A Beginner's Guide to Technical Analysis. (PART 3)📉

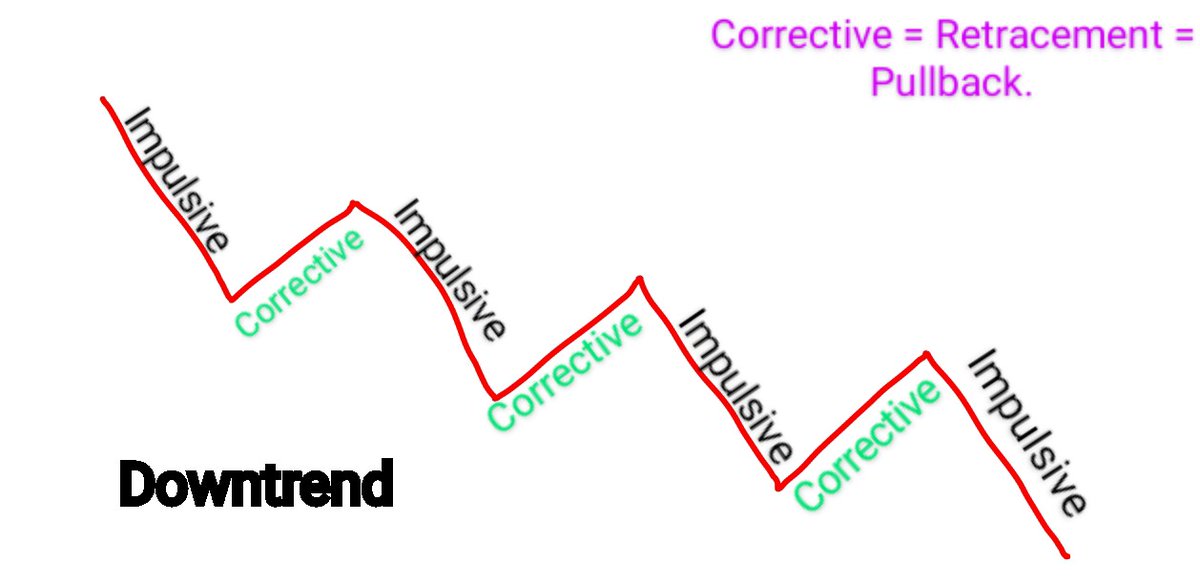

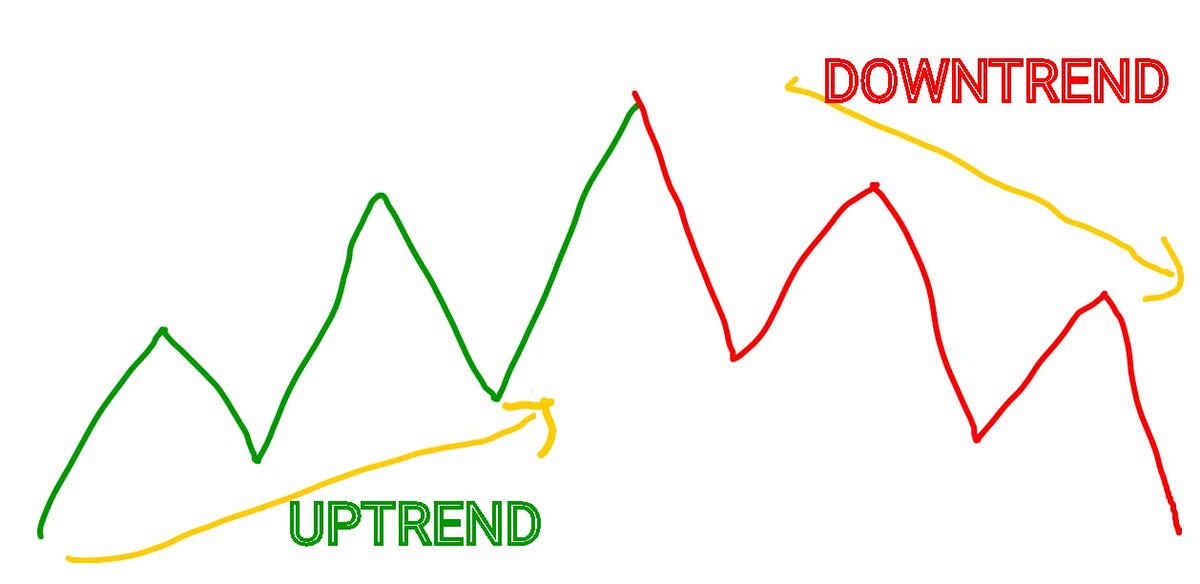

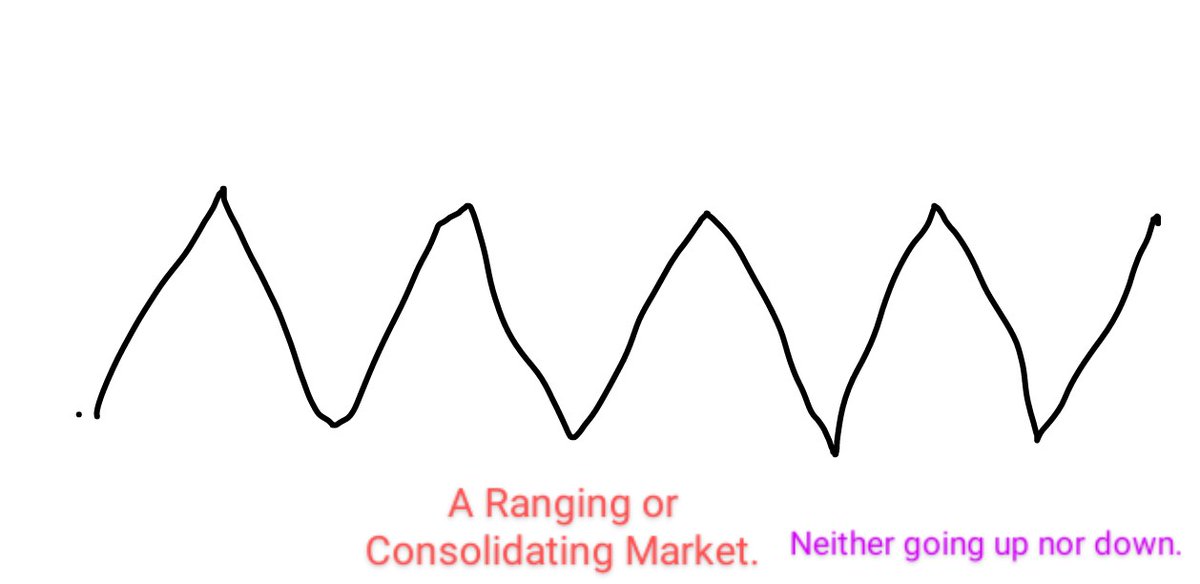

In the previous parts, I taught how to identify trends and interprete Candlesticks, in this part I'll be teaching you how to enter and exit trades using "Support and Resistance".

A #Thread.

RETWEET for others to learn.🙂🔥

In the previous parts, I taught how to identify trends and interprete Candlesticks, in this part I'll be teaching you how to enter and exit trades using "Support and Resistance".

A #Thread.

RETWEET for others to learn.🙂🔥

Now let's get to how this concept applies.

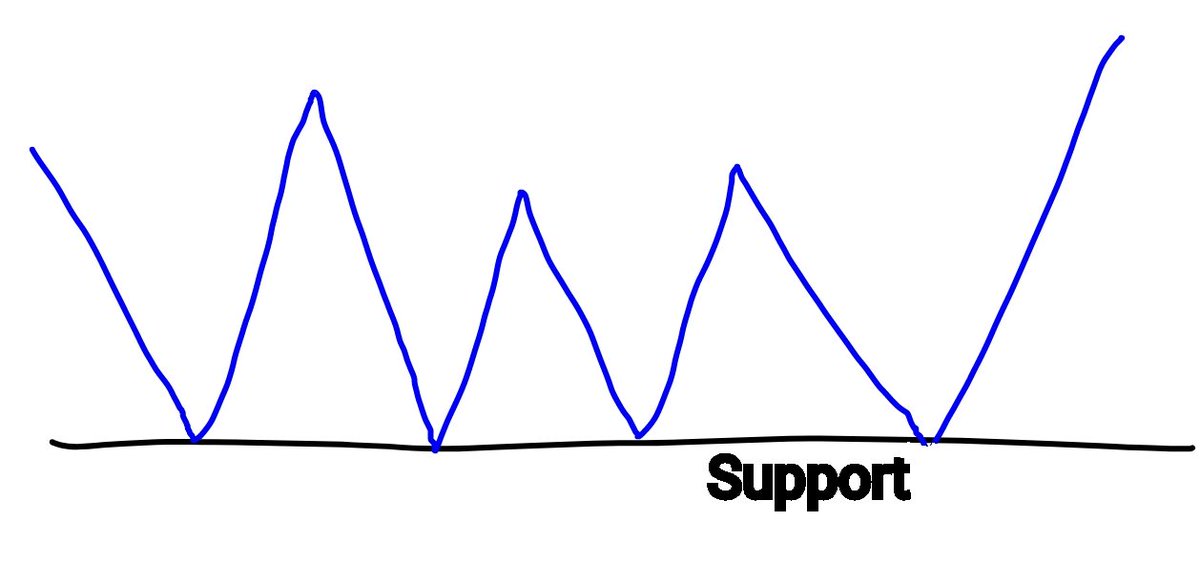

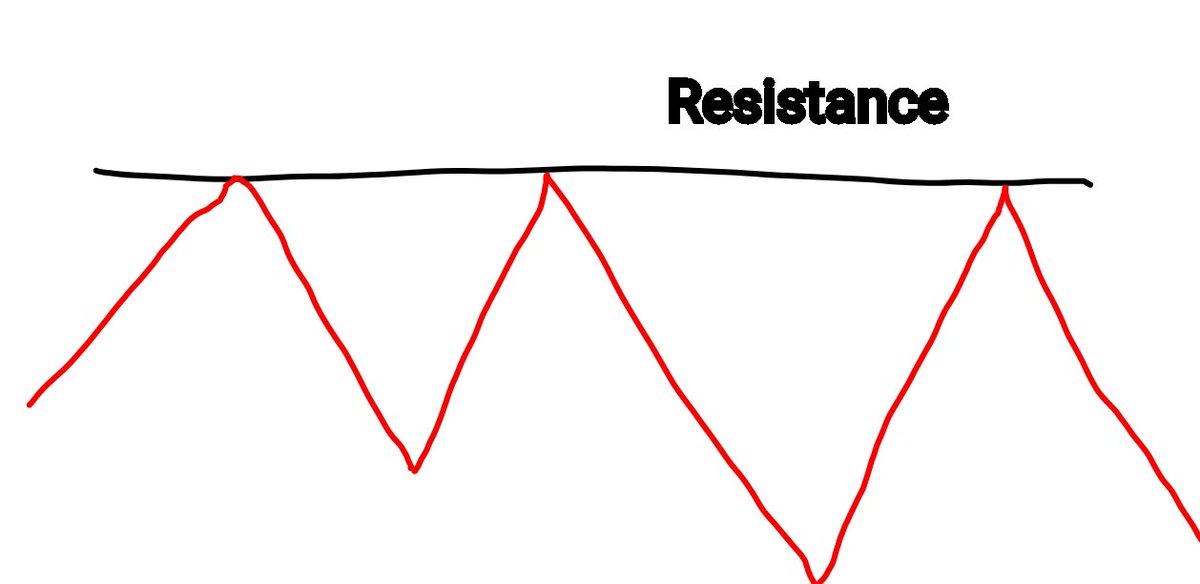

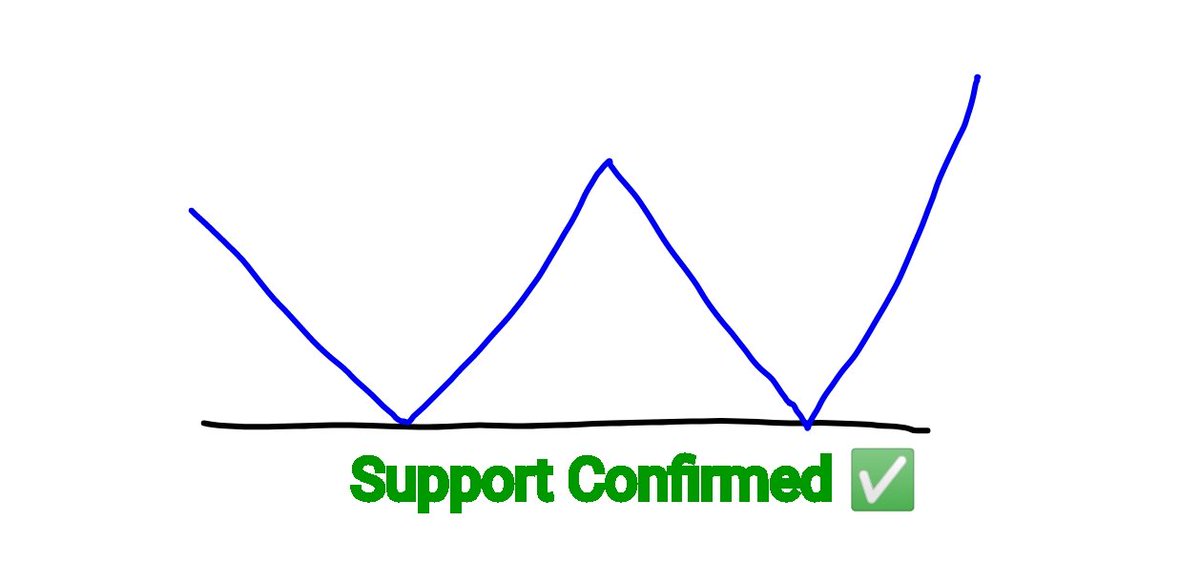

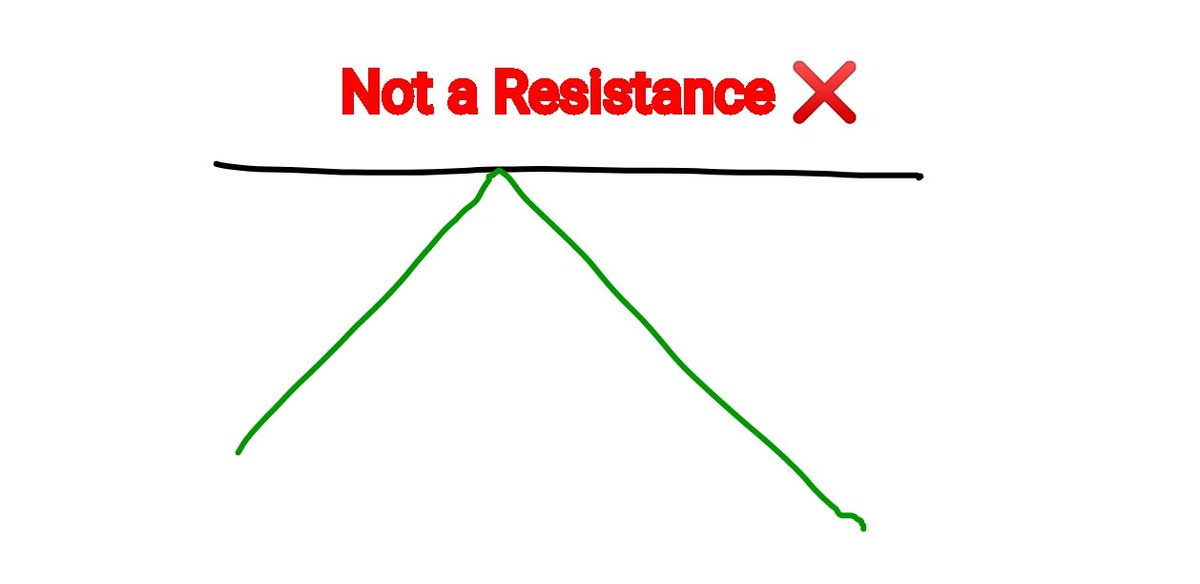

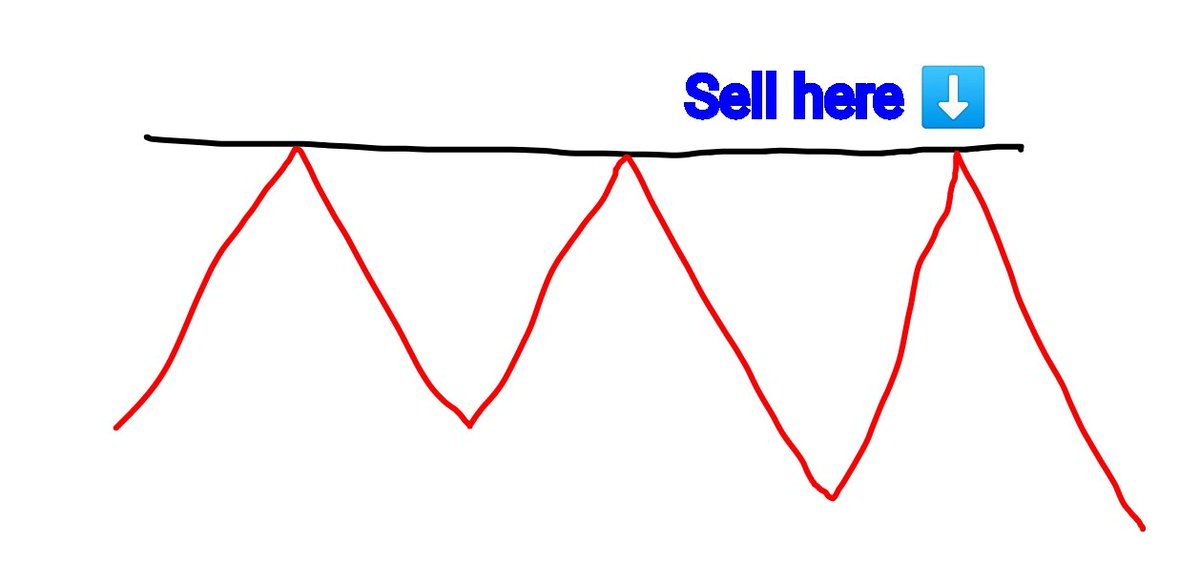

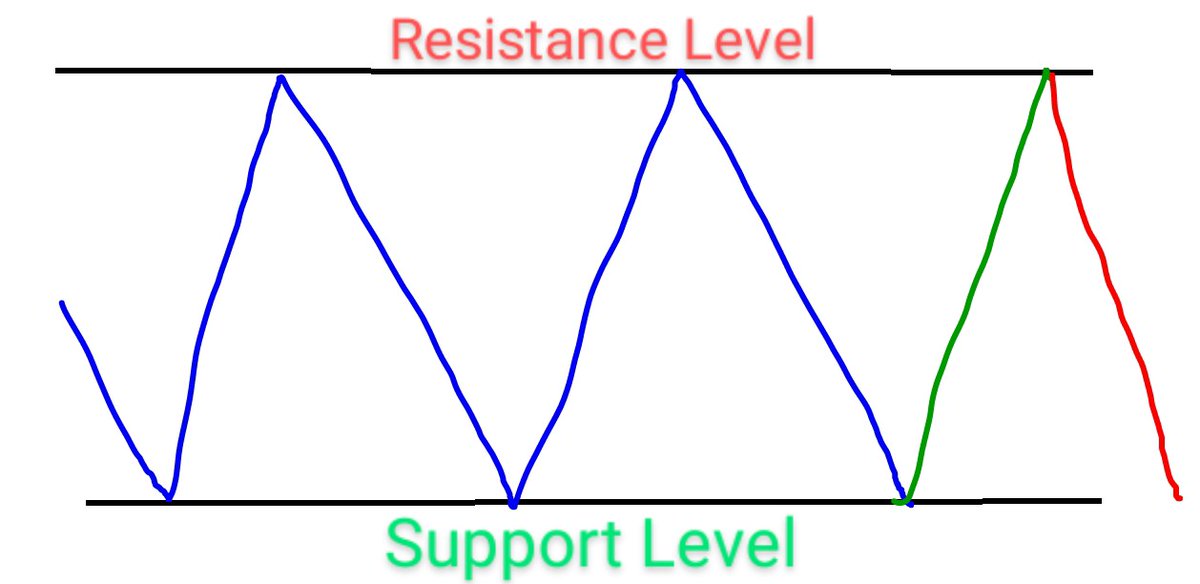

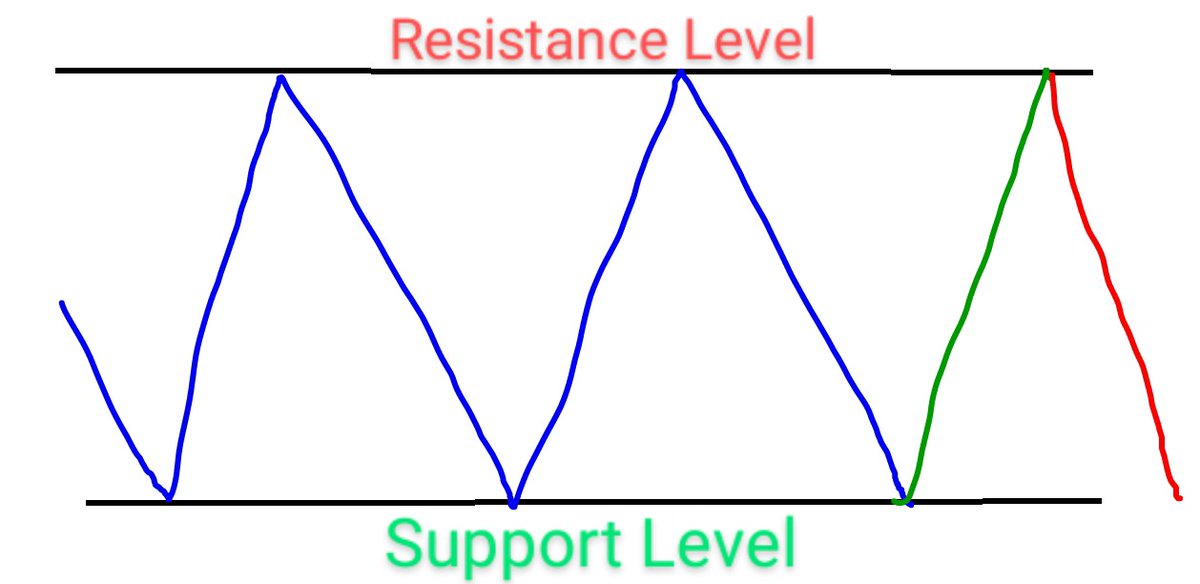

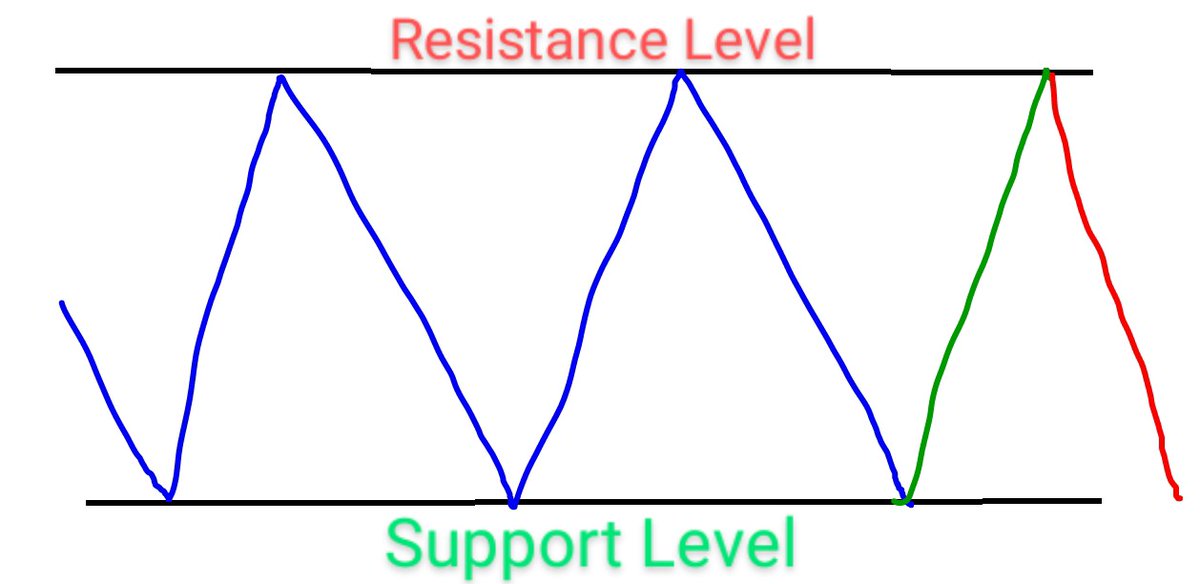

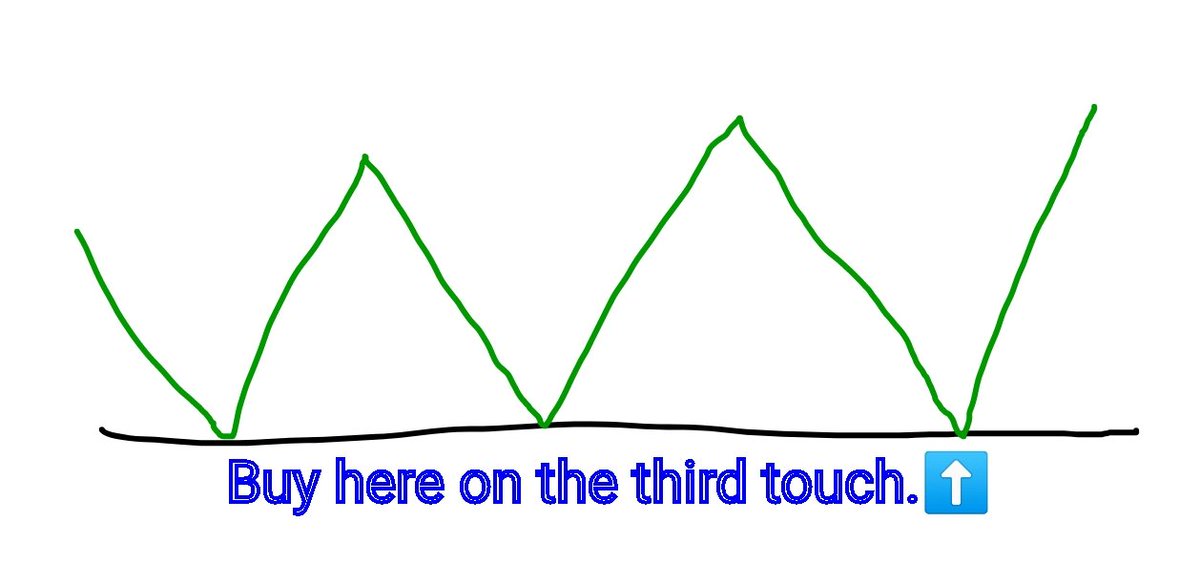

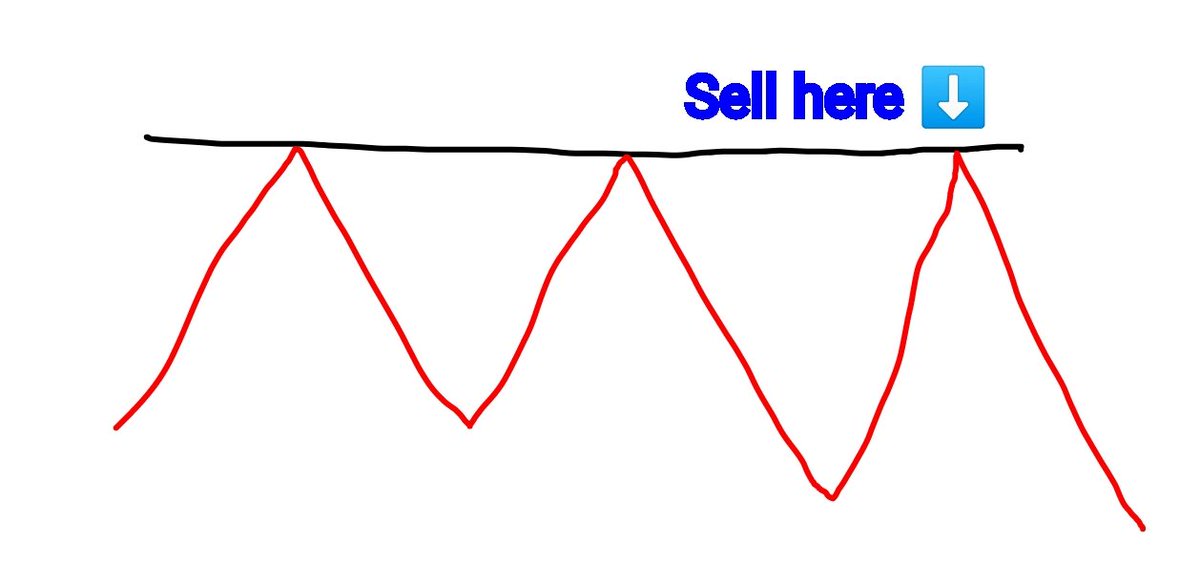

To understand it easily, see "Support" as the ground or floor level where price finds it difficult or fails to break after multiple attempts and see "Resistance" as the ceiling or roof level where price finds it difficult to break too.

To understand it easily, see "Support" as the ground or floor level where price finds it difficult or fails to break after multiple attempts and see "Resistance" as the ceiling or roof level where price finds it difficult to break too.

For instance if you bounce a ball hard in your room, the floor would act as the "support" level for the ball to bounce up & high while the ceiling would "Resist" or oppose that upward move by driving back the ball downwards.

Ball = Price.

Floor = Support.

Ceiling = Resistance.

Ball = Price.

Floor = Support.

Ceiling = Resistance.

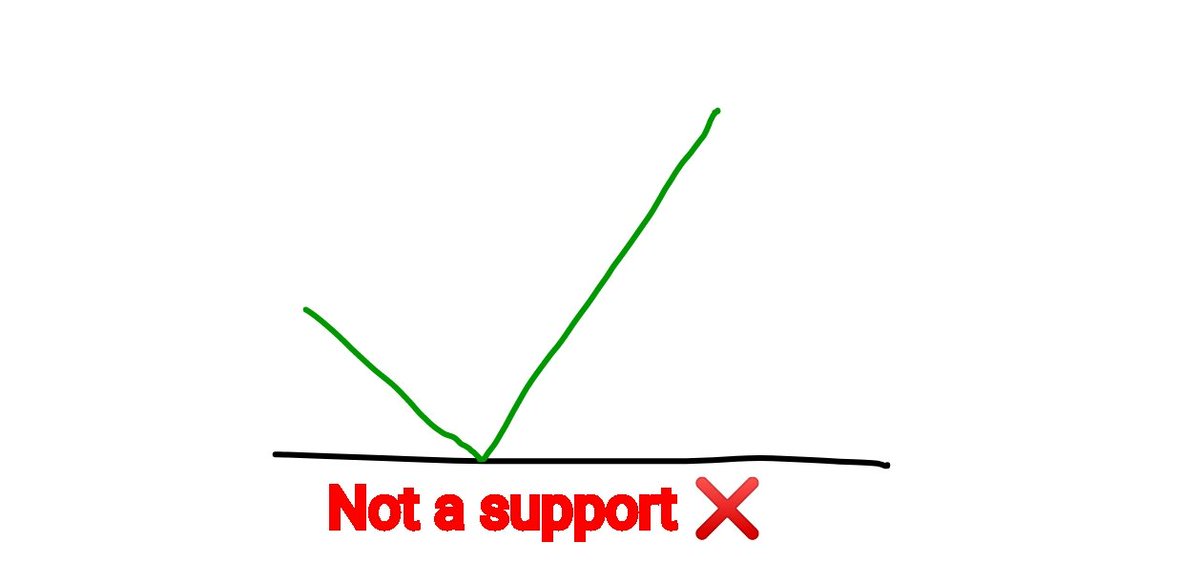

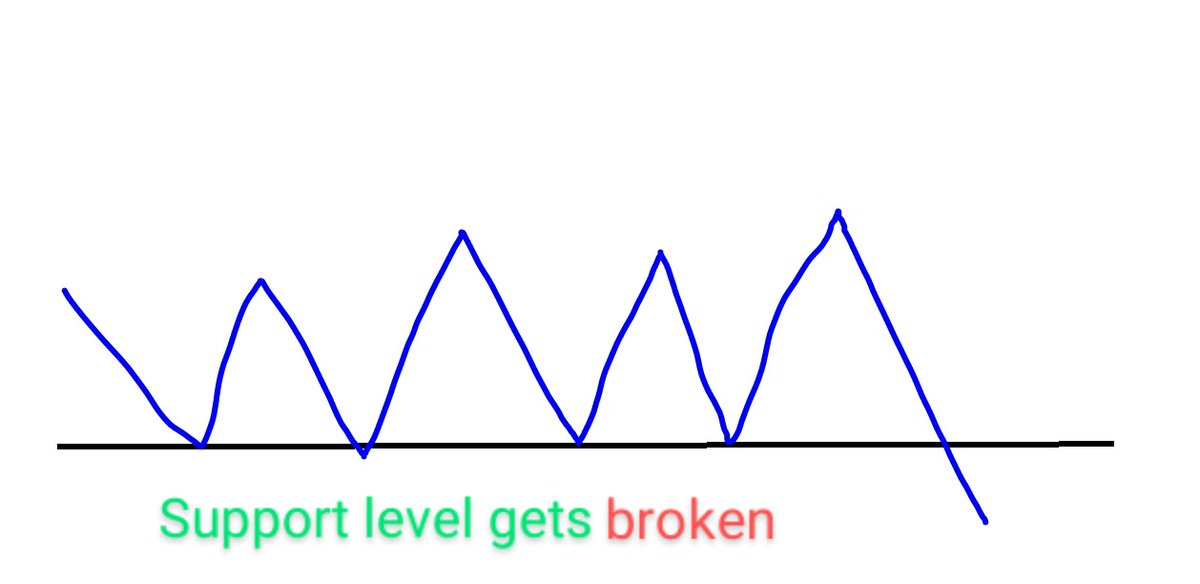

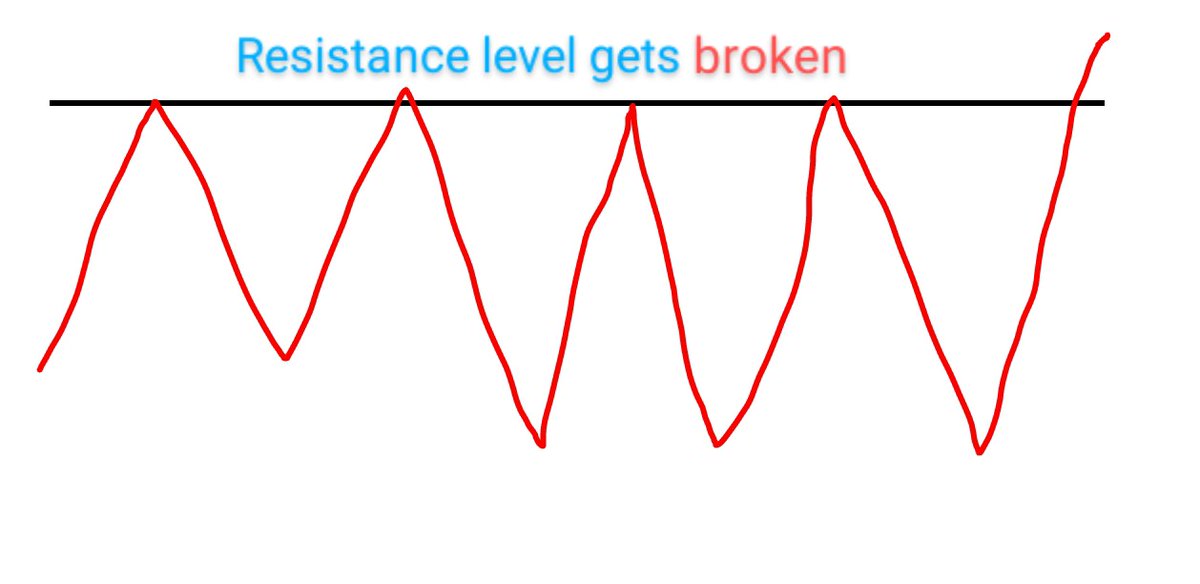

One important thing you need to note is that the more a level is tested, the weaker it'll get. This doesn't mean it won't work, it may and it may not. But if a level (be it support or resistance) gets tested 4, 5 or more times, it'll get weaker and would be more likely to break.

So what happens next after price breaks those zones?

Once those zones are broken, they are now invalidated and you can't place trades using them again, but here's a twist.

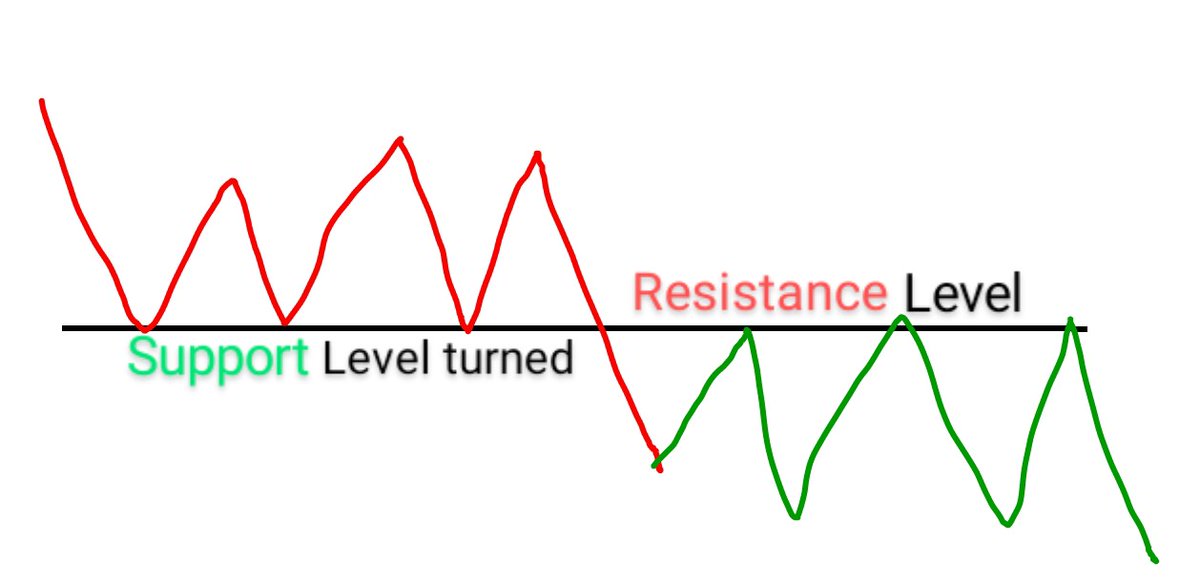

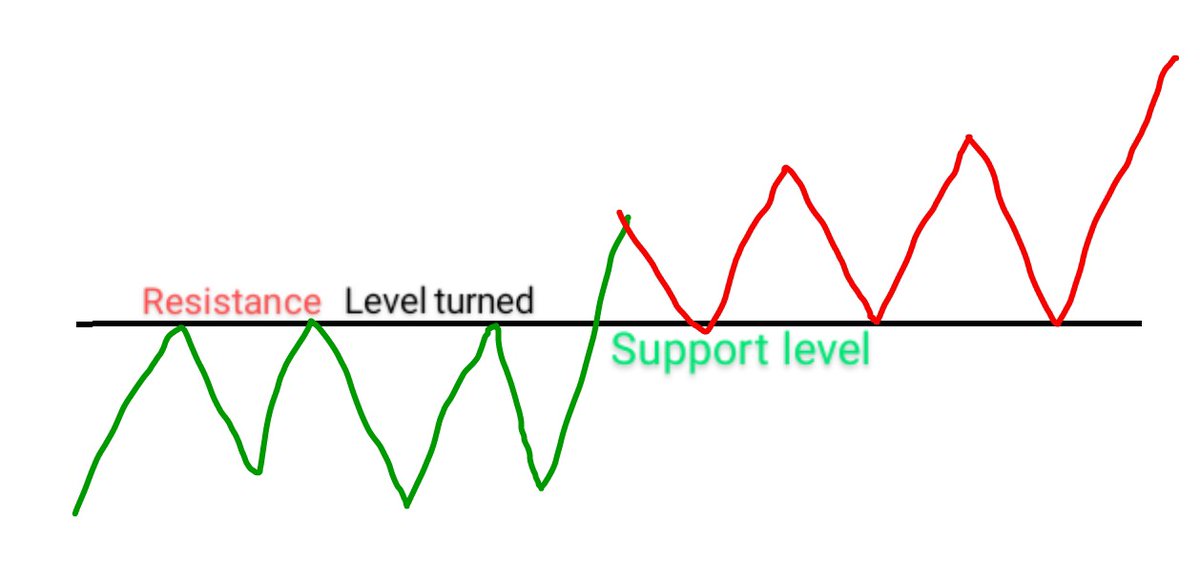

Sometimes we can have a flip in these levels, that is a support zone that was once a difficult area for...

Once those zones are broken, they are now invalidated and you can't place trades using them again, but here's a twist.

Sometimes we can have a flip in these levels, that is a support zone that was once a difficult area for...

This shows trading is all about probabilities and you can't be too sure or 100% guaranteed on any price action, which is why you need to always apply risk management in your trades and use a stop loss to prevent heavy losses if there's one.

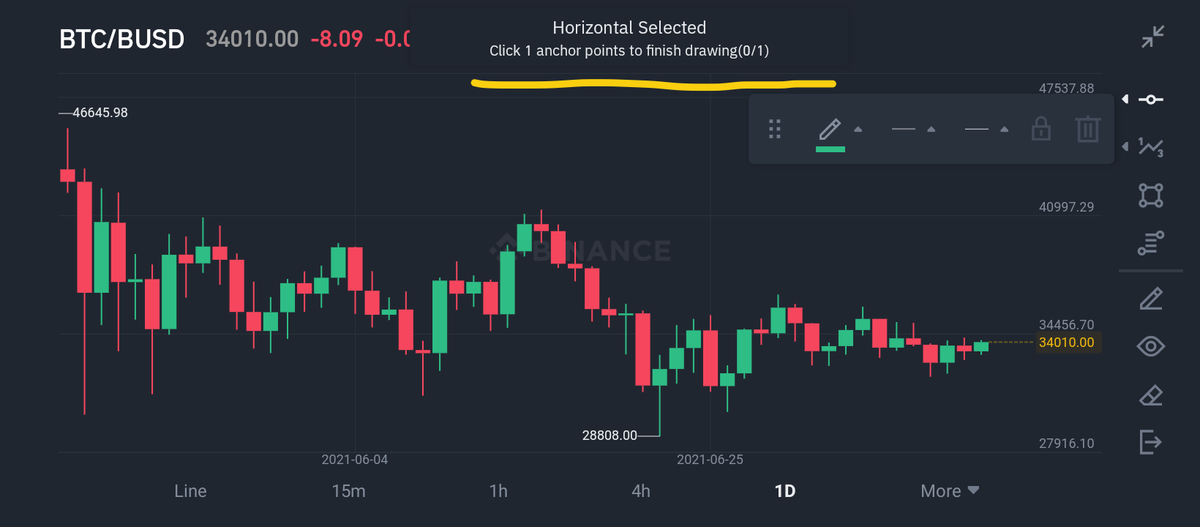

Now let's go practical using Binance.

Now let's go practical using Binance.

Now another thing you need to know is that chart examples and illustrations given in textbooks are mostly theoretical are different from live ones you practically see, and this is a problem a lot of traders face, they get accustomed to studying concepts and patterns on materials

but fail to identify those concepts and patterns on a live chart... And this is something I don't want you to face which is why I always ensure we go practical after every theoretical teaching I give.

The concept of support and resistance I taught you and just used illustrations

The concept of support and resistance I taught you and just used illustrations

So with this I hope you now understand how to make trade entries & exits using the Support and Resistance concept.

What I'm giving you as your assignment is to pick several trading pairs of your choice and identify their Support & Resistance levels.

Do so on several timeframes.

What I'm giving you as your assignment is to pick several trading pairs of your choice and identify their Support & Resistance levels.

Do so on several timeframes.

In the next chapter I'll be teaching you the Trendline concept and how to place trades using trendlines.

Follow my account and turn on post notifications to receive it on time when it drops.

I remain your favorite Cryptocurrency Coach @ThePaulOla.

More trade success.🙂♥️📊

Follow my account and turn on post notifications to receive it on time when it drops.

I remain your favorite Cryptocurrency Coach @ThePaulOla.

More trade success.🙂♥️📊

If you have any questions, you can ask below, I'll reply you.

And also I'll appreciate a RETWEET on this thread so others can benefit too.

Here's the beginning of the thread if you want to retweet.

And also I'll appreciate a RETWEET on this thread so others can benefit too.

Here's the beginning of the thread if you want to retweet.

Here's the PART 2 of this Series.

You can join my Telegram channel for more Cryptocurrency updates and teachings.🙂

t.me

t.me

Just saw I made a mistake to the attachment of the second part, I dropped the second part to DeFi (Fundamental Analysis) instead of technical analysis

Here's the second part.

Here's the second part.

Here's PART 4 - Trendline Trading Strategy.

جاري تحميل الاقتراحات...