It's OK not to worry about IL. But saying that "IL is generally very very minor" and "Swap fees almost always make up for it" is simply wrong and may be harmful for the audience. Let me prove it with some on-chain data.

1)

I will discuss the 4 points about IL:

1⃣ IL is generally very very minor.

2⃣ The current crypto market is extremely correlated which limits IL.

3⃣ Swap fees almost always make up for it.

4⃣ If asset values go down, be thankful you're diversified.

I will discuss the 4 points about IL:

1⃣ IL is generally very very minor.

2⃣ The current crypto market is extremely correlated which limits IL.

3⃣ Swap fees almost always make up for it.

4⃣ If asset values go down, be thankful you're diversified.

2)

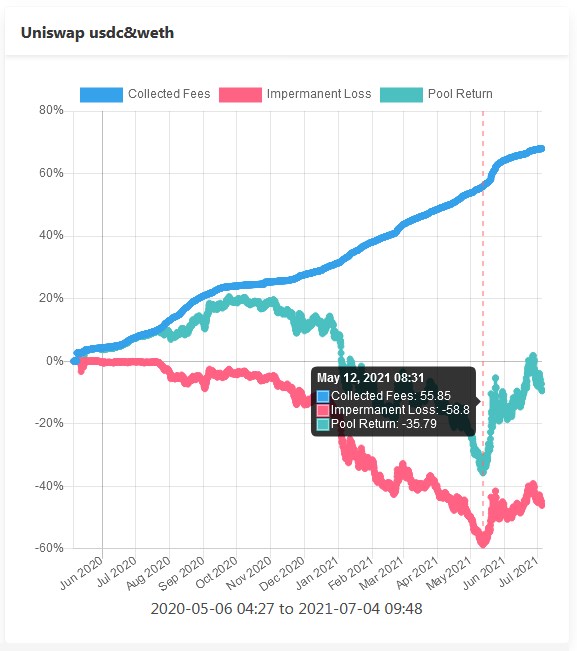

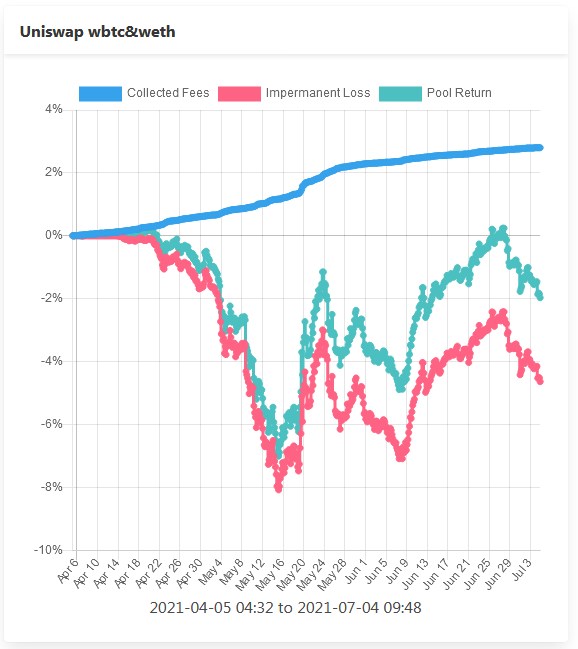

I will use amm.vav.me to plot graphs of percentage returns on Uniswap vs a buy-and-hold strategy.

- 🟦 Collected Fees

- 🟥 IL

- 🟩 Pool Return (🟦 and 🟥 combined)

- Positive values: profit vs holding

- Negative values: loss vs holding

I will use amm.vav.me to plot graphs of percentage returns on Uniswap vs a buy-and-hold strategy.

- 🟦 Collected Fees

- 🟥 IL

- 🟩 Pool Return (🟦 and 🟥 combined)

- Positive values: profit vs holding

- Negative values: loss vs holding

4)

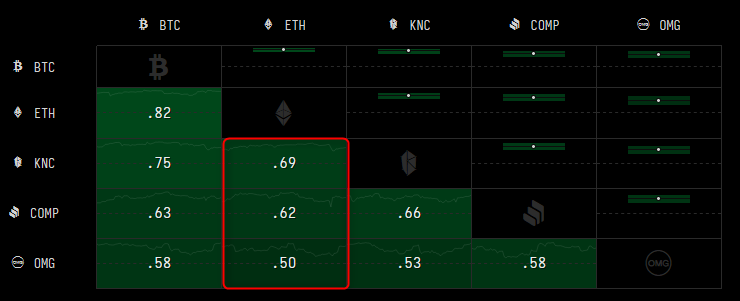

2⃣ The current crypto market is extremely correlated which limits IL.

Correlation indeed limits IL. But "extreme correlation" may be true for ETH and BTC but not for the majority of pairs on AMMs where DeFi tokens are pooled with ETH.

2⃣ The current crypto market is extremely correlated which limits IL.

Correlation indeed limits IL. But "extreme correlation" may be true for ETH and BTC but not for the majority of pairs on AMMs where DeFi tokens are pooled with ETH.

5)

The website with correlations: cryptowat.ch doesn't have a lot of DeFi tokens. I found only $KNC, $COMP and $OMG. Their correlations with ETH are obviously positive, as crypto moves in cycles, but lower than ETH-BTC. IL hits them stronger.

The website with correlations: cryptowat.ch doesn't have a lot of DeFi tokens. I found only $KNC, $COMP and $OMG. Their correlations with ETH are obviously positive, as crypto moves in cycles, but lower than ETH-BTC. IL hits them stronger.

7)

3⃣ Swap fees almost always make up for it.

My observations are just the opposite. I compared long-term LPing on Uniswap and Bancor to find out that LPs on Uniswap often lose vs a simple buy-and-hold strategy because fees don't make up for IL.

3⃣ Swap fees almost always make up for it.

My observations are just the opposite. I compared long-term LPing on Uniswap and Bancor to find out that LPs on Uniswap often lose vs a simple buy-and-hold strategy because fees don't make up for IL.

8)

4⃣ If asset values go down, be thankful you're diversified.

Argument of a "forced diversification" is not convincing. If I want to diversify my ETH stack into 50% ETH and 50% USD and LPing underperforms "hodling" by a few %, why would I even bother to enter LP position?

4⃣ If asset values go down, be thankful you're diversified.

Argument of a "forced diversification" is not convincing. If I want to diversify my ETH stack into 50% ETH and 50% USD and LPing underperforms "hodling" by a few %, why would I even bother to enter LP position?

9)

If fees don't offset IL, LPing doesn't make any sense because LPs would have more money by just holding initial amounts of both tokens. So there is no point in paying IL fee to AMM for balancing my portfolio if I could have more money without this "balancing service".

If fees don't offset IL, LPing doesn't make any sense because LPs would have more money by just holding initial amounts of both tokens. So there is no point in paying IL fee to AMM for balancing my portfolio if I could have more money without this "balancing service".

10)

If we assume that investors wouldn't hold both tokens if they weren't LPing in an AMM, then "forced diversification" in LP position truly limits the risk for them. But if investors want diversification, why would they accept extra risk of IL instead of holding both tokens?

If we assume that investors wouldn't hold both tokens if they weren't LPing in an AMM, then "forced diversification" in LP position truly limits the risk for them. But if investors want diversification, why would they accept extra risk of IL instead of holding both tokens?

11)

To sum up, I disagree that LPs shouldn't worry about IL. It's like not worrying about negative interest rate on a savings account. I prefer to be paid for lending my idle assets to AMM and that's why I consider @Bancor as a perfect option for holders.

To sum up, I disagree that LPs shouldn't worry about IL. It's like not worrying about negative interest rate on a savings account. I prefer to be paid for lending my idle assets to AMM and that's why I consider @Bancor as a perfect option for holders.

I made a few comprehensive threads about IL and I encourage everyone to check them out:

- What is IL and how to mitigate it:

- Why using "Fee APR" in IL-exposed pools is an unreliable indicator of future returns:

- What is IL and how to mitigate it:

- Why using "Fee APR" in IL-exposed pools is an unreliable indicator of future returns:

جاري تحميل الاقتراحات...