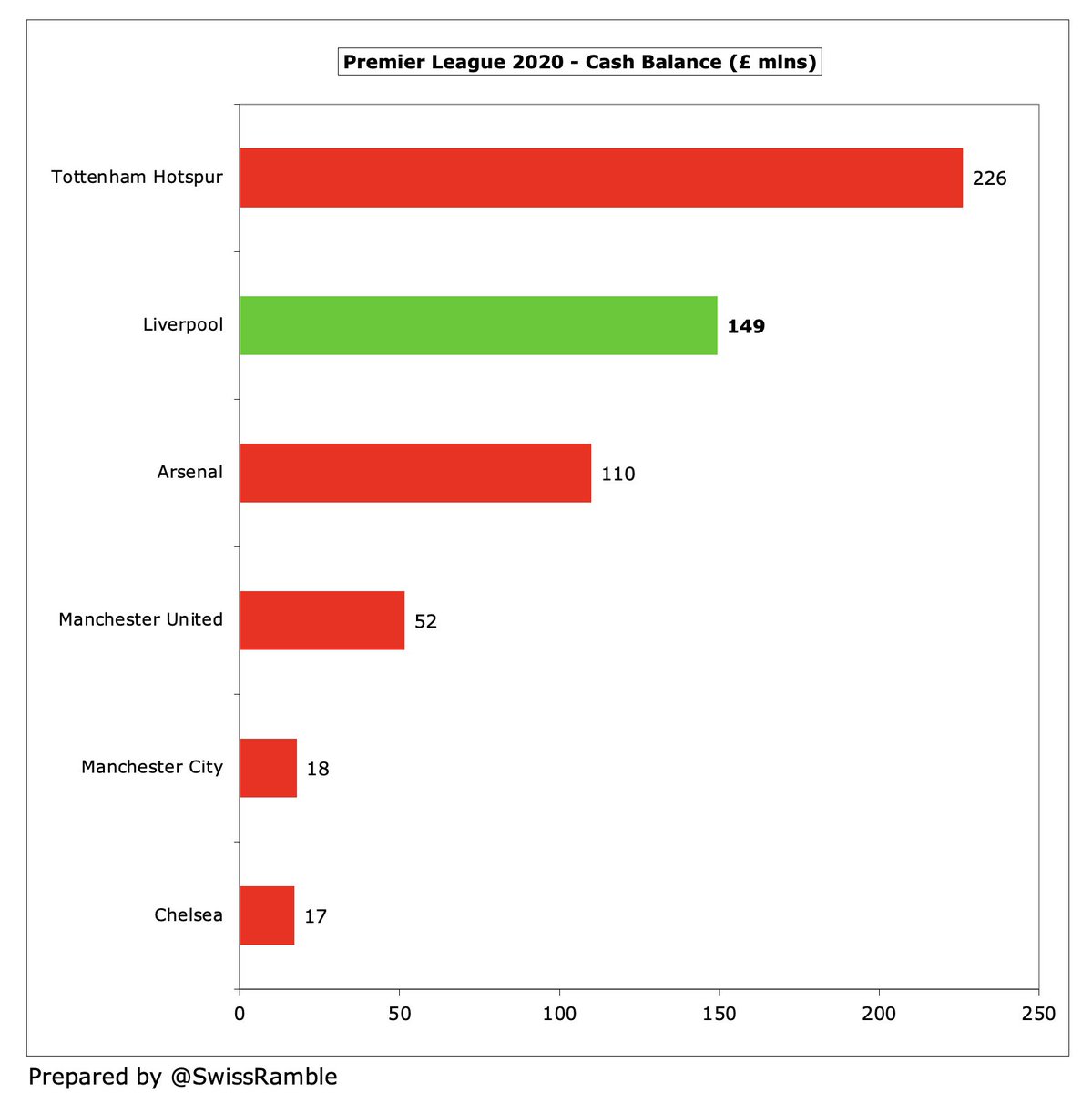

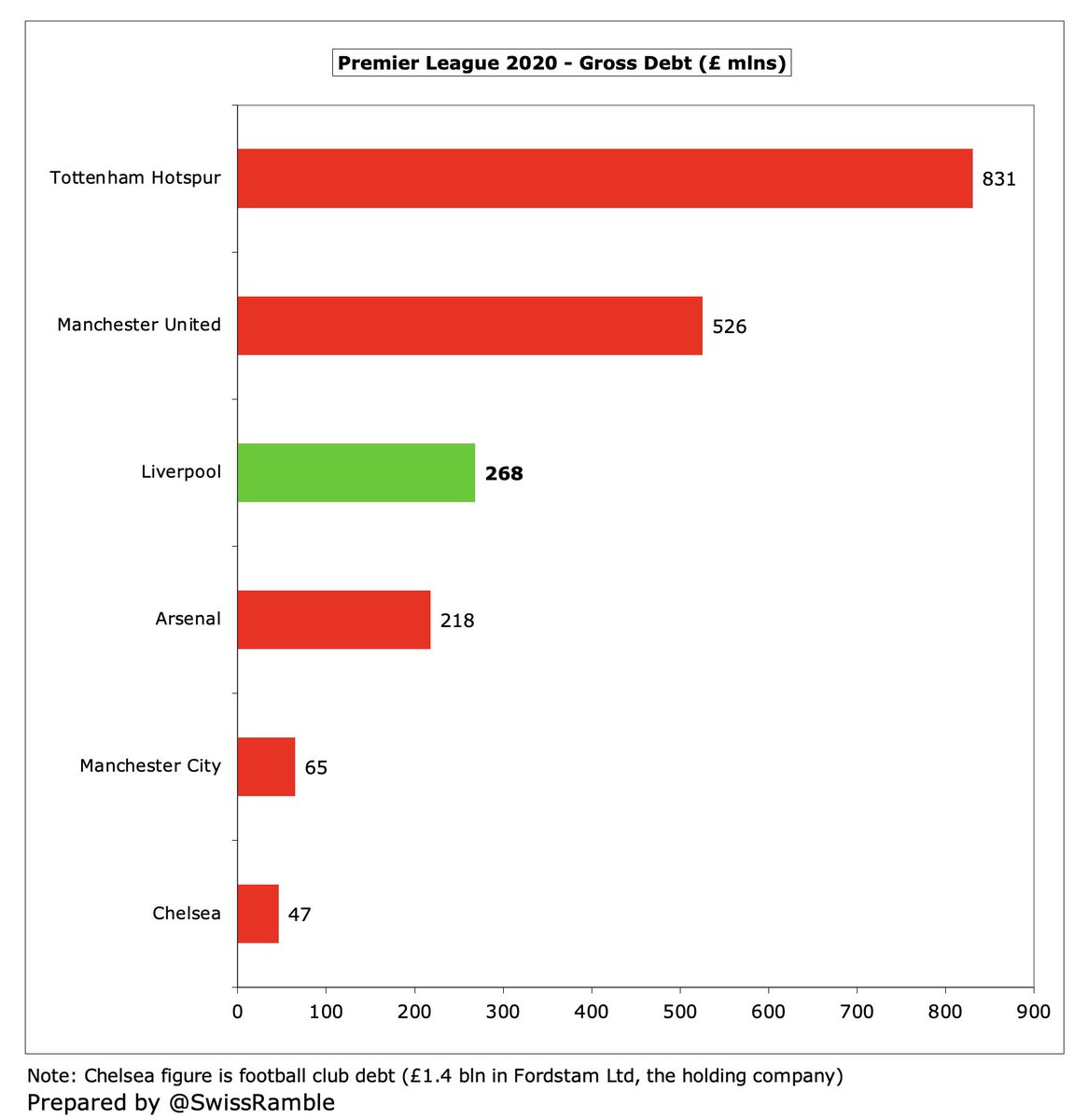

After all these movements, #LFC had a net cash inflow of £130m over 10 years, the second highest of the Big Six. However, this is a little misleading, as it is largely due to the £147m increase in the bank loan in 2020. Excluding this, Liverpool would have had a cash outflow.

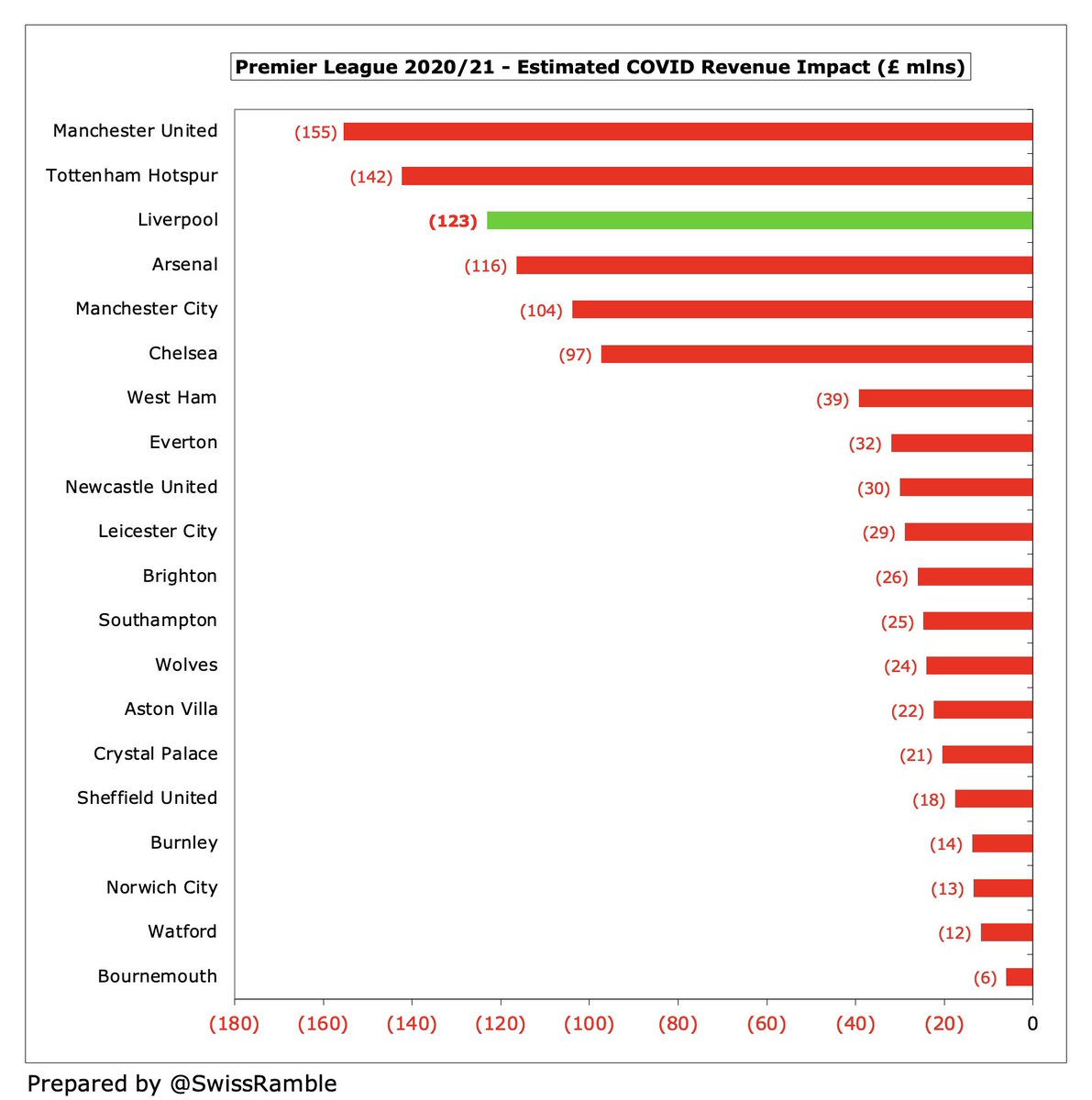

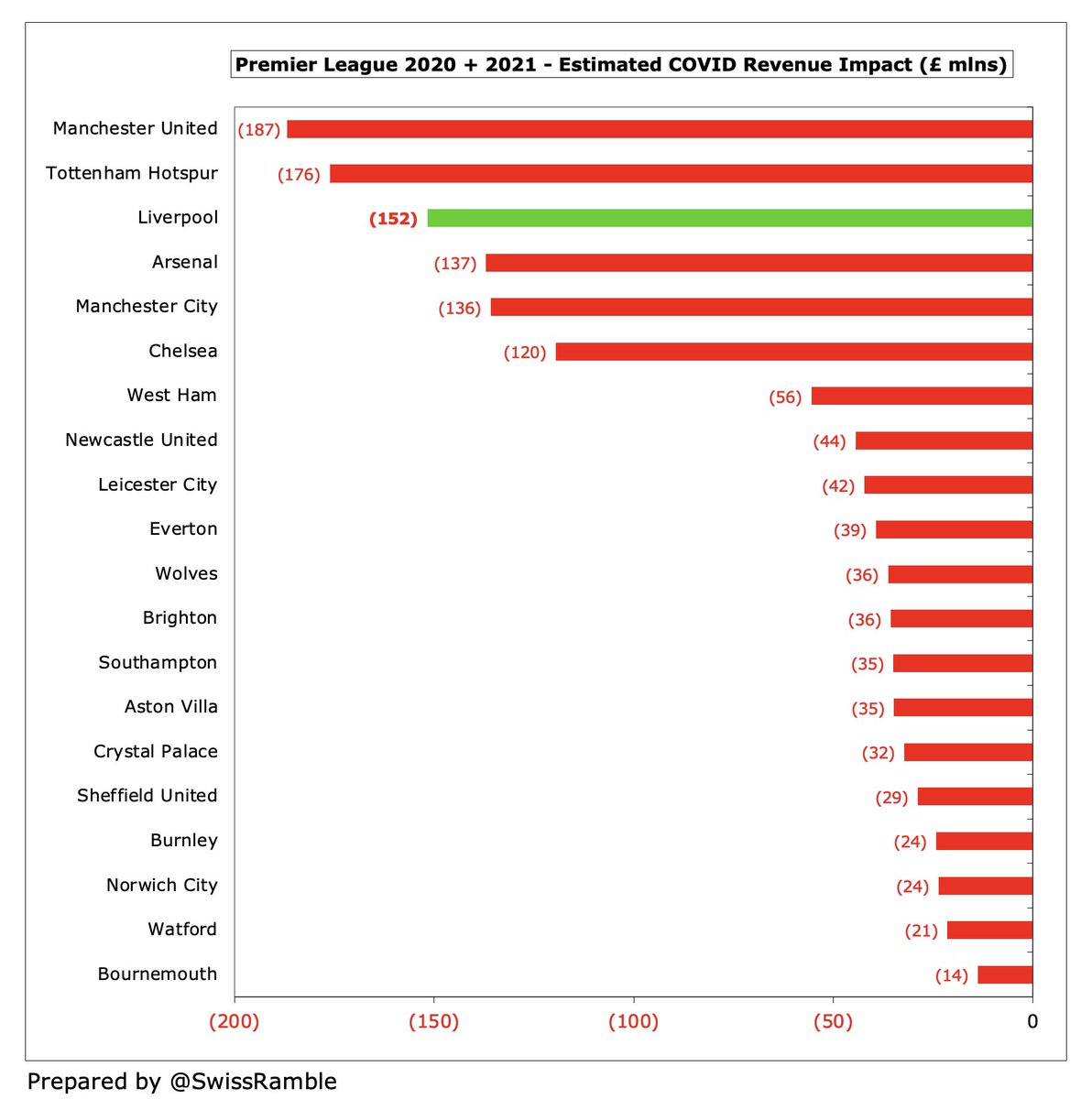

Like other clubs, #LFC have been hit hard by the impact of COVID. I reckon they lost £29m in 2019/20, due to games played behind closed doors £13m and broadcaster rebates £16m (£13m Premier League, £3m UEFA). Also £35m deferred to 2020/21 accounts, but only a timing difference.

Based on these assumptions, #LFC will have lost £152m over the past 2 seasons (2019/20 £29m and 2020/21 £123m), split between match day £92m, broadcasting £27m & commercial £33m. These figures are only indicative, but for sure the club has missed out on a lot of money.

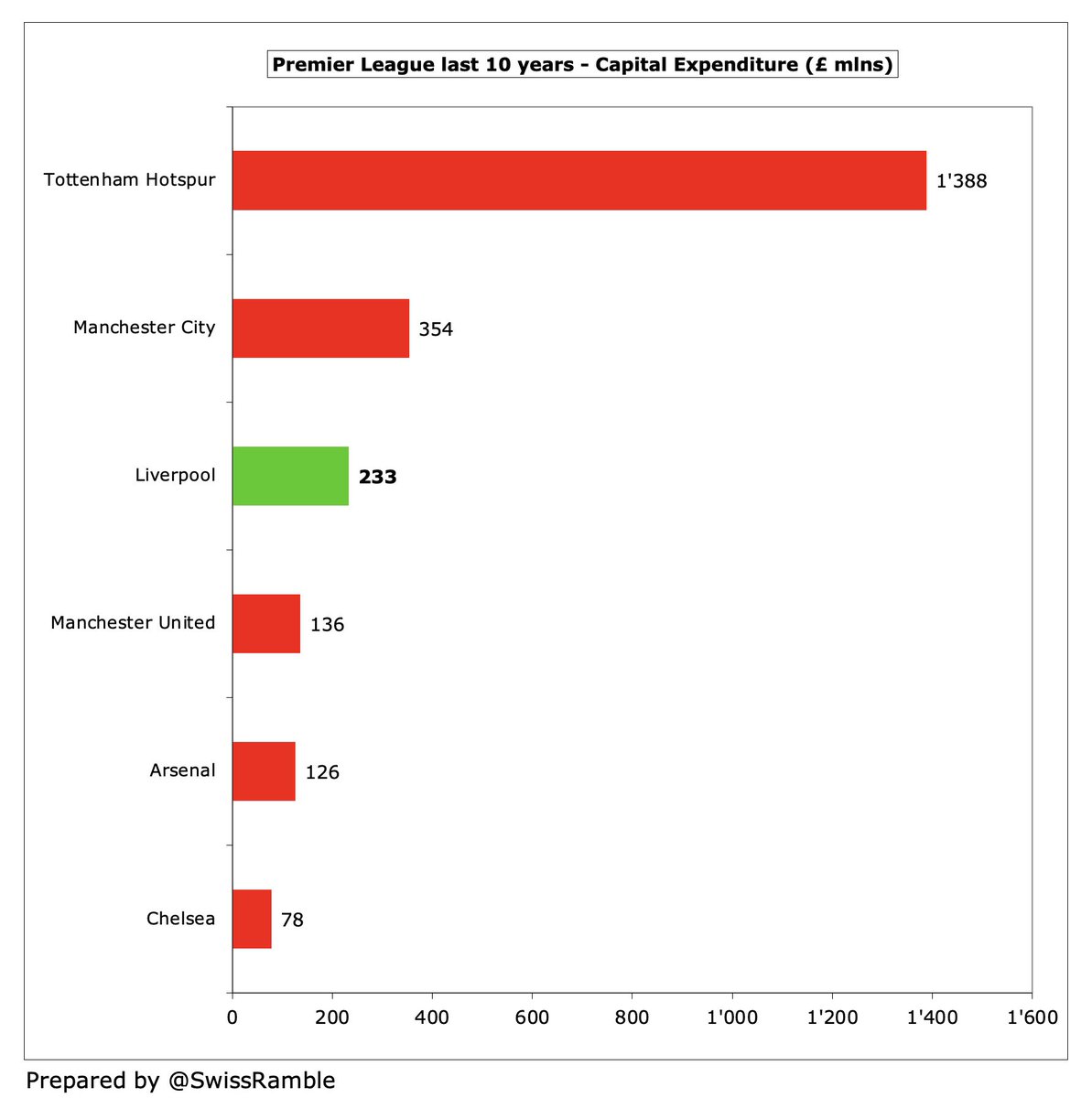

FSG have sold 10% of their company to Red Bird Capital, which should help strengthen the #LFC balance sheet, cover COVID losses and help fund the Anfield expansion. Although this might facilitate some transfer spending, it is unlikely to go towards a massive “war chest”.

It is understandable that #LFC fans would want their club to strengthen, but Jürgen Klopp acknowledged their challenge, “We all know the situation at Chelsea, City and PSG. Obviously, they have no limits. We are allowed to spend the money that we earn. That’s what we always did.”

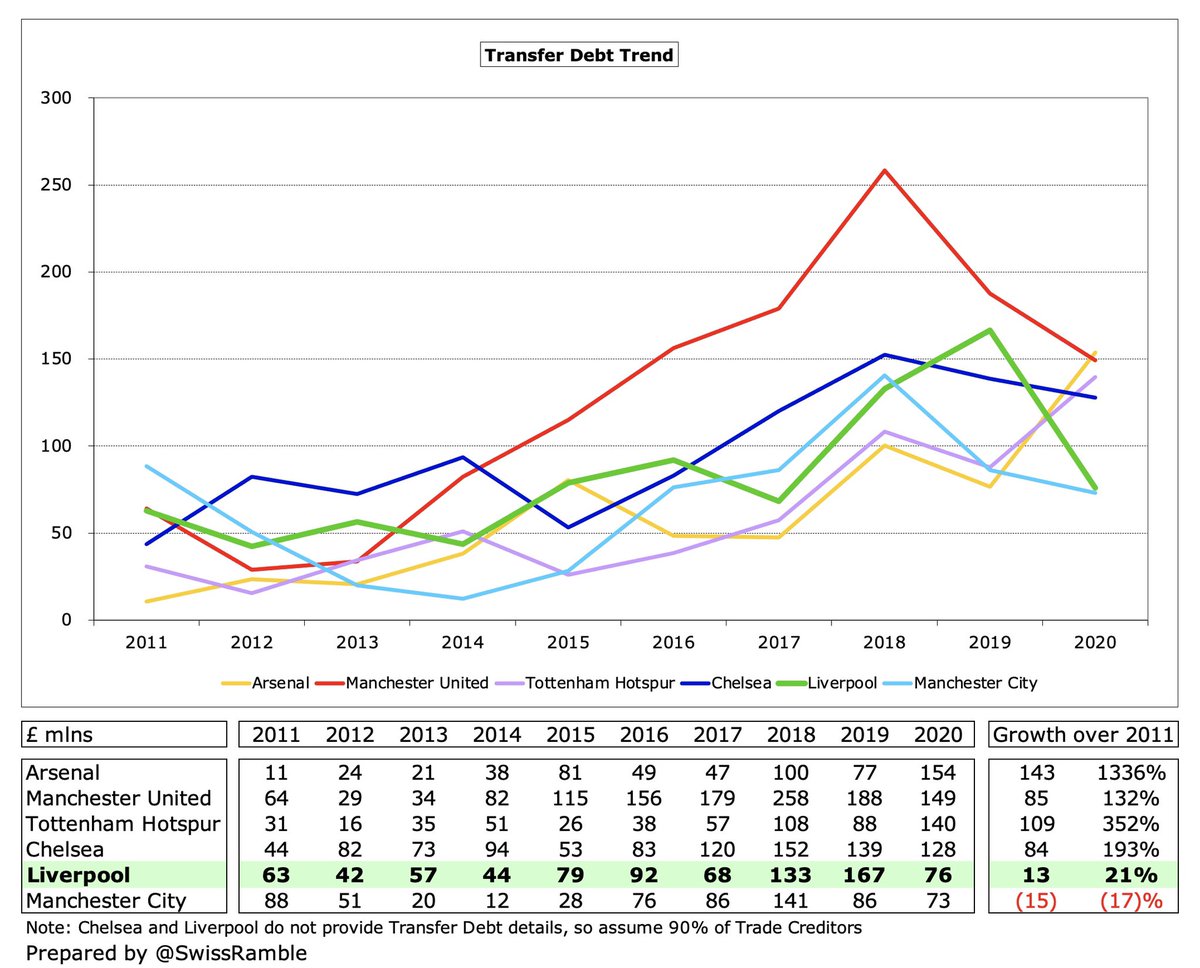

#LFC could invest more money in the transfer market, but this would mean them changing their sustainable business model. They have always tried to “sell to buy”, but this has proved difficult in the current environment, as the usual purchasers are suffering financially.

Low spending is a calculated risk, as #LFC might be overtaken by others in the race for the Champions League (and its lucrative rewards), especially as the team is growing old together, but as Klopp said, “we were quite successful given the limits in the last two years.”

جاري تحميل الاقتراحات...